Self Employed Health Insurance Deduction: How to Legally Write Off Premiums

Health insurance is expensive, and making sure it’s a write-off in your business is a big deal. Regrettably, it’s not as easy as just putting it on your P&L and treating it like office supplies. Health insurance premiums can be deductible. However, they must be reported in a specific way based on your type of […]

Koinly: The Smart Tax Pro’s Tool for Tracking Crypto Gains

Crypto clients don’t always know what they’re doing—but their wallets sure do. If you’ve ever looked at a spreadsheet full of transactions from a crypto client and wondered how you’re supposed to make sense of it all… you’re not alone. Tracking crypto trades, swaps, staking rewards, and DeFi earnings can feel like trying to untangle […]

How to Protect Your Personal Info When Starting an LLC

When you filed your LLC or corporation paperwork, did you accidentally just blast your home address to the internet? It’s a mistake I see business owners make all the time—and trust me, it’s one you don’t want to make. Here’s the deal: the moment you list your name and home address in your business filing, […]

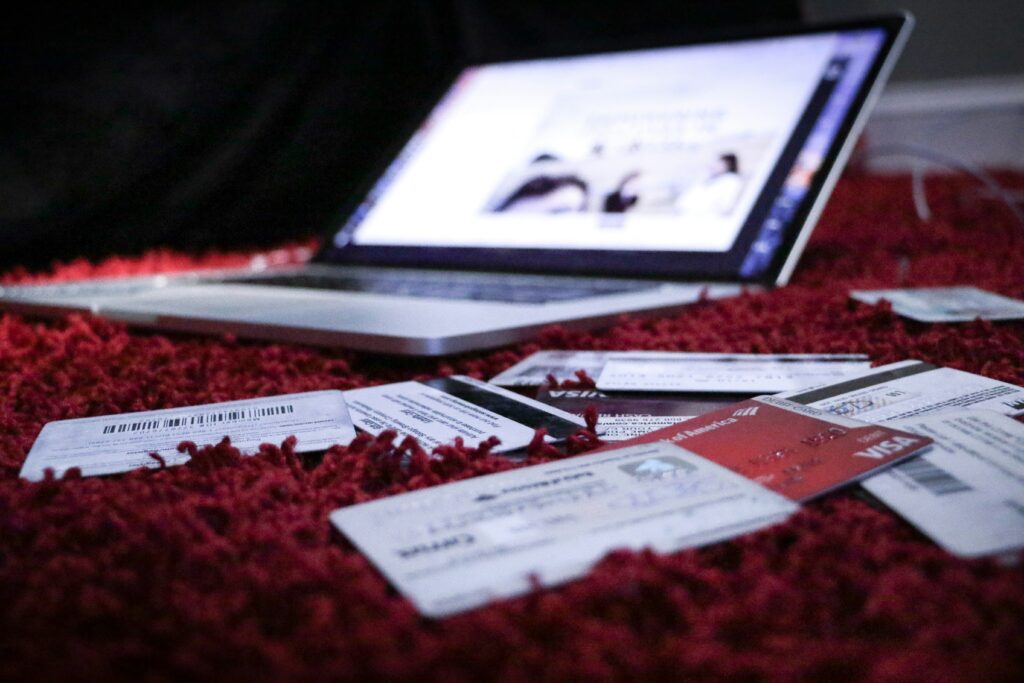

Good Debt vs. Bad Debt: The Real Talk Clients Need to Hear

Not all debt is created equal. For years, we’ve been told that debt is something to avoid at all costs. But the truth is, debt can be either a wealth-building tool—or a financial anchor. Understanding the difference between good debt and bad debt isn’t just helpful… it’s essential. Whether you’re advising clients or managing your […]

Crypto Communication: Why Tax Pros Must Learn the Language of Blockchain

Cryptocurrency isn’t going away. In fact, it’s becoming more mainstream by the day—and that means tax professionals need to keep up. But here’s the tricky part: your crypto clients might not even understand what they’re doing. They throw around terms like “staking,” “swapping,” and “DeFi,” often using them interchangeably. And if you’re not fluent in […]

The Real Impact of Tariffs on Main Street Businesses

If you’re a small business owner, there’s a good chance you’ve felt the ripple effects of tariffs—whether directly or indirectly. While the headlines often spotlight global giants, it’s Main Street entrepreneurs who experience the day-to-day impact of policy changes. And while tariffs can bring new challenges, they also open the door to unexpected opportunities—especially for […]

6 Ways to Protect Your Home From a Lawsuit

For most of us, our home is one of our most valuable assets. It truly is our “castle,” but can also be one of our most vulnerable assets. Although we need to protect it at all costs, we face several dilemmas that create significant hurdles to protecting the complete value of our home from a […]

10 Strategies for Pet Tax Deductions

If you’re a pet owner, you know the joy and companionship a pet can bring to your life. But did you know that you may be able to write-off some of the expenses associated with owning a pet on your taxes? It’s estimated that over 68% of American households have a pet. There are a […]

How to Sell Your Business: What Every Owner Needs to Know Before Exiting

Thinking about selling your business? Whether you’re ready to move on or just exploring your options, selling a business is a major financial and emotional decision—and it’s not as simple as listing it and waiting for offers. If you want to increase your business valuation, attract serious buyers, and secure the best deal possible, there’s […]