How to Spot IRS Tax Scams in 2025: Stop Fraud Before It Starts

IRS impersonation scams are on the rise in 2025, and scammers are getting smarter. From fake emails and robocalls to phishing texts and social media messages, these tactics are designed to steal your personal or financial information. Learn how to spot red flags, understand how the IRS really contacts taxpayers, and take smart steps to protect yourself and your business from tax fraud.

The 10 Accounting Terms Every Business Owner Should Know

Let’s be honest—most people don’t launch a business because they’re excited about accounting. But here’s the truth: if you’re a business owner and you don’t understand the basics of your financials, you’re putting your success at risk. Knowing your numbers is essential for everything from applying for a loan to scaling your business to building […]

The CPA-Lawyer Advantage: Smarter Planning for Small Businesses

If you’re a small business owner, you’ve probably bounced between your CPA and your attorney more times than you’d like to admit. One tells you to ask the other. The other tells you, “That’s a tax issue, not legal.” And somehow you’re left in the middle—still unsure what to do. It’s confusing, frustrating, and usually […]

10 Tax and Legal Mistakes to Avoid in 2025

Starting a business, managing rentals, or just trying to get your financial house in order? You’re not alone—and if you’ve been Googling questions like “LLC vs. S Corp” or “Should I put my car in a trust?”—this guide is for you. Tax law and legal planning don’t have to be overwhelming. In fact, when you […]

How to Simplify Your Estate Plan with a Trust

Will you leave a legacy or a disaster? In this guide, we’ll break down the two most essential estate planning tools you need: a will and a revocable living trust. We’ll also talk about what each one does, how they work together, what it should cost, and the biggest mistake most people make with their […]

Tax & Legal 360: The In-Person Experience You Can’t Miss

Everything changes when you’re in the room. One hallway conversation can lead to a six-figure referral partnership. One live session can unlock a tax strategy that saves your client thousands. One dinner with growth-minded professionals can recharge your confidence and reshape your future. This kind of experience doesn’t happen on Zoom. It happens in person, […]

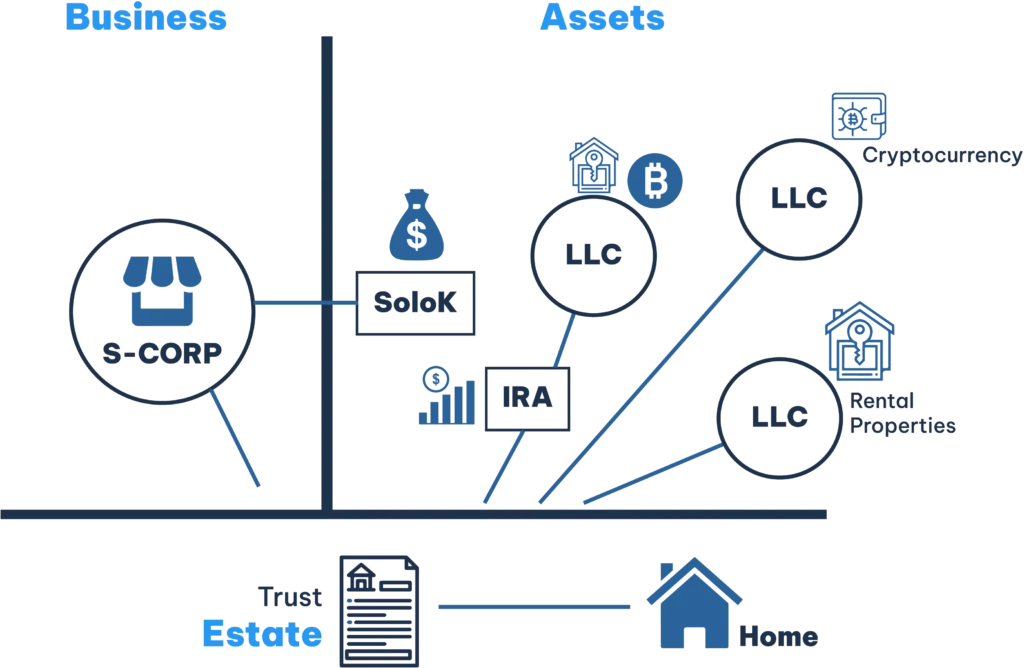

How the Trifecta Structure Helps You Keep More of What You Earn

If you’re a business owner, investor, or side hustler, your tax and legal structure MATTERS.And if you’re still filing everything under your own name or haven’t made the switch to an S corp, you could be leaving thousands of dollars and tons of peace of mind on the table. That’s why we created the Trifecta. […]

6 Types of LLCs Every Entrepreneur Needs to Know

You’ve probably heard that forming an LLC is a smart move for protecting your business and assets. But did you know there are six main types of LLCs—and two bonus variations—that each serve very different purposes? In this guide, we’ll break down exactly what those types are, who should use them, and how choosing the […]

Avoiding problems with the IRS and the “Dirty Dozen”

All of us want to save taxes, but at the same time stay out of trouble with the IRS. In fact, I would hope we would even have a higher standard of being honest and ethical in the manner in which we all report our income, deductions and file our tax returns. We live in […]