Not all debt is created equal. For years, we’ve been told that debt is something to avoid at all costs. But the truth is, debt can be either a wealth-building tool—or a financial anchor.

Understanding the difference between good debt and bad debt isn’t just helpful… it’s essential. Whether you’re advising clients or managing your own money, this mindset shift could change everything.

So let’s break down what makes debt “good” or “bad,” and how to make smarter decisions moving forward.

First Things First: What Is Debt?

Debt is simply borrowed money. That part’s straightforward. What matters more is why you’re borrowing, how you plan to pay it back, and what it’s doing for your financial future.

Is it helping you grow wealth, increase cash flow, or build a long-term asset?

Or is it draining your income for something that loses value the moment you swipe the card?

That’s the key question behind good vs. bad debt.

What Counts as Good Debt?

Good debt is money borrowed to invest in something that will (ideally) grow in value or generate income. It’s strategic. It’s intentional. And it serves your bigger financial goals.

Here are a few common examples:

- Real Estate Loans: Buying rental property with financing? That can be good debt—especially if the property cash flows and appreciates over time.

- Business Loans: Starting or expanding a business can justify taking on debt, provided you have a solid plan and positive projections.

- Education Loans (Sometimes): If the degree significantly increases earning potential in a stable career field, it can be worth the investment.

With good debt, the return should exceed the cost of borrowing. That means low interest rates, favorable terms, and a clear payoff.

What’s Bad Debt?

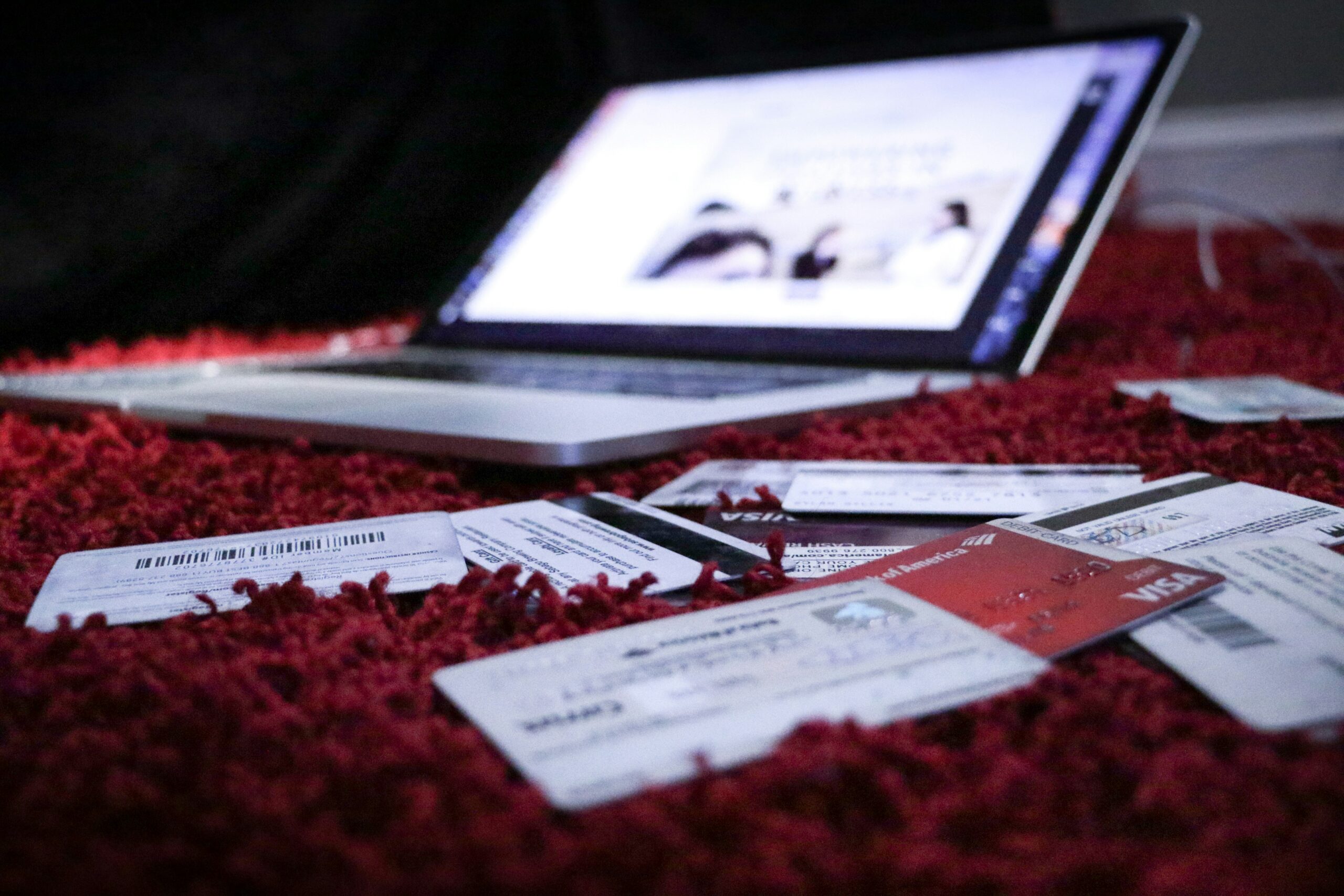

Bad debt, on the other hand, is money borrowed for something that doesn’t generate value—or worse, depreciates immediately.

Here’s where people often get tripped up:

- Credit Cards for Vacations or Clothes: Great memories, nice shoes… but they don’t pay the bills later.

- Auto Loans (Especially New Cars): That new car smell? It cost you 10% of the car’s value the moment you drove off the lot.

- Dining Out and Entertainment: If it’s going on a credit card you can’t pay off in full, it’s not just expensive—it’s interest-heavy.

Bad debt tends to be impulse-driven, high-interest, and tied to things that lose value quickly. And unlike good debt, there’s no upside waiting on the other side.

Why the Distinction Matters

When people lump all debt together as “bad,” they miss the opportunity to leverage smart financial tools.

You can avoid credit cards completely, drive used cars for life, and still miss the chance to use other people’s money to build wealth.

Meanwhile, those who embrace good debt wisely—buying assets, investing in themselves, or growing their business—can create serious long-term gains.

The goal isn’t zero debt. It’s smart debt.

Questions to Ask Before Taking on Debt

Before signing that loan agreement or pulling out the credit card, try this quick mental checklist:

- Will this debt make me money or cost me money?

- Is the item increasing or decreasing in value?

- Do I have a plan to repay this in a reasonable time frame?

- Is this decision based on strategy—or emotion?

If the answers don’t support your financial future, it’s probably time to hit pause.

Helping Clients Understand the Difference

If you’re in a financial or tax advisory role, you know how often debt shows up in client conversations. Helping people distinguish good debt from bad debt isn’t just educational—it’s transformational.

You’re not just telling them what to avoid. You’re giving them a framework for better decisions.

And when clients learn to stop funding past choices and start investing in future opportunities? That’s when the magic happens.

Final Thought: Debt Isn’t the Enemy—Poor Strategy Is

Debt is a tool. Like any tool, it can build or break, depending on how it’s used.

The real win is learning the difference—and teaching it to others.

If you can spot the kind of debt that opens doors instead of closing them, you’re already ahead. And if you can help clients shift from “debt regret” to “debt strategy,” you’re not just saving them money—you’re changing their mindset.

And that’s the kind of work that really builds wealth.

Start Building the Future You Deserve

Want 2025 to be the year you finally feel on top of your taxes and business?

Start with the Trifecta Planner—your all-in-one system to stay organized, save money, and plan your growth.

- Calendar + tax deadlines

- Business tools + wealth-building tips

- Roadmap to more freedom

Download our FREE Tax Guide to uncover tips, tricks, hidden deductions, and 30+ tax-saving secrets you can implement right now.

CPAs, EAs, Brokers, Attorneys, and Financial Planners, listen up! If you’re looking to take your practice to the next level, become a Main Street Certified Advisor and help your clients navigate the tax game like a pro—while adding more value to your business.

Call us at 520-800-0986 or book your FREE Discovery Call with our supportive team today!