If you’re a pet owner, you know the joy and companionship a pet can bring to your life. But did you know that you may be able to write-off some of the expenses associated with owning a pet on your taxes?

It’s estimated that over 68% of American households have a pet. There are a variety of ways to make money with your pet, use your pet in a small business, or even for a charitable or medical reason. There are legitimate tax strategies buried in the tax code that millions of Americans do not take full advantage of.

Curious if you can claim your pets on your taxes? Review our 10 strategies below to learn if your pet may qualify.

The Breakdown of the 10 Strategies

The tax-deductible options outlined in this blog are broken down into three categories:

- Pets integrated into your business as an expense (5)

- Pets that make money and are their own business (3)

- Charitable and medical (2)

Check out this video that provides additional details on each of these ten strategies for Writing-Off Your Pet

Pets Integrated into Your Business

1) Guard Dog Tax Write-Off

As a business owner, keeping your property and employees safe is a top priority. One effective strategy is the use of a security dog, trained or otherwise. Simply having a dog that makes noise and has a loud bark can do the job and be a tax-legitimate security measure.

Not only can they detect intruders or potential threats, but their mere presence can be a deterrent to criminal activity. As such, the IRS recognizes the use of security dogs as a valid business expense.

The dog’s abilities can be utilized in a variety of businesses. They can protect inventory at a warehouse or retail store, and even ensure the safety of the property, employees, or patrons.

Real-life Example: I had a fellow CPA write-off his dog for security at his home office for the purpose of protecting client files at his personal residence. He was audited, explained his position and the IRS quickly accepted the reasoning. While this may not always be the case – every IRS has their own approach to auditing – in this case the expense was accepted without issue.

Additionally, the use of a security dog may reduce insurance premiums and liability risks. Insurance companies often view the use of a trained security dog as a proactive step towards minimizing risks and may offer discounts on insurance premiums accordingly.

If your dog legitimately serves this purpose, expenses related to the purchase of the animal, and ongoing expenses such as food, bedding, boarding, and grooming supplies, including veterinary care and medication will be deductible.

Ensure you can indicate how the dog is being used for securityand why it’s justified. Finally, make sure you indicated on the tax return the expense as a ‘security expense’, not writing it off as ‘dog expense’. Keep good records and be able to defend your position if the IRS has questions.

2) Cats for Pest Control Write-Off

Maintaining a pest-free environment is crucial for many businesses, particularly those in the food service and hospitality industries. Cats are natural predators of many pests, and as such are a great method of pest control. The IRS recognizes the use of cats as a valid business expense for pest control purposes.

Real Life Examples: Disneyland’s use of cats for pest control in their park is a well-known example of how cats can be effectively utilized for this purpose in a business setting.

And in the case of Commissioner v. Tellier, the court ruled that the costs of caring for cats used to control vermin in a junkyard were deductible as a business expense.

To qualify for a business expense deduction, the cat must be used primarily for business purposes and the expenses must be ordinary and necessary for the business. In case of an audit, it’s important to have evidence to support why the cat is needed for addressing pest concerns at your business location and the potential risk to your product or inventory. Make sure you can explain and provide documentation to substantiate the use of the cat for business purposes.

Again, if your cat serves a legitimate business purpose expenses related to the operations of the business, the following purchases, and ongoing expenses will be deductible:

- Food

- Bedding

- Boarding

- Grooming supplies

- Veterinary care

- Medication

Finally, it’s important to keep detailed records of all expenses related to the cat and consult with a tax professional to ensure compliance with all IRS regulations regarding business expenses.

“Working Animal” in your Business Write-Off

Working animals play an important role in many different types of businesses. For example, dogs can be used for herding livestock on a ranch or farm. These animals are essential to the operation of the business and their care can be costly.

Here is a list of a variety examples of working animals:

- Rescue dog at the ski resort

- Police-type dog in a security business

- Drug sniffing dog at the entrance for an event business

- Doves in a wedding business

- Therapy animals at a physical therapy office or nursing home

- Horses that are used for transportation, riding, and in some cases, farm work

- Chickens can be used for insect control in some industries

- Falcons that are used for bird abatement, to scare away pest birds from crops and public spaces

- Even goats in a yoga business – yes, seriously!

The list of animals that can be used for work is extensive. If your ‘working animal’ serves a legitimate business purpose the following expenses related to the operations of the business will be deductible:

- The purchase of the animal

- Food

- Bedding

- Boarding

- Grooming supplies

- Veterinary care

- Medication

3) Pets as an Advertising Expense Write-Off

Pets are a great way to attract attention and promote your business. If you’re a business owner and have a pet that you use as part of your advertising strategy, you may be able to write-off some of the expenses associated with owning a pet on your taxes.

Using your pet for advertising is a great way to stand out and attract customers. Consider featuring your pet on print material, logos, signs, your website, or social media.

Social media platforms like Instagram and Facebook are great ways to show off your pet in your business. Create a profile for your pet and post pictures and updates related to your business. Use hashtags to increase the reach and engagement of your posts.

Consider bringing your pet to special events like trade shows or community events. This can be a great way to attract attention and promote your business.

It can also be as simple as a dog in the ski or bike shop every day to greet customers and to promote sales or promotions with a vest they wear around the store. It would certainly help with sales and also provide a calming atmosphere for the customers.

There are endless ways to incorporate your pet into your business’ brand and experience for your customers. Just legitimize it and keep good records.

Real Life Examples: Consider the Taco Bell dog, a Chihuahua named Gidget, Dogecoin’s Shiba Inu dog, and even the GEICO Gecko – if there’s a real-life Gecko somewhere on the GEICO campus for artist reference!

You can claim the following pet related expenses if your pet is a legitimate advertising expense:

- The purchase of the animal

- Food

- Bedding

- Boarding

- Grooming supplies

- Vet bills

- Medication

4) Fish as Office Decor Write-Off

As per the IRS tax code, expenses related to the decor of a business may be deductible as valid business expenses. This includes expenses related to aquariums and fish used as decorative elements in a business.

An aquarium can provide a calming and visually appealing atmosphere for customers and employees and can also serve as a unique branding opportunity. The cost of the aquarium itself, including the cost of maintenance, cleaning, feeding, care for the aquarium, and of course the cost of the fish themselves may be deductible as a business expense.

It’s important to note that the expenses must be ordinary and necessary for the business, and the use of the aquarium must be at a location where customers frequent or employees work. Unfortunately, a home office would NOT qualify for this tax write-off.

Pets that are their own business

In this section, we’ll explore different tax write-off examples where your pet IS the business. If your pet is making money for you, all expenses related to the business operation are deductible against the income.

At the very least, you would be reporting the income and operations on a Schedule C on your 1040. Again, all expenses related to the purchase, and ongoing expenses such as food, bedding, boarding, and grooming supplies, including veterinary care and medication will be deductible.

The Hobby Loss Rule

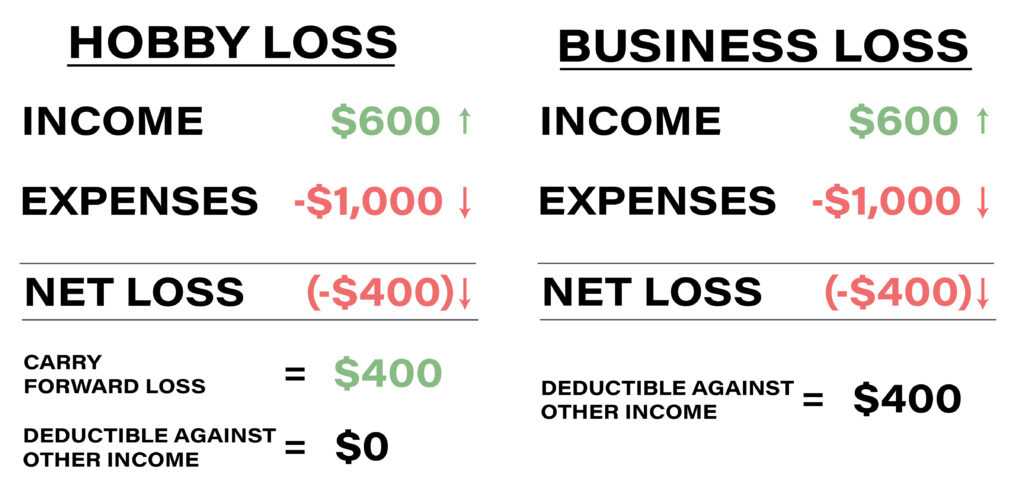

When claiming a pet as their own business, be mindful of the “hobby loss” rule. The IRS distinguishes between hobbies and businesses. An individual can only deduct hobby expenses to the extent of hobby income, while they can deduct business expenses regardless of whether the business is profitable. The IRS defines hobbies as activities pursued for the purpose of enjoyment or pleasure and businesses as activities with a primary purpose of profit.

Essentially this means you get the ‘write-off’ in the business/hobby, but you can’t take the net loss as an ordinary expense against your other income. The loss must be carried forward and can be used against future income in the ‘hobby business.’, Even if you sold the animal, the losses are locked down until future income in the business unlocks the losses.

The graphic below highlights some examples:

To avoid being classified as a hobby and running afoul of the IRS hobby loss rules, individuals must demonstrate a profit motive. This can be done by showing that they have a reasonable expectation of making a profit from the activity and that they are actively working to achieve that goal.

Typically, this means generating profit in at least two out of five consecutive years. It’s important to note that this rule is not an absolute test, and the IRS will consider other factors when determining whether an activity is a hobby or a business. (For more information about the Hobby Loss rule, see IRS Code IRC § 183)

In short, be sure to claim your income using a 1099. Do not take cash under the table for a pet business.

5) Pet Breeder Write-Off

Animal breeding is often a lucrative business. Pet breeders are able to write-off related costs as valid business expenses, provided they report their income.

Write-offs include:

Animal care

- Feeding

- Breeding of animals

- The cost of acquiring breeding stock

- Any travel related to breeding the animal (for instance, to breed exotic or rare animals or to acquire delicate or fragile breeding materials such as horse semen).

To qualify for the deduction, the animal breeding operation must be a legitimate business and not a hobby (see above). Thus, the breeding activity must be conducted with the intent of making a profit. With the proper documentation and information, animal breeders can receive the tax benefits they deserve while also ensuring the success of their business.

6) Pet Boarding, Grooming, or Related Services Write-Off

Running a pet boarding business can also be a rewarding and profitable venture. This includes caring for pets in your own home and any grooming, walking, or animal setting that takes place in someone else’s home.

Expenses related to the care and feeding of the animals in your care will be deductible in the operation of the business. It may also include the ability to deduct your own animal in the process. Your pet could provide companionship and a calming effect for boarded pets, for example. This implies that your pet becomes a necessary expense for the business operation.

According to the IRS, expenses must be ordinary and necessary for the operation of the business and must be incurred with the intent of making a profit. As a pet trainer, your expertise and reasoning for the purpose of your own pet in the operation will be important to justify the expense. Make sure you properly document your position in an effort to take such write-offs.

Again, if your personal pet legitimately serves a business purpose, deductible expenses related to business operations include:

- The purchase of your animal

- Food

- Bedding

- Boarding

- Grooming supplies

- Veterinary care

- Medication

7) Performing Animals Write-Off

If you have a performance animal that makes you money, that is a business. These could be horses or even dogs in shows or sporting events. As such, you are allowed to deduct expenses related to their care as a business expense. This includes transportation to and from events, which can be a significant expense.

Keep detailed records of all expenses related to your performing animal including necessary equipment and care. This includes receipts, invoices, and any other documentation related to the care and training of your animal.

Again, be wary of the ‘hobby loss rules’ (see above). Claim the income, track the expenses, and report them both. At the very least, zero out the income. Even in a ‘hobby business’ you can write off these expenses, but you can’t take the net loss as an ordinary expense against your other income.

Foster and Rescue Write-Off

If you’re involved in fostering or rescuing pets, you know the importance of providing proper love and care until they find their forever homes. You may be able to write-off some of the expenses associated with your foster pets as charitable expenses on your taxes.

Capture the maximum write-off with these steps:

- Ensure you’re working with a valid 501(c)3 organization that has the charitable purpose of fostering or rescuing pets. You can’t simply “say” I’m doing charitable work and write it off on Schedule A of your 1040.

- Align yourself with a valid charity that has the proper status with the IRS. This means they are recognized as a tax-exempt organization.

Work with your tax professional and the charity to capture the write-offs and take the deduction. In some instances, you may need to ‘donate’ to the charity and have them pay for some of your supplies and equipment.

In a pet rescue operation, medical bills, medication, adoption fees, and transportation expenses (such as gas or mileage), including kennels and equipment, are generally deductible.

Don’t stress too much about the process of coordinating with a charity. Oftentimes, when you start to working with a value-aligned charity, unseen opportunities and a support network will open, resulting in a more successful operation. This also means you won’t have to go and ‘open up your own charity’, which can be costly compared to the scope of what you’re trying to accomplish.

If you are planning on organizing 501(c)3, my law firm, KKOS, can assist you. To learn more visit KKOS’ Non-Profit Set-Up Page.

Service Animals Write-Off

As per the IRS tax code (see Topic No. 502, Medical and Dental Expenses on the IRS Website, seventh bullet point), individuals with disabilities may be able to write-off the expenses related to their service animals as a valid medical expense.

To claim the deduction, you’ll need a “Letter of Medical Necessity” from a licensed healthcare professional. This should include information about the individual’s disability and the ways in which the service animal assists with daily activities. Keep this letter on file, as the IRS may request it as proof of the medical necessity of the service animal.

There are four options for where you write-off this medical expense:

- Itemized Medical Expense

- Health Savings Account

- Flexible Spending Account

- Health Reimbursement Arrangement

Again, if your animal legitimately serves a medical purpose and need, the greatest expense will generally be acquisition and training, which can may be expensive. Consider the example of a seeing-eye guide dog.

If you can prove the medical ‘need’, of course, the following expenses will be deductible in the method from the four options listed above:

- The purchase of the animal

- Food

- Bedding

- Boarding

- Grooming supplies

- Veterinary care

- Medication

The Conclusion to Writing-Off Your Pet

Pets bring joy and happiness to our lives. They can also be incorporated into your business and provide valuable tax write-offs. Pet ownership operations include advertising, a charitable act, or even a medical expense.

It is extremely important to consult with a tax professional to ensure you’re following all pet tax write-off rules and regulations.

For a list of tax professionals certified in ALL of my strategies, explore my Tax Advisor Network.

Pet Tax Deduction FAQs

Explore some of the most common questions when it comes to writing off your pet for a tax deduction.

Can You File Your Pets on Your Taxes?

If your pet constitutes a legitimate business expense, they can be claimed against your taxes. Examples of when you may be able to write off your pet include:

- Guard dogs

- Cats for pest control

- Performance animal

- Pet breeder

- Pet rescue and fostering

- Service animal

Can You File Dogs on Your Taxes?

If your dog is part of your business, a guard dog that protects your business, a breeder dog, or a service animal, you can likely file your dog on your taxes.

Are Pet Medical Expenses Tax Deductible?

Unless your pet is part of your business or a service animal, pet medical expenses and veterinary bills cannot be deducted as part of your tax return.

Is there an Emotional Support Animal Write-Off?

Generally, the IRS does not categorize expenses related to emotional support animals as medical expenses. Therefore, emotional support animals cannot be written off on your taxes.

Is the IRS Allowing Pet Deductions in 2025?

As of 2025, the IRS allows pet deductions for service animals, along with animals who are integrated into your business, and pets that make money and are their own business.

Love this!!!! Im a dog blogger with ebooks and products.