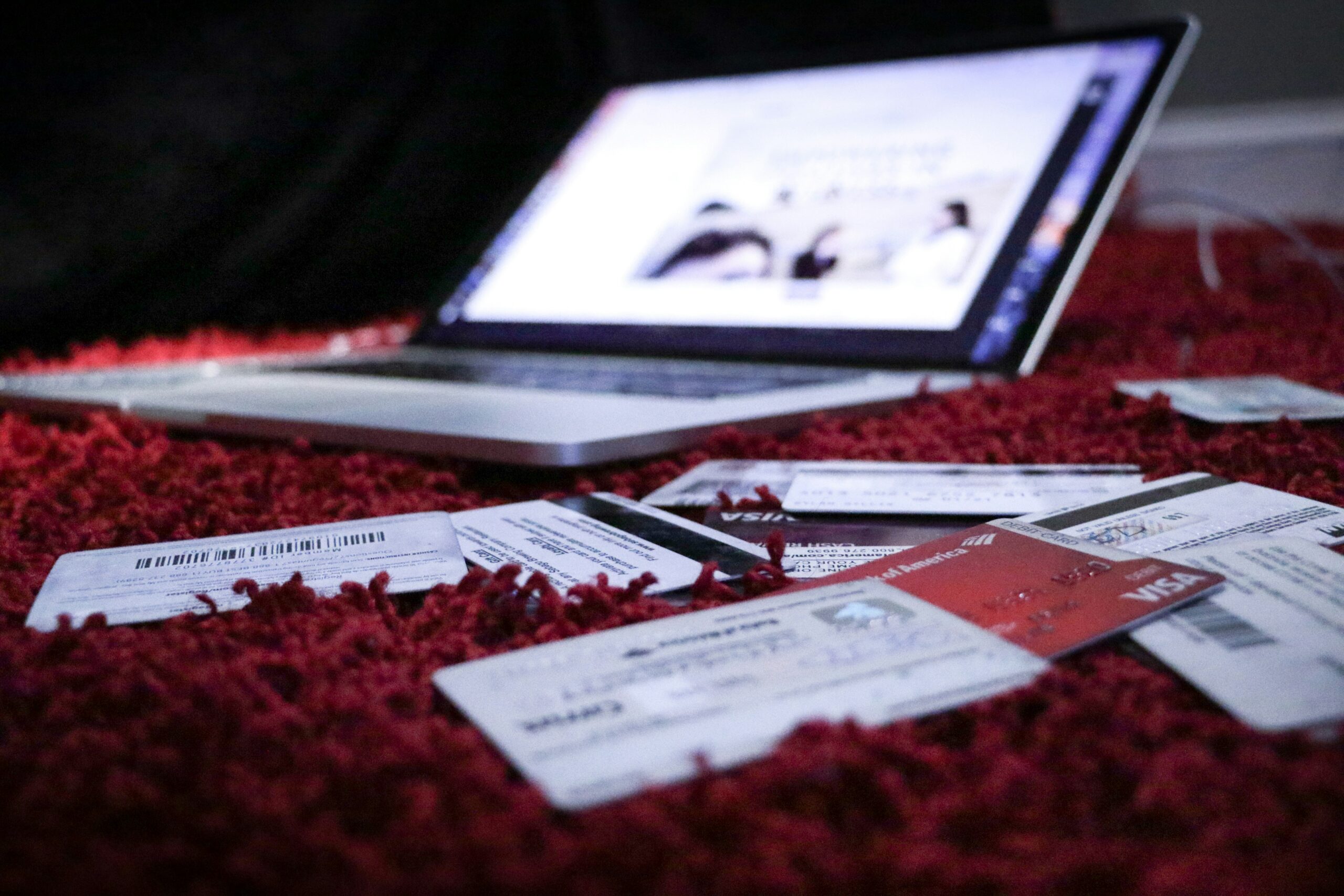

Bookkeeping for Beginners: Organize Your Business Finances

Starting your own business feels incredible—until reality hits: you’re also now the bookkeeper. If you’re wondering, “How do I even start my bookkeeping?”, you’re not alone. We’ve been there. So have thousands of business owners we’ve coached—some who got it right early, and some who learned the hard way. Good news? You don’t have to figure it