Travel is a perfect opportunity to mix business and pleasure. Yet, writing-off travel expenses is one of the most underutilized tax deductions by small business owners today!

If planned properly a trip that includes business could be 100% deductible even if there are some personal benefits included. In fact, even properly planned holiday travel can generate a significant tax deduction as a travel expense.

This can include visiting family or going to special/romantic location around the U.S. or the world while attending a conference or doing other valid activities necessary for your business.

However, in order to claim the travel deduction there are some important rules to follow.

Travel Deduction Rules

There are 5 Steps to follow in order to insure a properly documented tax deduction.

- Make sure the travel has a business purpose and it is “ordinary and necessary” for your business

- Understand what qualifies as a qualified transportation day and a business travel day

- Track and document what is actually deductible

- Treat dining and auto separate from travel

- Watch out for the traps and pitfalls

What is a valid business purpose

Making sure your travel has a “business purpose” is critical. Travel expenses are 100% deductible when traveling for business if they are ordinary and necessary for you in order to increase revenue, profit, or build your business in a constructive way.

The trick becomes finding a legitimate, honest and justifiable business reason for the “travel”. Frankly, it’s not too difficult to find a business purpose for travel.

Here are some wonderful reasons for a deductible trip:

- Attend a Conference or Workshop. Look at possible workshops in the local area where you are visiting. Tax, legal, business, marketing, website, SEO, customer relationship, or technical training based on your type of business are classes that you should consider taking. At the very least, visit a local real estate or investment club meeting if possible. The training could be fantastic and justify a great write-off, but just make sure there are valid meetings taking place at least four (4) hours a day and meets the rule of a Business Travel Day. (see below)

- Hold a Company Annual Meeting. If you have a corporation, this would be considered your Board of Directors Meeting and Shareholders Meeting. If you have an LLC, elect a Board of Advisors to assist the Manager or Managers of the Company. This is an excellent opportunity to discuss the operations of the company over the past year. Profits, losses, acquisitions, new ventures, goal setting…utilize the advice of your board members and make plans for the next year.

- Visit a Client. Wherever you are traveling to ask yourself, is there a customer or client in the area? Could you cultivate a new relationship or strengthen a current one? Schedule meetings each day you are traveling, at least for a few hours, and keep notes of what you accomplished along with why the meeting was important.

- Visit a Vendor. When traveling, think about if there is a vendor or supplier, sub-contractor, or affiliate you could meet with where grandma or grandpa lives? Could you negotiate new pricing, tour a facility, talk about networking and how you could work more closely together? The tax write-off may even be simply a bonus, when you consider the business you could generate with a strategic meeting that produces more revenue for the business.

- Check on a Rental Property. I’ve said it time and time again. At least consider and/or attempt to purchase rentals where you travel. More specifically, could you buy rentals where the extended family live. Have them help manage your properties or you could simply work on them while you are visiting. Sometimes, it’s a great excuse to get out of family functions to have to leave and work on the ‘rental’- just saying.

The list goes on and on as to what might a valid reason for your business; it just doesn’t make sense for any business owner to not have at least some business purpose for every travel experience.

Transportation Days and Business Travel Days

Understanding the difference between transportation days and business travel days is critical.

A transportation or “Travel Day” is the day or days necessary to get where you are going to actually DO business. These Travel Days are different than a Business Travel Day under the tax code, however they are still fully tax deductible. The concept of the Travel Day originated with the “Overnight Rule”. Meaning that a business trip and the deductible travel was necessary because the taxpayer needed a day or night to get where they were going and needed to sleep or rest before the workday or the return trip. IRS Rev. Rul. 63-145 & 75-169. See also United States v. Correll, 389 U.S. 299 (1967).

A Business Travel Day or “Business Day” is the day or days you are conducting business and typically doesn’t include the day you are ‘getting there’ or the Travel Day. The challenge then becomes, what qualifies as a “Business Day”. On the face of it, the rule seems simple:

“If a trip is primarily for business, a taxpayer may fully deduct transportation expenses for travel even if that combines business and personal activities” (emphasis added). IRS Reg. 1.162-2(b)(1). See also Habeeb v. Commissioner, T.C. Memo. 1976-259, aff’d, 559 F.2d 435 (5 Cir. 1977).

Conversely, the courts have also clearly stated that “no transportation expenses are deductible if the travel is primarily for pleasure, even though the taxpayer engages in some business activities at the destination” (emphasis added). Duncan v. Commissioner, 30 T.C. 386 (1958).

However, what is primarily for business or pleasure mean and what is the tipping point? The IRS has also stated in Regulations that “a ‘business day’ is a day in which, during appropriate business hours, the principal activity of the taxpayer is the pursuit of the taxpayer’s trade or business” (emphasis added). IRS Reg. 1.274-4(d)(2)(iii).

- 4 hour work day – Over time and due to the subjective nature of the words ‘primarily’ and ‘principle’, the “4 hour or more Work Day Rule” has evolved to provide a safe harbor for taxpayers. Under tax law, the words ‘primarily’ and ‘principle’ mean more than 50%, or the majority of the time in this instance. Moreover, the concept being well recognized that that a full work day in the U.S. is 8 hours, as long as the taxpayer spends the majority of that time (at least 4 hours) doing business, they have satisfied the Business Day requirement. (This interpretation remains accurate and widely accepted in 2025. See U.S. Department of Labor guidance on FSLA and IRS exam practices.)

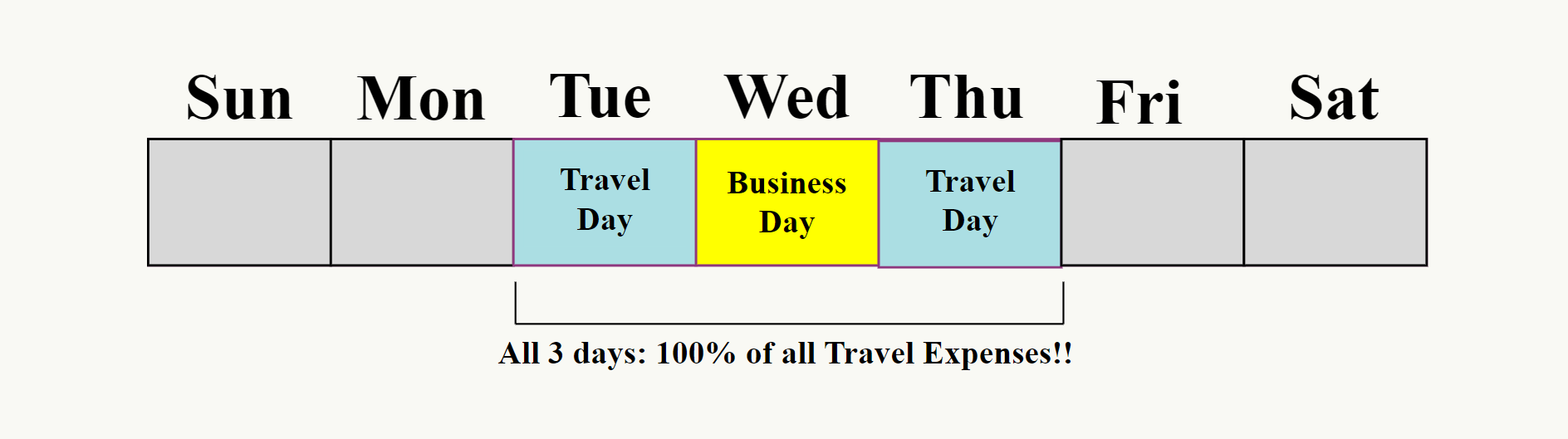

Thus, a properly planned 3-day trip may look something like this: Traveling on Tuesday for an important in-person meeting on Wednesday, and traveling back on Thursday. In this instance, all 3 days of travel expenses are 100% deductible.

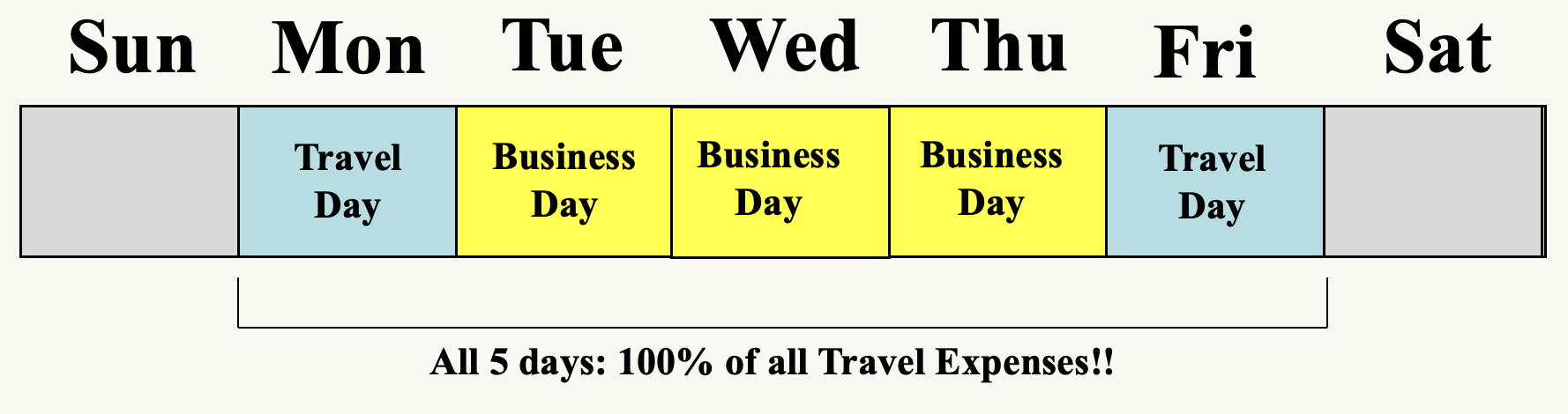

A 5-day business trip may look like this and all of the travel expenses for the full 5 days being full deductible.

Weekends and Holidays

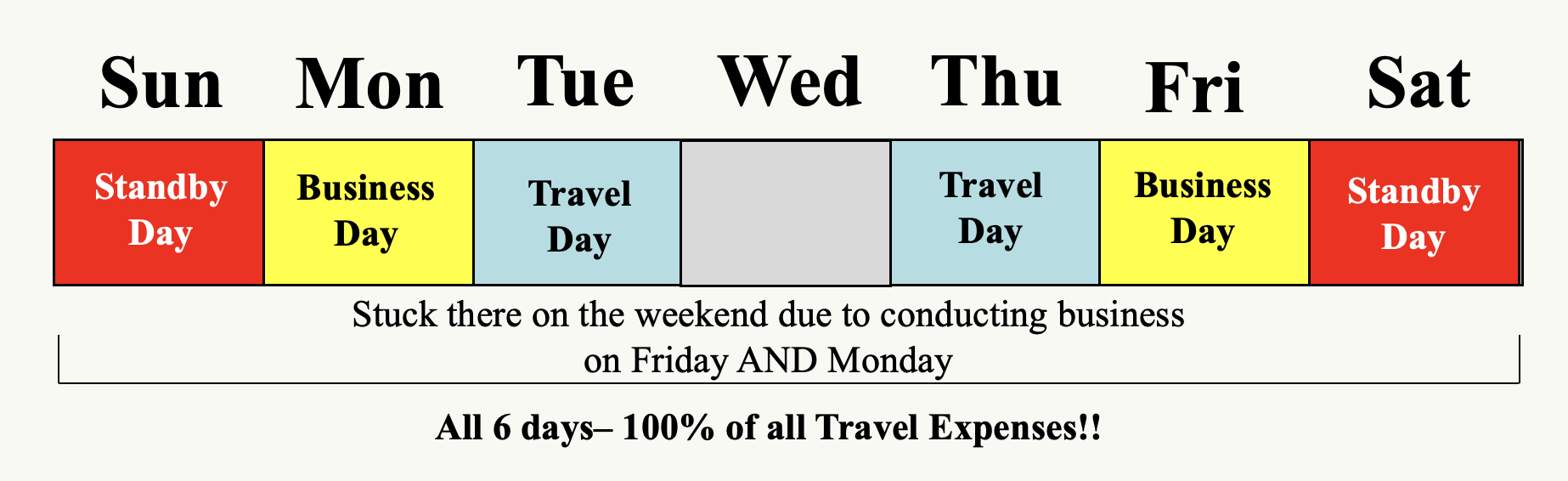

Another rule that’s important for business owners to know and understand, is the “Standby Day Rule” that applies to weekends & holidays. This rule essentially means that any weekends, holidays, and other necessary standby days sandwiched between Business Days, are counted as a Business Day themselves. — IRS Reg. 1.274-4(d)(2)(v)

However, in order for a taxpayer to qualify for this rule, they must complete the trip within a reasonable time frame (meaning no extra days laying around in the sun), and the Business Day activities over multiple days couldn’t be combined into one particular Business Day. Essentially, you got stuck in that city over the weekend because the meetings or activities needed to take place on both Friday and Monday.

Here is what the Standby Day Rule may look like on a weekend:

Days when your presence is required

When a taxpayer is traveling for business on multiple days, an exception to the 4 hour Work Day Rule is when a business owner’s presence is required. Thus, if a taxpayer is required to stay overnight for an important meeting or presentation the next day, even if it’s not for 4 hours the result is a deductible Travel Business Day. IRS Reg. 1.274-4(d)(2)(ii).

A taxpayer can also count as a Travel Business Day, any day when circumstances beyond their control prevent them from actively pursuing the business purpose of their trip. IRS Reg. 1.274-4(d)(2)(ii).

For Example: A taxpayer is traveling to New York for a business meeting on Wednesday, and arrives in the city the night before on Tuesday. However, a snow storm hits the city and delays the taxpayer’s meeting until Friday. While the taxpayer is stuck in NY going to museums, shows or restaurants that are still open, patiently waiting for the meeting on Friday, the extra days being stranded are deductible Travel Business Days.

What is actually deductible?

Many new clients’ tax returns come across my desk every year with literally zero travel deductions. Imagine the tax deduction from the travel expenses they could have taken advantage of with proper planning.

- Airfare

- Hotel and Airbnb

- Rental cars, Uber & Lyft

- Valet & Taxi

- Trains, Tolls, etc.

Essentially, any expense incurred that’s necessary for the business travel is going to be 100% deductible. However, this won’t include speeding or parking tickets, entertainment, and meals will still be limited to 50% (see below)

It is also important to note that the costs of a trip can be pro-rated or allocated if if a trip is a blend of non-deductible personal time and qualified business travel. So if the trip is deemed to be 20% personal, a taxpayer may still be able to take 80% of the travel expenses when calculated properly.

Finally, per diems can also be an option for taxpayers traveling on business. This is the concept that federal per diem rates can be taken as an expense, rather than the actual expense, whichever is higher. The problem is that greater than 5% business owners can’t use the lodging per diems, but are still allowed to use the dining per diem rates. See IRS Publication 1542.

Dining and Auto when traveling

First, keep in mind that the dining deduction is separate from the travel deduction. Yes, you can write off dining by yourself while you are traveling for business, but it is still limited to 50% of the expense (including tips and drinks).

The dining expense would go on a separate line on the tax return and not be included on the travel line. See my article “Writing-off the Dining Expense” for a variety of strategies and also combining the dining deduction with travel.

Auto expenses during your business travel for a rental car, gas, uber, taxi, etc… are also 100% deductible when traveling for business.

However, if a taxpayer is using their own car while traveling for business, the auto deduction is completely separate from the travel expense. There isn’t a special rule or method to put your auto on the travel deduction line. Any expense for your auto, truck, rv, or trailer would be deducted as an auto deduction. See my other article “The Best Auto Deductions for 2025.

Traps and Pitfalls

A few important considerations to be aware of when deducting your travel:

- Cruises. Writing off a cruises is extremely difficult, at least to any beneficial degree. See my other article “How to Write-off the Cost of a Cruise”. (See limits on cruise ships and other forms of “luxury water transportation” IRC Section 274(m)(1).)

- Multiple days. When traveling for business multiple days, make sure you are justifying each day with either 4 hours of work, or required meetings that couldn’t be combined into one business day.

- Documentation. Keeping receipts (or images of the receipts) and credit card statements are critical in an audit, but when it comes to ‘travel’, keeping a good log in your calendar as to the business you conducted, meetings, people you met with, etc… is even more important. Poor documentation of the ‘business purpose’ for your trip would be a killer when it comes to an audit.

- “Shopping” for rental properties. Looking for real estate to purchaser is not a valid business purpose for a trip. If a taxpayer is wanting to write-off travel while researching for rental real estate, they must actually conduct business on the trip. This is defined as making a legitimate offer on a property, visiting a property you already own, or better yet, working on the rental property physically and personally meeting with property managers, contractors, or tenants.

- Staying home. Business that could be done at home does not qualify as a deductible Business Travel. Taxpayers will often try to justify the travel because it helps their business, but it needs to be more than that. If a taxpayer just wants to ‘get away’ to study, or watch videos, or work on their own, but the business they’re doing isn’t tied to a reason to be in that geographical area, it’s not going to be deductible.

For Example: A taxpayer feels they are in their most creative state for writing their next book if they are staying at a cottage in the countryside of France. Regrettably, this is not going to be a valid tax write-off to stay in Europe while writing their book. However, if the taxpayer is in the business of writing travel literature, makes money in this business, and travels on a regular basis in order to carry out their valid business purpose, they would be able to write off the ordinary and necessary expenses to travel to France in order to write their book about travel in France.

Concluding Thoughts

With all of these strategies, moderation and balance is the key. Remember, ‘pigs get fat and hogs get slaughtered’. Don’t be too greedy to write-off every trip or travel experience unless your business model and income justify the deduction.

No matter what, at least attempt to do business each day you’re traveling and keep records of what you are doing, who you are meeting with, and how it relates to your business. As usual, the more money you make in your business, the more opportunity we have to be aggressive and take a larger deduction.

In sum, be intentional. Plan for business and pleasure to maximize your travel expenses. Keep your receipts, good records, and discuss the expenses with your Certified Tax Advisor at the end of the year in order to report a well-balanced tax return. Learn how you can become a Certified Tax Advisor.

Mark J. Kohler is a CPA, Attorney, co-host of the PodCasts “The Main Street Business Podcast” and “The Directed IRA Podcast”, and the author of “The Business Owner’s Guide to Financial Freedom- What Wall Street Isn’t Telling You” and, “The Tax and Legal Playbook- Game Changing Solutions For Your Small Business Questions”, as well as several other well-known books. He is also the CFO of Directed IRA Trust Company, and a senior partner at the law firm Kyler Kohler Ostermiller & Sorensen, LLP.