The 1031 Exchange can be a powerful tool when investing in real estate, but it’s not the perfect fit for every situation.

Recently, I was holding a Live Broadcast on 1031 Exchanges on YouTube and was surprised when I got a forceful comment from one of the viewers: “Come on Mark! A 1031 Exchange is always a great strategy…wtf?”. I was surprised by the comment and also loved the opportunity to address this opinion.

Thus, I want to clear up some misconceptions about the 1031 Exchange. Also I want to explain the basics of how this strategy can be great in the right circumstance.

When does the 1031 Exchange make sense?

I think three factors need to be present to bring the 1031 Exchange magic alive:

- A U.S. taxpayer owns a highly appreciated real estate,

- The property owner desires to buy more real estate in the U.S., and

- The taxpayer has tolerance and the ability to jump through some timing hoops

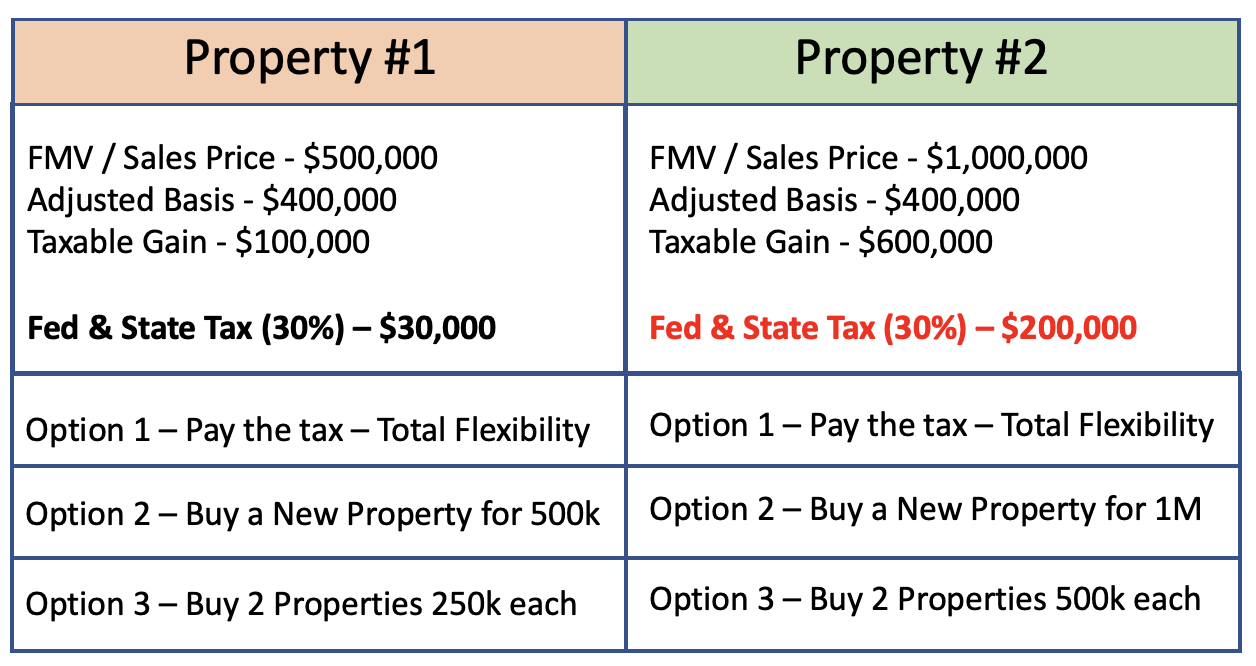

Now what one person considers “highly appreciated” is subjective and varies from person to person. Moreover, what one taxpayer feels justified paying in taxes is going to vary dramatically from what another taxpayer may be willing to pay.

However, with the cost, time, and effort to complete a 1031 Exchange, I typically see clients having a tax bill of 100k or more before electing to pursue the 1031 Exchange.

If they do nothing and just take the hit, I always suggest clients “run the numbers”. This way they can find the baseline of what the tax bill will be.

Also, it’s important to remember that a 1031 Exchange requires the taxpayer to purchase more real estate. Some people don’t want to buy more real estate and are ready to move on to another asset class. Doing this means they have decided that paying the tax is worth it to free up the cash.

EXAMPLE: “Running the #s”

But if buying more real estate is on your radar, it’s important to know that you can trade any type or class of real estate for another type or class of real estate. Some taxpayers think they have to trade their duplex for another duplex and that’s certainly not the case.

EXAMPLE: A Taxpayer can trade Mississippi swamp land for a downtown L.A. high rise…or trade a single-family home for a 4-plex multi-family project.

Finally, remember there are timing rules and some procedures that you have to specifically follow. It’s critical that taxpayers decide early on if they’re going to do a 1031 Exchange. They should also understand the timeline for their transactions (more on this below).

When a 1031 Exchange is NOT a Good Choice

There are times when the 1031 Exchange is not a good choice. For instance:

- You’re willing to pay the tax for more flexibility

- You don’t want to buy more real estate or at least the same dollar amount of real estate

- The timing isn’t going to work, or

- An Opportunity Zone project/strategy makes more sense

Also, keep in mind that the 1031 Exchange isn’t free and just a click of a button. The Accommodator for the Exchange could charge anywhere from $250-$1,000 per closing (or more depending on the type of 1031).

Finally, remember that your accountant has to file Form 8824. Then create work papers to track your basis on the new property and start new depreciation schedules. Tax prep fees could easily range from $1,000 to $2,000 (or more depending on the complexity of the 1031 Exchange).

How the 1031 Exchange Works

At the most basic level, the 1031 Exchange essentially requires that upon the sale of your highly appreciated real estate, you turn around and buy a new property(ies) of equal or greater value. The purchase price of the new property(ies) is directed compared to the sales price of what you sold.

When it comes to the purchase price of the new properties, it generally does not matter what the mortgages are, how much you originally invested in the first property(ties), or what your taxable gain will be. It all comes down to comparing purchase prices.

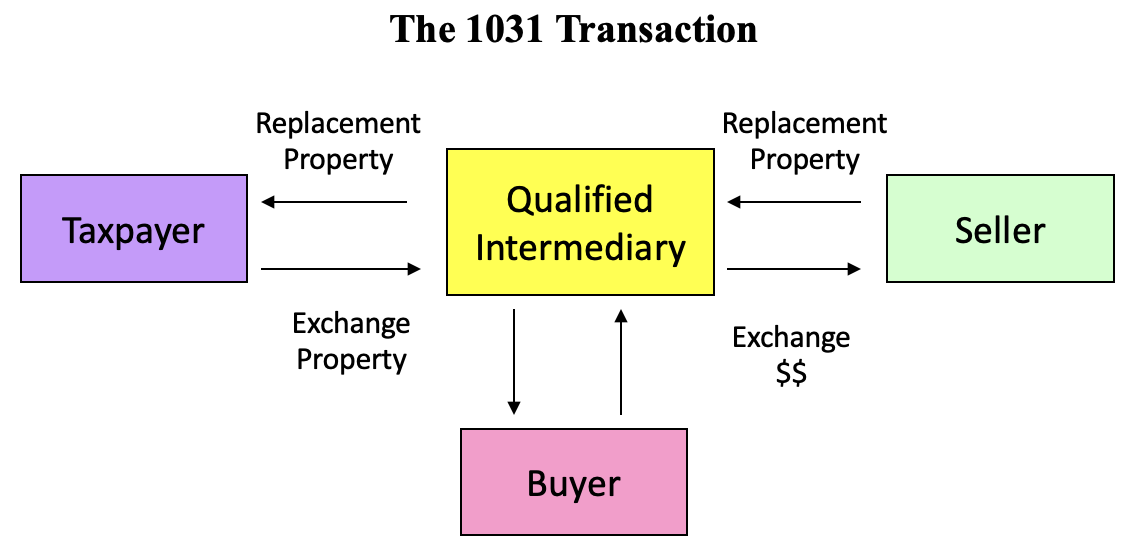

However, keep in mind that in this “exchange” the “stars will never align.” Wherein the property(ies) you want to sell will match up with a Seller that wants to exchange their properties for yours. Hence the term we learn about is what’s called the “Delayed exchange”.

What is a Delayed Exchange

This means that an intermediary or accommodator will act like an escrow in the middle of the deal. They will hold your money from the sale until you find and purchase your new property. Here is what it looks like:

Important Terms

Also, there are important terms to be familiar with as you communicate with your realtor, accountant, accommodator, and other parties:

- Primary Taxpayer – The Primary Taxpayer is the one that owns the highly appreciated property(ies)s that doesn’t want to pay the tax at this time.

- Relinquished/Exchange Property – The property(ies) the Primary Taxpayer is selling and wants to exchange.

- Replacement Property – The property(ies) the primary taxpayer will ultimately acquire.

- Buyer – The Buyer(s) of the Relinquished/Exchange Property(ies) They don’t care what the Primary Taxpayer is ultimately going to buy or when. They are simply “buying” the Relinquished or Exchange Property from the Primary Taxpayer.

- Seller – The Seller(s) are the owners of the Replacement Property(ies). They don’t care what the Primary Taxpayer sold and their timeline, they simply want to sell their property(ies).

- Accommodator/Intermediary – This is the company that will hold the monies from the sale of the Relinquished/Exchange Property, help the Primary Taxpayer follow the proper timing rules, and will transfer the money to the Seller or Sellers when the purchase of the Replacement Property(ies) takes place.

- Tax Deferral – The 1031 Exchange is not a ‘tax-free’ exchange. The tax the primary taxpayer would pay will be deferred and the basis adjusted down in the new Replacement Property until it’s ultimately sold down the road in a non-1031 transaction.

- Basis – The basis in the Relinquished/Exchange Property needs to be calculated and measured against the sales price in order to estimate the potential tax if the Taxpayer doesn’t undertake the 1031 Exchange. Also, the Basis must be calculated in the new Replacement Property and new depreciation schedules to track the deferred gain.

Timing Rules when Doing a 1031 Exchange

There are a lot of timing rules when doing a 1031, and here are a few of the big ones:

PRO TIP: The Measuring Date is the date by which all of the timing rules are calculated.

The Primary Taxpayer has 45 days to “identify” potential replacement properties, or simply close. (If the Primary Taxpayer closes on the new Replacement Property before the 45-day mark, then they don’t have to ‘identify’ any properties.)

The Primary Taxpayer has 180 days to acquire the Replacement Property(ies), or essentially 135 days from the Identification Date.

Identification Rules when Doing a 1031 Exchange

IF the Primary Taxpayer doesn’t purchase the required Replacement Property(ies) within 45 days they have to follow Identification Rules.

NOTE: Essentially the IRS is saying: “If you want to do a 1031 Exchange, that’s great, you just can’t let it drag on and it can’t be willy nilly. We need to know you are following specific protocol”

The Primary Taxpayer is required to provide in writing an “unambiguous description” of the potential replacement property(ies) prior to midnight on the 45th day of the Measuring Date.

If the Primary Taxpayer wishes to identify or purchase multiple Replacement Properties, then they must follow one of the following guidelines:

- Identify up to three Replacement Properties of any value with the intent of purchasing at least one of equal or greater value of the Relinquished/Exchange Property.

- Identify more than three Replacement Properties with an aggregate value that does not exceed 200% of the sales price of the Relinquished Property(ies).

- Identify more than three Replacement Properties with an aggregate value exceeding 200% of the Relinquished/Exchanged Property(ies).With the requirement that 95% of the sales price of all Properties identified must be acquired.

Creative Options with 1031 Exchanges

In summary, remember the basic 1031 Exchange is simply just a jumping-off point to so many other “Exchange” options. There are:

- Reverse 1031 Exchanges

- Improvement Exchanges

- Building on Property ‘already owned’ Exchanges

- Construction Exchanges

- Promissory Note Exchanges

- AND receiving “Boot” or cash as part of an Exchange

I also like to use a 1031 Exchange in combunation with the Sale of Home Exemption, a Charitable Remainder Trust, or even Opportunity Zone Property.

Bottom-line, there is so much to learn in this area of tax planning. Even the average real estate investor should have a good understanding of the 1031 exchange option and related strategies.