The Charitable Remainder Trust or CRT is a powerful tool for multiple reasons. Saving taxes, creating a stream of income, asset protection, and benefiting a charity, just to name a few.

There are a variety of ways a that you can design a Charitable Remainder Trust and get creative. Along with the needs of the taxpayer. Historically, CRTs were used for highly appreciated real estate transactions where the seller potentially faced a hefty tax.

However, with the rapid increase in the value of certain cryptocurrencies, traders have discovered the benefits of the CRT. Along with the ability to avoid the initial tax on highly appreciated tokens or coins.

Why Cryptocurrency Investors Should Care

The root of the problem is that the tax crypto investors will pay when selling OR even trading their crypto is more than they realize. In fact, there are multiple taxes that could play into the equation in any one given transaction.

If you’re lucky, you will first get to apply the Federal Long-Term Capital Gains rates. This is a maximum rate of 20% IF you held the token or coin being sold for at least 1 year or longer. However, when the gain is over a certain threshold, you must also pay the ACA Net-Investment Income Tax (ObamaCare) of 3.8%. This tax applies on everything over $200,000 if you are single, or $250,000 for those married filing jointly.

Next, you have to worry about the state tax on your gain. I’m sorry, you can’t say you earned the money out of the country or even in another state to avoid this tax. Wherever you are a state resident, you will pay at least that state’s tax rate on the gain.

Finally, heaven forbid you are selling a token or coin you have held for less than 12 months. This means you have a Short-Term Capital Gain and pay Ordinary Income Tax Rates!! These rates are as high as 37% and kick in at gains of more than $540,000 if you’re filing single, or $648,000 if married filing joint.

Example 1.1: An investor owns tokens or coins valued at 1M with an initial investment of $50,000. The gain would be $950,000 if the investor was to sell the tokens in their own name and potentially face a capital gains tax rate as high as 36.8% (Federal rate of 20%, plus ACA of 3.8%, and a state tax rate ranging from 0-13%). This could result in a tax bill of $349,000!!

Specifically, here are the different taxes crypto investors need to be aware of:

- Long-Term Capital Gains (15-20%)

- State Taxes (3-13%)

- Net Investment Income Tax (3.8%)

- Ordinary Income (Short-Term Capital Gains) (10-37%)

…and just to add to this stress, the Biden Administration wants to increase the Ordinary Tax Rates. If you have a short-term gain (crypto bought and sold in less than 12 months), you could ultimately face an Ordinary Tax of 39%.

Avoiding the Initial Tax on the Sale

With a CRT, the basic concept is that a ‘charity’ (the Charitable Remainder Trust), is selling the cryptocurrency – Not You! Thus, there isn’t any tax due on the initial sale.

This is because the ultimate beneficiary of the CRT assets is a qualified 501c3 charity, (the one receiving the ‘remainder’ when you die). As such, the CRT can sell the crypto ‘tax-free’!

Now “tax-free” may sound a little too good to be true. It’s correct that there will be ‘some’ tax paid in the future (more below). The real beauty of this is that the Donor doesn’t pay tax on the initial sale of the cryptocurrency. Thereby creating a larger ‘pool’ of money the Donor/Trustee can invest within the CRT.

Example 1.2 – With the same facts as above and facing a tax bill of $349,000 (and again that’s simply long-term capital gain rates), this would leave you a ‘bucket of money’ of only $651,000 to invest into the future. However, with a CRT, you would have the entire $1,000,000 to invest on day-2 and pay no tax on the future trades inside the CRT. Based on a tax-free rate of return inside the CRT growing at just 10%, the numbers become staggering.

With all of that said, this certainly excites crypto investors about the CRT. Along with the ability to save on the initial upfront tax. They’ve also realized that choosing the right type of CRT is absolutely critical.

For example, the ‘annuity’ type of CRT, or CRAT, really isn’t a good fit because of the fixed payments in the CRT. The Donor’s lack of control moving forward (although the Donor may receive a larger tax deduction on the way in).

Hence, more Crypto traders are turning towards the Charitable Remainder Unitrust, or CRUT, for the possible ‘perfect equation’ to solve their tax woes.

This type of CRT is my personal favorite for the reason that a CRUT can create increasing distributions and give significant control to the Donor over the investment strategy inside the CRUT. They also deploy the assets directly back into Crypto.

What’s Unique about a Charitable Remainder Unitrust?

A CRUT is a version of the broader CRT strategy. It is still an irrevocable trust that allows the holder of highly appreciated assets to donate them to the Trust creating a tax deduction and avoiding the tax on the sale of the asset or assets. It also creates the process for a ‘revaluation’ of the trust assets each year.

Sometimes the easiest way to understand a CRUT is to compare it to the Charitable Remainder Annuity Trust (CRAT). Most understand the concept of a CRAT in that it pays out a fixed annuity to the Donor over a term of years and it’s a clear-cut calculation. In fact, the dollar amount of the payment never changes even if the trust value goes up or down based on the rate of return inside the trust.

However, with a CRUT, the trust value is ‘revalued’ in January every year. Then makes payments to the Donor based on this value and the distribution percentage. Yes…the distribution percentage is fixed from the outset (more on this below), but when the value of the CRT increases, the actual dollar amount of the payments does as well.

Thus, the Donor is not only encouraged to invest the CRUT assets wisely in order to grow the ‘bucket or pot’ of assets in the CRT, but they are allowed to be actively involved in and decide on the investment decisions inside the CRUT.

What are the Benefits of a CRUT?

It surprises many taxpayers to learn that the IRS allows this strategy and has for many years. There are so many reasons why the parties involved benefit, and why the IRS effectively loses. The reason the government allows it is because of its beneficial impact on charities and thus society as a whole.

In fact, a properly implemented CRUT will result in the following six (6) benefits to one degree or another.

- ‘Tax-free’ sale of the Crypto. Thereby creating a larger ‘pool’ of money the Donor/Trustee can invest within the CRUT.

- The Donor can invest the proceeds of the sale inside the CRT tax-free for the life of the Trust.

- The donor receives a quarterly distribution based on the annual value of the CRUT. It is at a fixed distribution percentage determined by their sex and age when creating the CRUT (between 5% and 15%).

- The donor receives a current income tax deduction for the charitable contribution based on the present value of the future donation to the charity (typically around 10% of the FMV of the donated crypto.).

- Asset Protection for the trust assets from the Donor’s personal actions. The CRUT creates an asset generally untouchable by creditors of the donor. This is assuming you enter the CRUT before any ’cause of action’ or ‘judgments’ exist.

- …and the Charity gets the remainder when the donor dies.

Do I really pay NO Taxes whatsoever with a CRUT?

No. You still pay taxes on your distribution amount.

A number of advantages may flow from a well-crafted CRUT. However, keep in mind that the Donor will indeed pay tax on the quarterly distributions from the CRUT. The following are two key points:

- First, (as explained above) the CRUT didn’t pay any taxes while building the bucket of investments to its annual value;

- Second, the Donor doesn’t always pay ordinary income tax rates on every dollar. It depends on the type of income generated inside the CRUT. Thus the Donor pays the tax rate based on the ‘type of gain’ created in the CRT (for example, long-term, short-term capital gains, or interest);

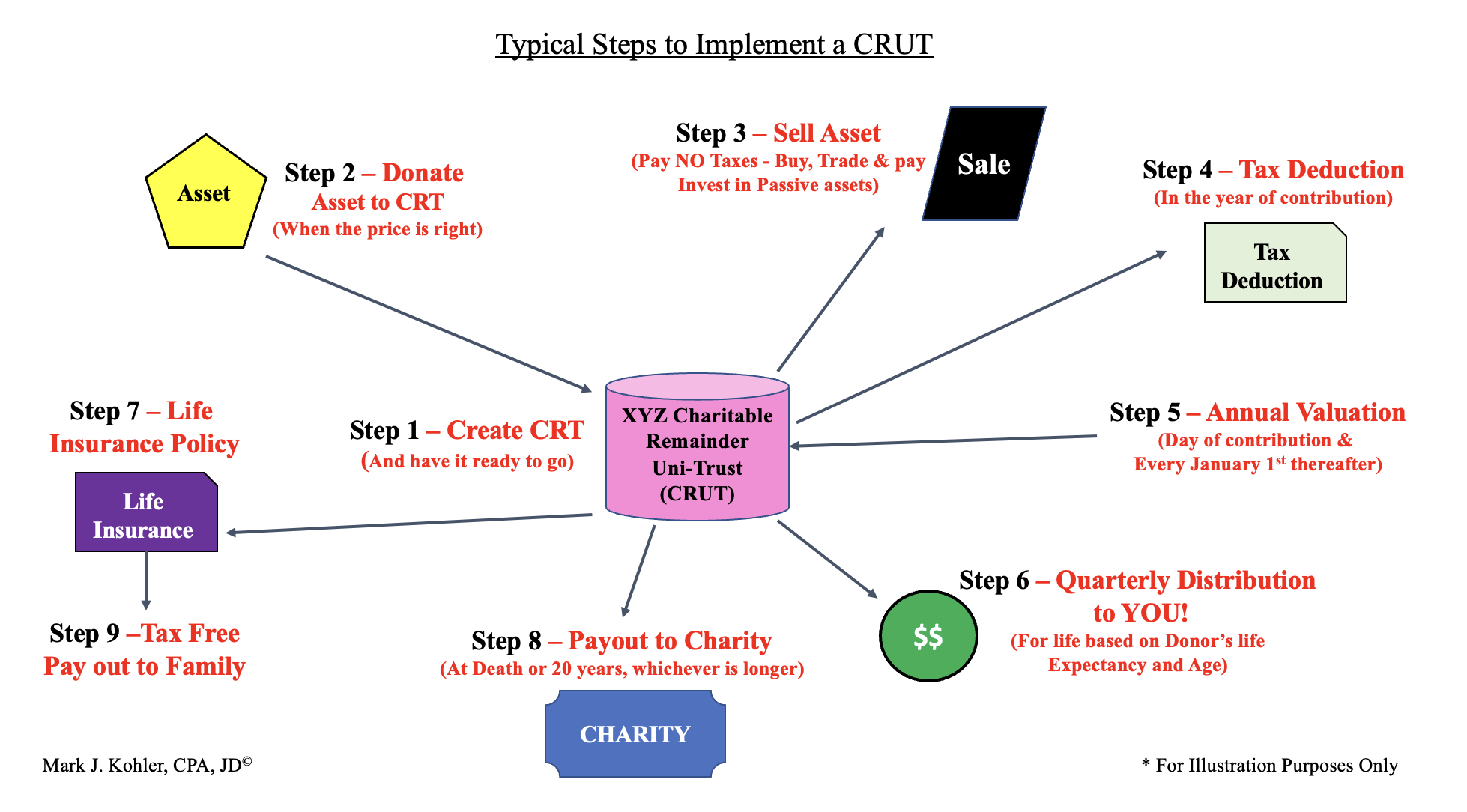

What Are the Basic Steps Involved in Creating a Charitable Remainder Trust?

Keep in mind that there can be variations on this basic plan. Charities are more than willing to get creative to meet a donor/property seller’s needs. However, below are the basic steps with a standard CRT plan.

- Create the trust, designate the charity, and define the terms of the trust. For example, what amount of income from the trust will be paid to the donor. As well as, when and how it will be disbursed;

- Donate/transfer property to the trust. You need this to take place before the property is under contract. Other IRS rules apply as to the timing of the trust and the transfer and sale of the property;

- The trustee sells the property to a third party tax-free. All proceeds from the sale of the property donated to the trust go into a trust account. the trustee controls this;

- The donor takes a tax deduction over the next five years. The deduction will be based on the property value. Typically, the sale to the third party or an appraisal determines this;

- The trust pays income to the donor for life. Again, the terms of the trust will direct the trustee as to how to invest the trust assets. Plus when and how to distribute funds;

- The donor may fund life insurance. The income paid to the donor can then fund a separate irrevocable life insurance trust on the life of the donor and/or their spouse. This is the final piece of the equation. As you can see in Figure 14.2 below (a diagram from my book The Tax and Legal Playbook in Chapter 14);

- The charity gets the remaining money in the trust; and

- The family gets life insurance tax-free upon the donor’s death. This is the life insurance policy that will pay the beneficiaries upon the donor’s passing tax-free. Also in effect, replace the value of the assets that they/you donate to the charity.

Bottom line, if you have highly appreciated real estate, a business, stock, or even cryptocurrency, reach out for a consultation with one of our team members at KKOS Lawyers. Consider if this Charitable Remainder Trust is a good option for you.