How the Trifecta Structure Helps You Keep More of What You Earn

If you’re a business owner, investor, or side hustler, your tax and legal structure MATTERS.And if you’re still filing everything under your own name or haven’t made the switch to an S corp, you could be leaving thousands of dollars and tons of peace of mind on the table. That’s why we created the Trifecta. […]

6 Types of LLCs Every Entrepreneur Needs to Know

You’ve probably heard that forming an LLC is a smart move for protecting your business and assets. But did you know there are six main types of LLCs—and two bonus variations—that each serve very different purposes? In this guide, we’ll break down exactly what those types are, who should use them, and how choosing the […]

Avoiding problems with the IRS and the “Dirty Dozen”

All of us want to save taxes, but at the same time stay out of trouble with the IRS. In fact, I would hope we would even have a higher standard of being honest and ethical in the manner in which we all report our income, deductions and file our tax returns. We live in […]

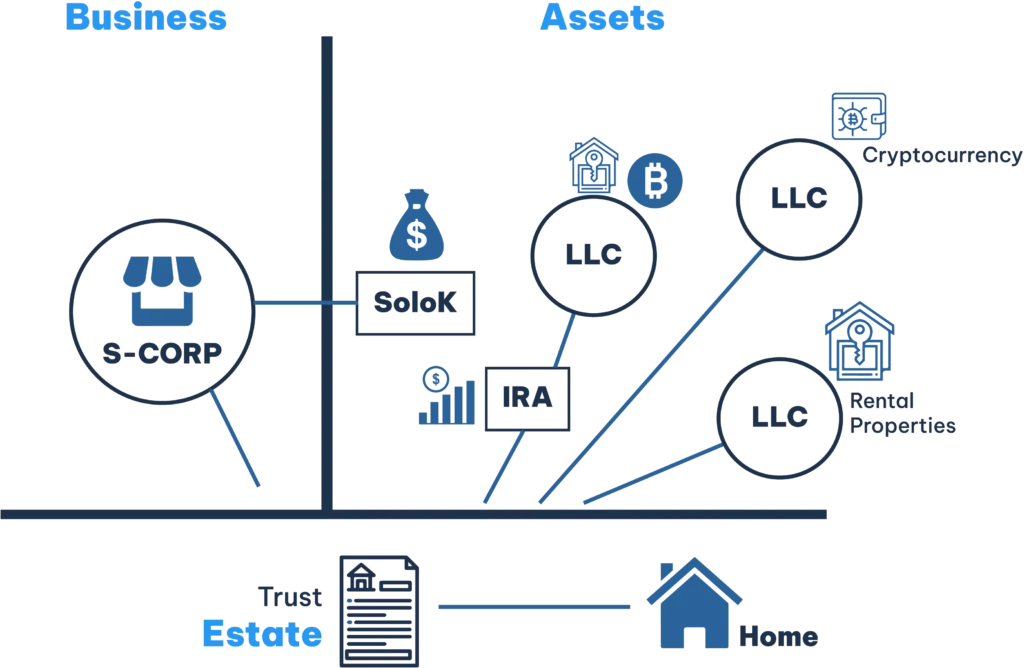

Why You Need Your Own Family Office (And How to Set It Up)

When most people hear the term “family office,” they imagine billionaires with private jets, private investment advisors, and fancy offices. But guess what? You already have a family office — it might just be the third bedroom down the hall with a hide-a-bed in it. And that’s more than enough to start building serious tax […]

Self Employed Health Insurance Deduction: How to Legally Write Off Premiums

Health insurance is expensive, and making sure it’s a write-off in your business is a big deal. Regrettably, it’s not as easy as just putting it on your P&L and treating it like office supplies. Health insurance premiums can be deductible. However, they must be reported in a specific way based on your type of […]

Koinly: The Smart Tax Pro’s Tool for Tracking Crypto Gains

Crypto clients don’t always know what they’re doing—but their wallets sure do. If you’ve ever looked at a spreadsheet full of transactions from a crypto client and wondered how you’re supposed to make sense of it all… you’re not alone. Tracking crypto trades, swaps, staking rewards, and DeFi earnings can feel like trying to […]

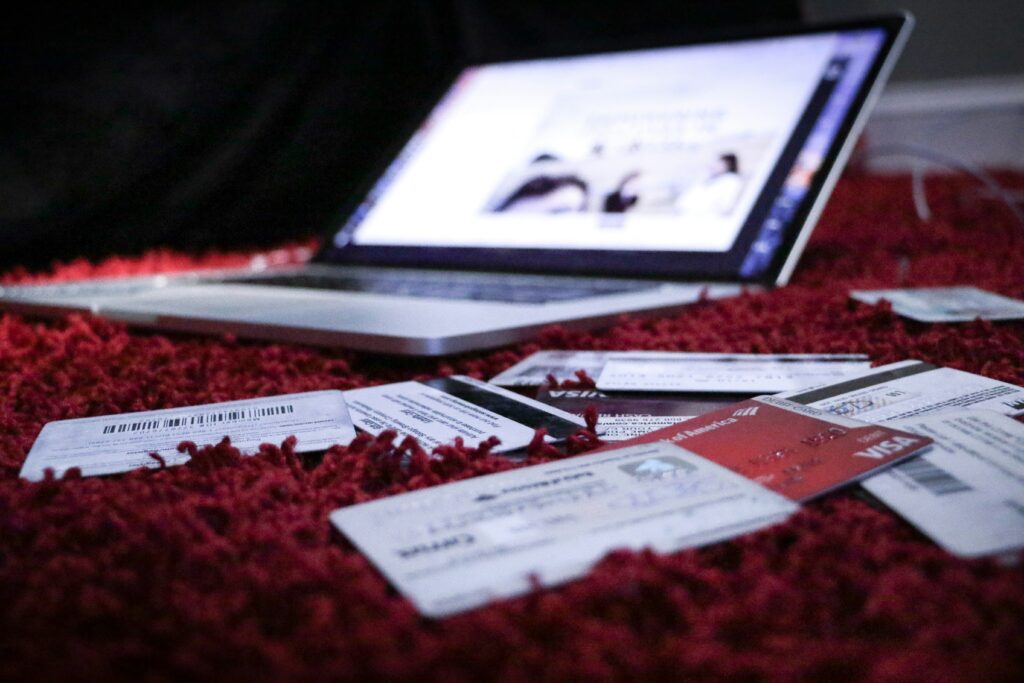

How to Protect Your Personal Info When Starting an LLC

When you filed your LLC or corporation paperwork, did you accidentally just blast your home address to the internet? It’s a mistake I see business owners make all the time—and trust me, it’s one you don’t want to make. Here’s the deal: the moment you list your name and home address in your business filing, […]

Good Debt vs. Bad Debt: The Real Talk Clients Need to Hear

Not all debt is created equal. For years, we’ve been told that debt is something to avoid at all costs. But the truth is, debt can be either a wealth-building tool—or a financial anchor. Understanding the difference between good debt and bad debt isn’t just helpful… it’s essential. Whether you’re advising clients or managing your […]

Crypto Communication: Why Tax Pros Must Learn the Language of Blockchain

Cryptocurrency isn’t going away. In fact, it’s becoming more mainstream by the day—and that means tax professionals need to keep up. But here’s the tricky part: your crypto clients might not even understand what they’re doing. They throw around terms like “staking,” “swapping,” and “DeFi,” often using them interchangeably. And if you’re not fluent in […]