Penalties for Not Filing a 1099

Penalties for not filing can be expensive. They vary from $50 to $110 per Form, depending on the length of time following the deadline they are issued.

If a business intentionally disregards the requirement to provide a correct payee statement, it is subject to a minimum penalty of $550 per statement (more on this below).

Below, we’ll outline the best practices for efficiently issuing 1099 forms to avoid fines.

What if I received a 1099?

Contractors need to report all 1099 income. Fortunately, there are plenty of tax deduction options that can be applied to 1099 earnings.

Learn more about what you should do if you receive a 1099 form.

Who is required to send out 1099s?

If you are a homeowner or consumer you do NOT need to send out a 1099 if you pay someone to perform work at your home, for example.

The following entities are more than likely required to send a 1099:

- Business owners

- Lenders

- Finance manager

Failing to do so can lead to serious penalties, and you may not be entitled to a deduction for the expense you incurred/

Below, we’ll explore the most common types of 1099 forms you may encounter.

1099-NEC

This is the most common 1099 form issued. The “general rule” is that business owners will file Form 1099-NEC for each person or business, whom in the course of the payor’s business, paid at least $600 during the year. Only those who are NOT employees of the business need a 1099 form.

Learn more about the 1099 form and how to file.

1099-MISC

Form 1099 Misc is needed for other payments over $600 to someone who is NOT an employee, made in the course of the payers business. This may include:

- Rents

- Prizes

- Awards

- Other income

1099-INT

A 1099-INT is required if you pay interest to investors on money you’ve borrowed or invested.

This tax form is used to report interest income, paid by all ‘payers’ of interest income to investors or private lenders at year-end

Learn more about the 1099-INT form and how to file.

1099-DIV

A 1099-DIV is typically used by large banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. If you own and operate a C-Corporation with shareholders, this would be the Form to report payments to those investors (1099-DIV Instructions).

Learn more about the 1099-DIV form and how to file.

1099-R

Like the 1099-DIV, this form is generally used by banks, trust companies, or brokerages. This Form is used to report the distributions of retirement benefits such as pensions and annuities. Also, if you take distributions from a self-directed IRA or 401k, you should receive some type of Form 1099-R.

Learn more about the 1099-R form and how to file.

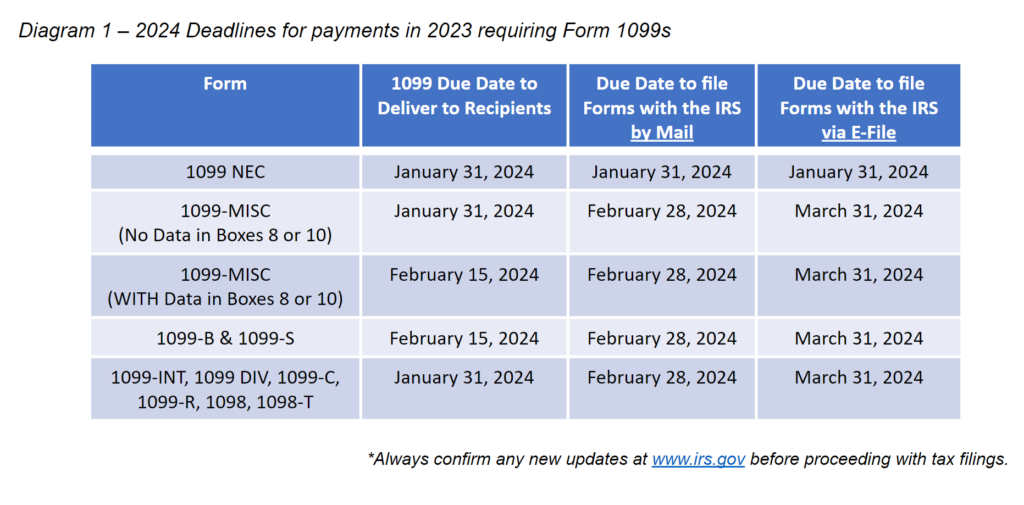

When are 1099s Due in 2025?

Business Owners and 1099 Rules

You do NOT need to send a 1099-NEC to the following:

- Vendors operating as S or C-Corporations (excluding lawyers)

- LLCs or partnerships taxed as an S or C-Corp

- Sellers or merchandise, freight, storage or similar

- Rent payments, or payments

- Payments made by credit card, debit card, gift card, or other third-party payment (provided you’ve indicated on the platform that this is a business transaction)

However, if you are a business paying rent for a business space, you WILL need to issue a 1099 form for your landlord unless they meet another tax exception.

1099-NEC Forms for Lawyers

Lawyers are the exception to the 1099 S-Corporation rule. The IRS has special rules for lawyers to ensure they report their entire income. This means even if your lawyer is ‘incorporated’, you are still required to send them Form 1099-NEC (provided you paid them over $600 and intend to make a business deduction for paying them).

1099 Procedures

Unfortunately, IRS rules have changed. You can no longer download your 1099 forms online from the IRS website. The new method is to file all forms electronically and mail forms to payees before the deadline.

We recommend using an accountant. You can also file your forms using software or an app, such as Track1099.

Electronic vs. Mail Tax Filing

- If you have more than 10 Form 1099s to file, you MUST file electronically

- If you have less than 10 Form 1099s to report, you may file via mail

If a taxpayer fails to comply with the proper method, they may be subject to fines of up to $100 per form if reasonable cause cannot be established.

1099 for Foreign Workers

If you hire a non-U.S. citizen to perform work inside the United States, you must file a 1099-NEC. If the worker is a U.S. citizen, you are required to use the appropriate 1099 form even if the work is completed outside the United States (unless they qualify for exemption).

As a business, it is your responsibility to determine if someone is a U.S. citizen.

Anyone working for you who is not a U.S. citizen should fill out, sign, and return a Form W-8BEN.

1099 Deadlines

January 31 is the deadline for payees. Forms can be delivered via email or mail.

For businesses with 10 or more 1099-NEC forms, the deadline to file electronically with the IRS (form 1096) is January 31. Note: the previous filing deadline was the end of February. As of 2023, this is no longer the case.

Depending on your state law, you may also need to file a 1099 NEC with the state. Working with an accountant or using approved software helps make this process easier

Curious about becoming a certified tax specialist? Discover year-round success with the Main Street Tax Pro certification.

The following states have additional filing requirements for Form 1099 and 1099-NEC:

- California

- Delaware

- Hawaii

- Kansas

- Massachusetts

- Montana

- New Jersey

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Wisconsin

The W-9 is your “Best Friend”

It can be frustrating if you don’t have all the information you need to issue Form 1099-NEC to a payee. One of the best ways to prevent this is for all business owners to request a W-9 form from any vendor you expect to pay more than $600 before you pay them.

This way, you’ll have information on exemptions, mailing address, and tax ID number ready to go. Download the W9 Form here.

Suggested Procedure for 2025:

Moving forward this year, make sure to get a Form W-9 from all your vendors before they can get paid. Whatever you do, do not attempt to pay for services under the table.

Getting a W-9 from them will ALSO ensure you ultimately get your tax-write off for 2024 and will save headaches next tax season. For more information on this see the Instructions for the W-9.

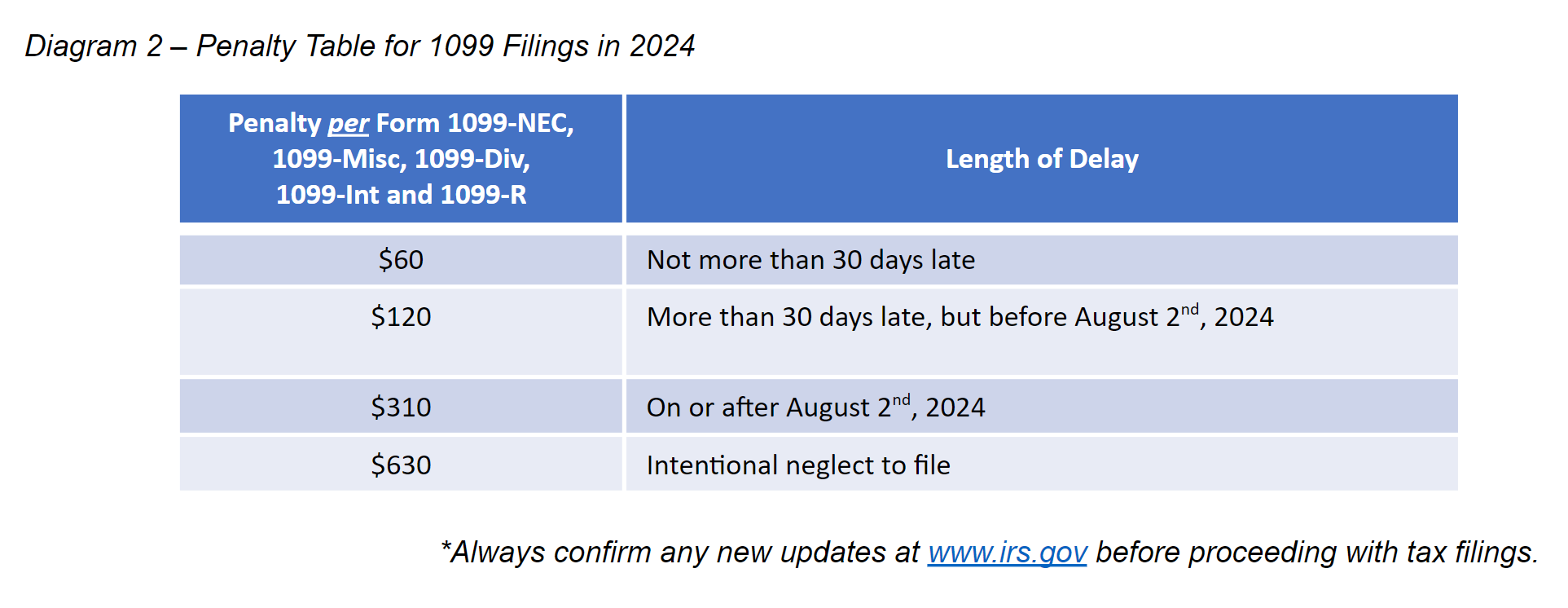

What are the Penalties if I miss a Deadline?

As mentioned above, penalties for not filing a correct 1099 can add up quickly. They vary from $50 to $110 per Form depending on how long past the deadline.

If the IRS can prove that a business intentionally disregarded the requirement to provide a correct payee statement, they are subject to a minimum penalty of $550 per statement, with no maximum.

Real Life Story

A client contacted me this year because they chose to file their 1099s on their own and didn’t carefully follow the rules. They inadvertently mailed in the forms and didn’t electronically file (see rules below regarding electronic filing).

After the IRS issued $17,000 in penalties, our only hope was to show reasonable cause.

After months of time, accounting, legal fees, and unnecessary stress, we were eventually able to avoid the penalty.

If you are already late in filing your forms, like “The Rock” in the movie ‘The Rundown’, you have two options:

- Hurry and file the forms. If this is your first time filing late and you can show reasonable cause, the IRS sometimes waives penalties.

- Ignore the issue and hope it goes away. In this case, you will be subject to additional stress and heftier fines if the IRS audits you (which they often do).

Option A is always best. And as The Rock was quick to remind Seann, William Scott, “There is no Option C.”

In Summary

Never miss a deadline with my 2024 Trifecta Planner and Calendar Click here for more information.

Be sure to meet all appropriate 1099 rules and regulations. The maximum penalty can easily exceed $1M plus interest for small businesses in 2025.

The IRS considers you to be a small business if you’ve earned an average of $5 million or less in annual revenue for the past three tax years. There is no limit on the penalties for intentional disregard to file. Ignorance is never an effective defense.

Finally, be careful trusting websites just to save just a few dollars. It can cost you significantly if you miss even a small rule or procedure. Most accountants have an affordable procedure to assist in the filing and can be a huge resource. Business owners must take the filing process seriously and take personal accountability to ensure they complete them.

FAQs

Learn the answer to commonly asked questions on the 1099 Form and process below:

What Qualifies as a 1099 Vendor?

A 1099 vendor is someone who works for a business as a freelancer or independent contractor and not an employee of the business. The IRS defines a contractor as someone with:

- Autonomy over work performance

- Financial control over their activities

- Project-based work, without the expectation of indefinite employment

What is the 1099 Minimum Amount?

1099s must be filed for contractors who make $600 or more.

Who is Exempt from 1099 Reporting?

Typically, C-corporations, S-corporations, or LLCs are exempt from 1099 reporting.

Can you 1099 Someone You Paid in Cash?

Yes, you can, and you should provide a 1099 Form for someone you paid in cash, as long as the amount was over $600. Cash payments should not be treated any differently to any other form of payment when it comes to filing the 1099 Form.

once I upload my 1099’s to the IRS portal, do I still need to send them out to recipients

Also, is the only thing that I really need to submit electronically the 1096?

1099 NEC Questions

1 – I have a vendor I paid $500 for services, and $6000 for computer hardware. Does he get a 1099, and for what amount?

2- Similar to the first question, but lets say I paid him $601 for services, and $6000 for the hardware. He would get a 1099 since he is over the $600 in services, but would his 1099 report $601 or $6601? Do I need to account (or somehow record) service vs hardware separately ?

I have a question, If I am buying My business from a private party do i have to file a 1099 Int. for them.

If you are buying a company this year, you do not have to worry about 1099s till the next year.

The 1099 forms are issued for people who received payments in 2022. You need to remember the end of the year is the period borderline for fillings.

I have a question, because I am totally confused… let me explain my situation first.

I work for a small mom and pop place. There are a total of 4 employees that work here. We are getting paid $8/hour with no over-time compensation. We are also working under a form 1099. So, we are actually making less than $8/hour. Does this small business fit the criteria to use 1099s?