With increasing inflation and the cost of living, more Americans are questioning if it’s worth staying in their home state when they could save thousands on State Income Tax.

Whether you call it ‘moving domicile’ or ‘moving residency’, it’s typically with only one goal in mind: Saving State Taxes!

Currently, ten (10) states have an income tax rate of 7% or more. California leads the pack at 12.3%. Hawaii, New Jersey, New York, and Washington D.C have income tax rates of over 10%! Other states are trying to attract new residents and making significant shifts in tax policy. Arizona recently just announced a 2.5% flat income tax rate that goes into effect on January 1, 2023!

Then the questions start piling up. For Example:

- How difficult is it to ‘show’ I moved?

- Am I really going to move my whole life to this other state?

- Will I really have ‘net’ tax savings when I look at property and sales taxes?

If you’re considering making a move to save on state taxes, create a master spreadsheet with all of the possible taxes, cost of the move, savings in the cost of living, etc. Carefully determine if it makes sense on paper. Then, if does, get to work taking the steps to move your residency or domicile. It doesn’t happen overnight.

What States have the Best State Tax Rates or No Tax at All?

First, we need to know what’s out there when it comes to State Income Tax Rates.

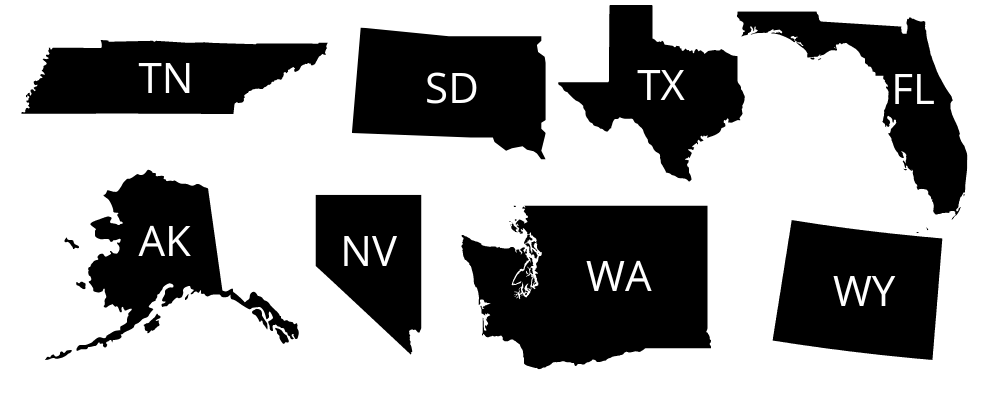

There are Eight (8) States that have NO Income Tax at all:

Tennessee, South Dakota, Texas, Florida, Alaska, Nevada, Washington, and Wyomning.

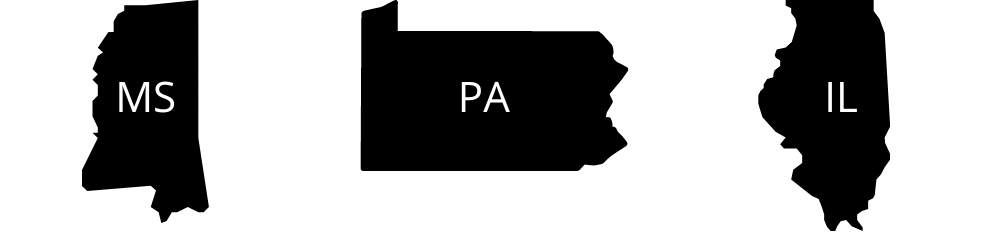

There are Three States (3) that DON’T Tax Distributions from 401ks, IRAs, or Pensions:

Missisippi, Pennsylvania, and Illinois.

Note: New Hampshire only imposes an an income tax on interest and dividends

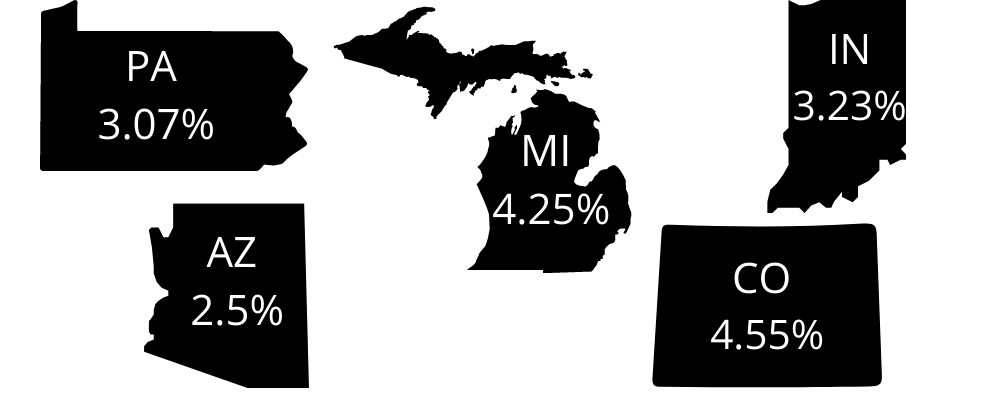

The TOP States with the LOWEST Income Tax Rates:

Pennslyvannia, Arizona, Michgan, Indiana, and Colorado.

Pennslyvannia, Arizona, Michgan, Indiana, and Colorado.

How do I Move my Domicile?

Regrettably, there are 50 different answers on how to completely and effectively move your residency or domicile to another State. Every state is different and their tax laws and tenacity to enforce them will vary from state to state.

There are probably only 41 states that have rules on this issue of changing domicile – with no income tax they really don’t care. They’re going to try and tax you in other ways to make up their bottom line.

However, there are steps you can take that will generally show you have ‘moved’ for state tax purposes and work 95% of the time keeping you out of a pesky audit from your previous state jurisdiction.

Steps Necessary to Show a Change in Domicile:

- Rent an apartment or purchase a home in the new state

- Obtain a driver’s license in the new state

- Register to vote in the new state

- Sign up with a new gym at your new location

- Attend church in the new state and move your membership

- Register your vehicles in the new state

- SELL your property in the old state or convert it to a bonafide rental

- And most importantly…ACTUALLY move to the new state and live there, sleeping in that new bed, at least 51% of the time.

Also, think about that you might be able to move ‘you’, but you also have to move ‘your income’. If you’re still making income from a day job or a business in the old state, moving is only going to save you income tax on the ordinary or passive income you make OUT of your old state.

Example 1 – If you still have a W-2 in Oklahoma and decide to move your domicile to Texas, Oklahoma is going to still tax your income even if you’re doing the work ‘remotely’ on a computer in a home office in Dallas.

Example 2 – If you have a business or rental property in New York, and decide to move to Florida, New York is going to still tax your income generated in New York even if you aren’t a New York resident.

Make sure you consider where you are generating your income, whether from a day job, small business, or even a rental property. 41 states take the position that IF you make money in their state, they’re going to tax it – whether you live there or not!!

What are the Risks?

Please note some states are more aggressive in pursuing the residents leaving their state. They won’t mess around with the game of a simple apartment in another state.

Your old state isn’t going to let you go without kicking and screaming. Your tax revenue is extremely valuable to them.

For Example: In California, it’s well known that Franchise Tax Board auditors will often look at cell phone records to see which cell tower your phone is ‘pinging’ from to prove if you were really in Nevada all those months you said you were.

The bottom line: you REALLY have to ‘move’ to the new State! Don’t think you can create a mirage on paper and ‘say’ you did it and think it will carry you under audit – it won’t… . Be careful, the penalties and interest can add up quickly.

What Special Opportunities and Issues do RV Owners Face?

Living as a full-time RV’er (is that a word?) is nothing new. However, it is becoming feasible and popular.

The strategy is that of selling everything in your ‘home state’, putting it in storage, and hitting the open road in your new RV, 5th wheel, or travel trailer. The benefits are numerous if you can handle living in tight quarters: saving on income tax, property tax, utility bills, and possible HOA fees, reducing your costs of living, tapping into that equity in your home, and then moving your domicile to one of the 9 tax-free states!

The problem is many RV owners think once they sell everything in their old state, their old taxing authority is just going to forget about them. That’s not always the case. Make sure you consult closely with your tax advisor, file any final tax returns with the state you’re leaving, and continue to show residency as much as possible in the new state (see the list above to change domicile).

Don’t Forget all the Other State Taxes

Remember, the grass isn’t always greener on the other side. Keep in mind that there is more than looking at “income tax” when deciding whether or not to pack up and move.

State governments still have to ‘keep the lights on’ and pay bills. They’re going to make up for the lost income tax revenue somewhere.

Thus, the old adage rings true: Where the government giveth, the Government taketh away

Consider sales tax, property tax, fuels tax, and others. Nonetheless, saving on state income tax tends to be the big money saver and the driving force behind moving domicile.

Bottomline, create a massive spreadsheet to analyze all of the competing factors and run models. As Mat Damon’s character said in the movie ‘Martian’ when he moved to Mars and started growing potatoes: “So, in the face of overwhelming odds, I’m left with only one option: I’m going to have to science the shit out of this.”