6 Types of LLCs Every Entrepreneur Needs to Know

You’ve probably heard that forming an LLC is a smart move for protecting your business and assets. But did you know there are six main types of LLCs—and two bonus variations—that each serve very different purposes? In this guide, we’ll break down exactly what those types are, who should use them, and how choosing the […]

Avoiding problems with the IRS and the “Dirty Dozen”

All of us want to save taxes, but at the same time stay out of trouble with the IRS. In fact, I would hope we would even have a higher standard of being honest and ethical in the manner in which we all report our income, deductions and file our tax returns. We live in […]

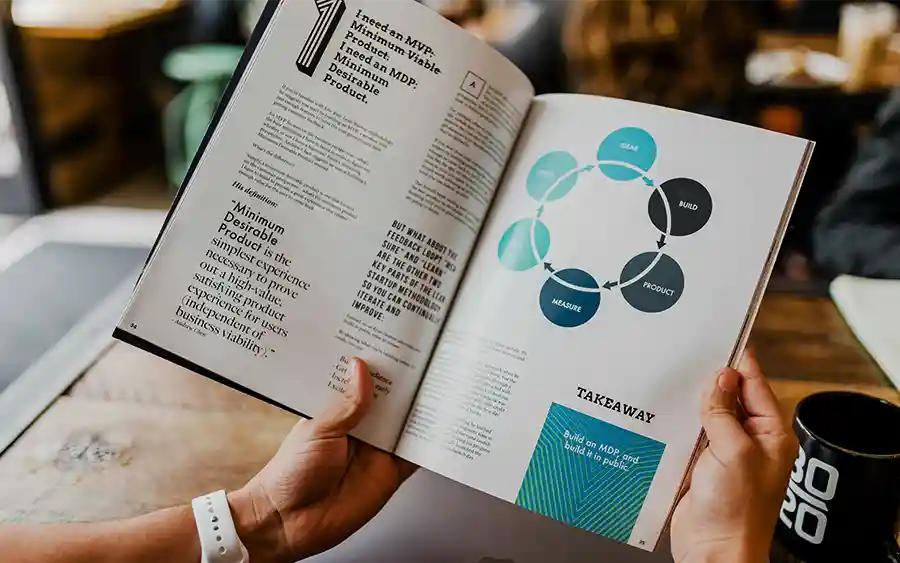

Bookkeeping for Beginners: Organize Your Business Finances

Starting your own business feels incredible—until reality hits: you’re also now the bookkeeper. If you’re wondering, “How do I even start my bookkeeping?”, you’re not alone. We’ve been there. So have thousands of business owners we’ve coached—some who got it right early, and some who learned the hard way. Good news? You don’t have to figure it […]

Maximizing Vehicle Write-Off for Your Business

Business vehicle write-offs under current law help company owners deduct more than ever – faster than ever – from their taxes. But the specifics are sometimes confusing (not to mention they can change year by year). Never fear: I’m here to help. Let’s dig into the nitty-gritty of vehicle write-offs for your business, so you […]

Koinly: The Smart Tax Pro’s Tool for Tracking Crypto Gains

Crypto clients don’t always know what they’re doing—but their wallets sure do. If you’ve ever looked at a spreadsheet full of transactions from a crypto client and wondered how you’re supposed to make sense of it all… you’re not alone. Tracking crypto trades, swaps, staking rewards, and DeFi earnings can feel like trying to untangle […]

How to Write-off Your Travel Expenses

Making sure our travel has a ‘business purpose’ is critical and a perfect opportunity for business owners for a great tax write-off.

Pay Your Taxes by Credit Card and Score Some Points!

How many of you build, track and utilize credit card points for personal benefit? You can pay your taxes using a major credit card or a debit card online. Individuals can make these payments 24 hours a day and seven days a week.

Last-Minute Contributions and Deductions Before April 15th

April 15th is more than just “Tax Day.” It’s your last chance to make key financial moves that can still impact your 2024 tax return—even though we’re already in 2025. Whether you’re a business owner, investor, or simply looking to reduce your tax bill, these final contributions can still pack a punch. Here’s your checklist […]

Should I file an Extension for my Personal Taxes?

Short answer: Yes—most people should.

The rule of thumb? File an Extension. Send in an estimated payment if needed, gather better records, and file your return before October 15, 2025.