It’s estimated that there are over 78 million dog owners in the U.S. and over 85 million people that think they own a cat. That’s A LOT of pets and they aren’t cheap either. The pet industry spends now over $67 billion in the U.S. (Source American Pet Products Association)

Wouldn’t it be nice if you could get a little help from Uncle Sam as well as a tax write-off for the pricey pet food, vet bills, or even bigger price tag at the breeder? Well, there might just be an option to save some taxes in the process.

I’ve compiled 7 ways you might be able to find a tax write-off for that little ‘best friend’ of yours.

1. Medical Expense. The most common method to write off your pet is as a service animal; this is typically a dog. More and more doctors are prescribing/recommending patients to invest in a service dog who may accomplish wonders with individuals suffering from anxiety, depression, autism, and of course a physical or mental disability.

There are a few definitions here to keep in mind when considering how your dog may be ‘classified’ for tax purposes AND for access in public areas. There are Service Animals, Assistant Animals and even Emotional Support and Therapy Animals. In fact, these definitions regarding what type of animal that is ‘helping’ you or your family member, regulates where your animal is allowed to accompany you in public.

The Department of Justice defines the term “Service Animal” under the American with Disabilities Act (ADA). Read the ADA requirements here. This is not to be confused with the broader terms of “assistance animal” under the Fair Housing Act. In fact, some state and local laws also define service animals more broadly than the ADA does. Information about such laws can be obtained from your State Attorney General’s office.

However, for IRS purposes the deduction for a pet as a medical expense, is only for a qualifying service or assistance animal. Note that emotional support or therapy animals can’t be taken as deductions. Although it’s not expressly written in the IRS’s publication, there is a substantial support that mental disabilities or psychiatric service dogs, on the other hand, are classified as assistance dogs and therefore eligible.

This means that if you suffer from PTSD, anxiety, depression, or other psychiatric or emotional issues, you can claim your four-legged family member as a tax deduction, too.

The allowable expenses are set forth in IRS Publication 502, and included items such as the purchase of the pet, training, food, supplies, and equipment.

Where you deduct those medical expenses could range from an Itemized Deduction (not the best) to a Flexible Spending Account, Health Savings Account (HSA), or if you are a small business owner under a Health Reimbursement Arrangement (HRA).

Bottom line, it’s critical that you speak with your doctor AND your accountant before making the leap into dog ownership if you are on the fence.

2. Guard Dog. The second most common, pet tax deduction, is in the area of security and protection. If you have supplies, materials, or inventory at your business premises, which could even be a garage or home office scenario, a guard dog could be a good choice for security.

Think of the cost for a digital/electronic security system compared to that of a guard dog. You may even save money in the process and gain a new ‘best friend’.

Although, there isn’t a specific certification or qualification for your canine to qualify as a guard dog, a typical house dog or family pet isn’t going to cut it. For lack of a better word, this should generally be a ‘mean’ or ‘tough’ dog, and it would help if it was a member of a traditional guard dog breed such as a Rottweiler, German Shepherd, or Doberman Pinscher.

If your pet qualifies, you would be able to deduct dog food, vet bills, training, and other related expenses. However, keep in mind the dog is considered ‘business property’ and must be depreciated over 7 years (that’s human years not dog years). But you could certainly use the 179 depreciation deduction and probably write-off the dog within the first year. Keep good records and be able to back up the purpose of the security and downplay the pet and friendly relationship.

3. Cats for Pest Control. As with the concept of a guard dog for security, cats are often used for pest control (or security from rats and mice). In fact, I was recently at Disneyland and noticed several feral cats enjoying the happiest place on earth. Surprisingly, Disney wasn’t shy about publicly stating that have over 20 cats in the park providing good ole fashion pest control.

In the case of Samuel T. Seawright v. Commissioner, the Seawrights were entitled to a $300 business expense deduction for cat food. The couple owned a junkyard and put the food out to attract feral cats, whom they needed on the premises to deter snakes and rats.

Again, if you have valuable inventory and a rodent problem to boot, a tom cat may be the solution to your problems. I don’t think the IRS expects you to keep a record of the dead mice you might find laying around your property, but certainly be ready to document the need and reason for the cat. I’m sure Disney is taking a tax write-off for the care of those cats in the magical kingdom in order for you to have a better experience.

4. Breeding. If you are ‘in the business’ of breeding, then clearly your animal costs are an expense. Adding to that, you must also record the income from the sales. Remember, you are required to claim the income and it wouldn’t be a shocker for you to get a 1099 from an animal broker or pet store if they were helping you sell your animals. So with that said, wouldn’t it be nice to take a write-off for all of the related costs.

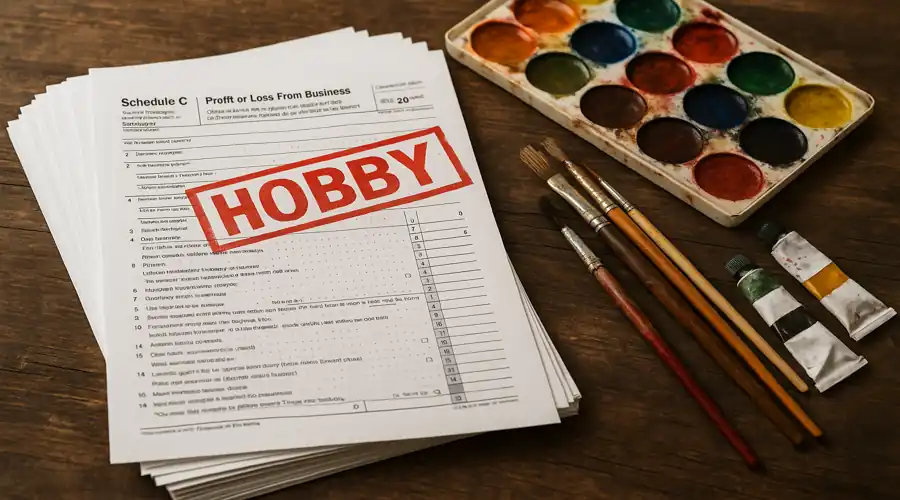

The cautionary word here is ‘hobby’. If the IRS feels that you are simply breeding your animal as a hobby, or otherwise stated for fun…forget any sort of write-off. Typically, you could write-off hobby expenses as an itemized deduction. However, under the new Tax Cuts and Jobs Act (TCJA), this deduction was completely eliminated (or at least suspended until 2025).

So if you want the write-offs, prepare ahead of time to show that you have a legitimate profit seeking motive and the records to back it up. For more information, read this article on “Turning Your Hobby into a Business”.

5. Competing and Shows. Yes…the Kohler family is a big fan of the Westminster Dog Show on Thanksgiving Day. Moreover, it’s not uncommon to find all sorts of sports competitions on ESPN involving dogs. Everything from hunting dogs to freebie enthusiasts.

Here, the same rule would apply as that with breeding. The critical question being: “Is this just a hobby or a legitimate business?” It is overwhelmingly in your best interest to be able to show that you have a business purpose. See the article about turning your hobby into a business.

The goal here is for you to actually make money at your competitions and shows, which will obviously help your breeding business as well, and then your expenses will be a direct deduction against your income.

One significant tip here is to show a profit every few years, even if a marginal one. Don’t consistently run your business at a loss, or you will certainly garner the attention of the IRS and lead them to believe your operation is simply a hobby.

6. Farm Dogs. Doesn’t every good farmer need a dog out in the fields with them? On one hand, it may seem like a legitimate expense to simply have another animal on the back forty. However, don’t move to fast. You have to, again, show a business purpose for the dog.

Horses, cattle, pigs and other farm animals typically have a profit purpose/motive. Whether they are for breeding, sale, or consumption. In fact, I recently was working with a client who raises roping cattle. Apparently, it’s big business in Texas to provide roping cattle to all of the state fairs and rodeos for those youngsters to practice roping and chasing down a heifer.

However, where does the dog fit into the equation? It’s imperative the farmer be able to show that the dog is specifically working with the livestock (think of a sheep dog keeping those lambs in check and safe when grazing on the open range). But it would also be conceivable to imagine a need for dogs to keep away intruders or even predators trying to get on the property. Even if the dog couldn’t take on a wolf, they may be there just to alert the family….need I bring up ‘Old Yeller’, another Kohler family favorite.

7. A pet as a part of the product or service experience. I know this may be a reach for some of you to justify, but it’s worth mentioning.

For example, I’m sure the Chihuahua in the Taco Bell commercials is a tax write-off, and if you own a petting zoo or some sort of business/service experience that involves animals, those pets and the cost to maintain them would be a deduction.

I’m also aware of several vacation resorts and ‘dude ranches’ that are completely outfitted for a western experience with horses, chickens, ducks and even dogs on the premises for the enjoyment of their patrons when they attend.

Think outside of the box, keep good records and take enjoyment and pride in finding a tax deduction others may not think of. I consider a good tax deduction akin to mining for a golden nugget. The pet deduction is truly one of those unexpected rewards of tax research and education.

Lastly, don’t forget to include your pet in your Will or Trust. Who is going to take care of them if something happens to you? Believe it or not, you can take care of the guardian and the whole process in your Estate Plan. Read more here.