The Health Savings Account or HSA is one of the most powerful pieces of a well-designed health care strategy. However, they surprisingly continue to be one of the most underutilized tax and wealth-building strategies in the tax code. It’s available to millions of Americans and they don’t even know it.

The bottom line is, that the HSA puts Americans in control of their own healthcare strategy. It is helping them to save on taxes, cut costs, and build wealth for future healthcare expenses. Investment accounts are crucial for your future, including a 401K. My law firm KKOS Lawyers offers a 401K set up, click here to check it out.

The Main Benefits of an HSA

The Health Savings Account (HSA) includes several significant benefits, all explained more fully below:

- Saving on taxes with a great above-the-line tax deduction.

- Creating a tax-free ‘bucket’ you can take with you anywhere you want (a portable IRA).

- Building this ‘bucket’ with any type of investment, not just Wall Street products.

- The potential to save on health insurance premiums.

- Saving on health care costs by paying cash for services.

- The ability to pull out cash tax-free at any age for a long list of medical expenses and services.

- AND taking CONTROL of your own health care strategy with a proactive approach.

The most important thing to remember when you begin to study the power of the HSA is that who your health insurance company is will be completely different from where your HSA is located (more on this below).

The Tax Deductions of a HSA Contribution

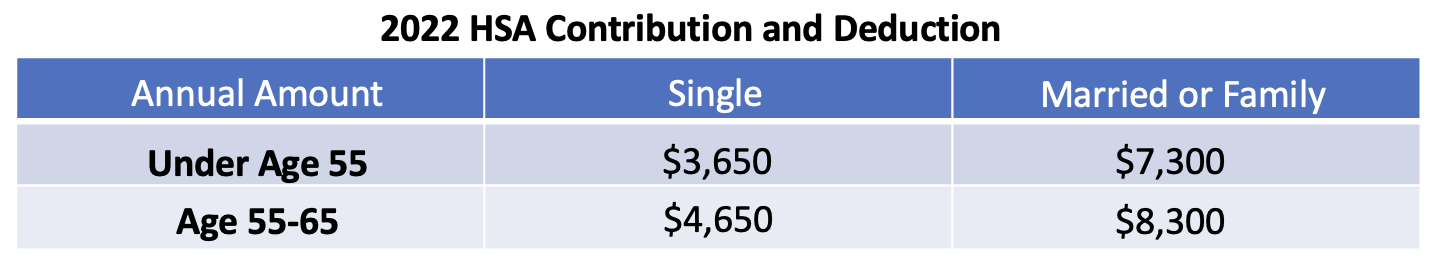

Your HSA contributions are deductible from your gross pay, or business income, on the front page of your tax return. No income limits! No phasing out! Married or Single! Kids or no Kids! Entrepreneur or W-2 Employee! The HSA gives you a powerful tax deduction and can potentially even put you into a lower tax bracket. Here are your numbers for 2022:

These amounts are adjusted for inflation each year and every time you “pass go”, in January, you can make a new contribution. Meanwhile, your investments within the HSA continue to grow tax-free ON TOP of the annual contribution amount. (More on that ‘investment’ aspect below).

Qualifying Health Insurance

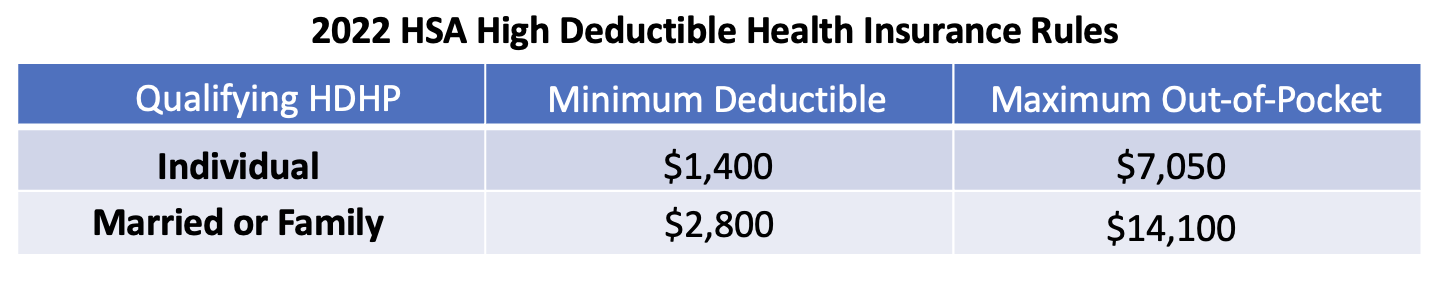

The biggest hurdle to starting and investing with a Health Savings Account is the ‘Health Insurance Issue’. In order to qualify for an HSA, you need to have a ‘High Deductible Health Plan’ oftentimes referred to as an HDHP. Under the tax law, HDHPs must set a minimum deductible and a limit, or maximum, on out-of-pocket costs. Here are the numbers for 2022:

Remember, insurance and an HSA are completely separate. Get the right type of insurance that qualifies you. DON’T CALL your insurance company for a Health Savings Account…they don’t administer the HSA – they just sell insurance.

Here is the ‘silver lining’…once you decide to go down this path to try and qualify for an HSA with an HDHP, there is a good chance you are going to see savings on health insurance premiums. Historically, when you have a higher deductible, you have a lower premium. This happens because you are coming out of your own pocket for dollars upfront. This saves the insurance company money. The question is, will they pass this savings on to you? (good luck – right?)

A Word of Wisdom about Choosing Insurance

Don’t be frustrated if you start shopping for an HDHP and your premiums stay level or increase. This may surprise you when you were operating under the logic that: “A ‘higher deductible’ and saving the insurance company money should reduce my premium”.

However, many of those working in the health insurance field will tell you the real factor driving the cost of your policy is the ‘Network’. When you get the higher deductible, but choose to have a more expensive network of doctors or specialists, you can see a premium increase.

Here’s the Tip: Health insurance premiums are driven more by ‘network’, rather than ‘deductible’.

If you are willing to go with any network AND a higher deductible, you should see premium savings and it opens the door to the HSA party!

Tax-Free Growth

You don’t pay taxes on the growth or investment profits inside the Health Savings Account, just like a retirement account. That’s it. Plain and simple.

To be more specific, the funds grow “tax-free” just like a Roth IRA…not “tax-deferred” like a 401k or IRA. When you pull money out of a Roth IRA, you don’t pay taxes. This is the same for an HSA. When you make withdrawals in the future for medical expenses, those withdrawals come out completely tax-free.

Remember, investment returns are NOT counted towards your annual contribution either. So…if you win big on an investment inside your HSA, you still get to make another contribution when you ‘pass go’ every January.

Let’s summarize: You get to make a tax-deductible contribution, the funds grow tax-free, you don’t pay taxes when you pull out the money for health care expenses, AND you can start pulling out money tomorrow? Are you kidding me?!

The Health Savings Account is ‘Portable’

It gets better! What I mean by ‘portable’ is that the Health Savings Account is yours much like an IRA (Individual Retirement Account). It’s not a “use it or lose it” plan. If you leave an employer sponsoring your HSA, you take the HSA with you no matter how long you worked there!

You don’t even have to own a business OR have a job to open and start an HSA. Again, the only requirement is the HDHP insurance (discussed above).

The Deadlines

There are three important deadlines you should be aware of. Again, opening the HSA is completely separate from making contributions. There is the process of paying for health care expenses or getting reimbursed.

- If you want the deduction in 2022, you have to enroll in a high-deductible health insurance plan (HDHP) before December 1st 2022.

- If you have the proper HDHP by December 1st, 2022, you have until April 15, 2023 to make your tax-deductible contribution.

- Your deduction is based on the number of months in 2022 you had a qualified HDHP, and NOT when you made the contribution. Basically, you can take the deduction for the period you ‘could have’ made a deposit.

- Once you turn age 65 you can’t open an account, OR make any more contributions to your HSA. HOWEVER, you can keep investing the funds in your HSA (if you have one) and pulling out withdrawals for qualified medical expenses until the day you die. (See below as to what happens if you die with money in your HSA). [easy_youtube_gallery id=iXpnnEQRMQo cols=1 ar=16_9 thumbnail=0 title=top]You Need an HSA[/easy_youtube_gallery]

How to Set Up a Health Savings Account?

Once you have the proper HDHP insurance, you can oftentimes set up your HSA within minutes. Moreover, you can open an account for an HSA wherever you choose. If you are going to simply want a debit card to pay expenses out of your HSA and make contributions in order to turn around and pay medical bills, a plan at HSA Bank- Debit Card may be a good choice.

If you want to more actively invest your HSA in stock market products like stocks, ETFs and mutual funds (not planning to take out withdrawals all the time), you may want to consider a Fidelity-HSA Trading Account. Furthermore, if you want to open an account that allows you to buy real estate or invest in small businesses (again, letting the account grow rather than pulling out $$), then an HSA at Directed IRA- HSA would be an excellent fit (more on self-directing below).

Tax-Free Withdrawals for Qualified Expenses

You can spend the money tax-free on a LONG LIST of qualified medical expenses. These expenses may include deductibles, dental, eye-care, chiropractic, acupuncture, and even hotel and lodging while at the hospital. The list is quite exhaustive and comprehensive. Check out IRS Publication 502 for a list of the hundreds of medical expenses you can pull out of your HSA tax-free.

How to Pay Medical Bills with Your Health Savings Account

Moreover, you can start taking out money immediately and there’s no waiting period. Just change the way you normally approach your health care spending. Essentially, you have two ways to approach “paying” for medical bills with a Health Savings Account.

- You can stop at the bank, or go online, and make a deposit in your HSA before you go to the doctor. Then pay the bill out of your HSA Visa debit card. You just generated a write-off the same day!

- Or, you could keep track of all your qualifying medical expenses, and at the end of the year, or several times during the year, simply ‘reimburse yourself’ out of the HSA account for the medical expenses you incurred.

Both methods of ‘reimbursement’ or ‘payment’ give you the write-off. Yet, some people choose to ‘let the money ride’ and invest in the HSA while paying out of pocket in the short term. Their goal is to build up the HSA over time. Then use the HSA account in the future when their medical bills may be more substantial.

Whichever method you choose to utilize, the keyword is ‘flexibility’. There are so many options to help you make the HSA work effectively. You shouldn’t have a problem creating a system that fits your needs, goals, and desires.

Self-Directing Your Health Savings Account Investments

You can even “self-direct” your investments inside your HSA. This means you aren’t simply stuck with a mutual fund option provided by your bank. You could invest in a restaurant, real estate, or even super bowl tickets. If you want to self-direct, just place your HSA funds with a ‘custodian’ that allows for self-directing rather than with your local bank. Read this related article on the topic regarding the self-directing strategy, by Best-Selling Author Mat Sorensen: Who are Self-Directed IRA Investors?

In fact, many of my clients are shocked to learn that I have owned a cash-flowing rental property in my HSA for more than 8+ years. My HSA owns 100% of an LLC in Illinois, that owns the rental property. This little rental LLC paid for one of my kid’s braces tax-free!

A Health Savings Account Can Help Pay for Your Retirement

After you turn 59 1/2, there is also the option to withdraw the money for non-healthcare expenses, and then pay federal income taxes on it. This means it is no longer a “tax-free” account as I described above, but a “tax-deferred” account – since you’ll be using the funds for non-healthcare reasons.

At this point, the HSA acts much like a traditional IRA since the HSA holder pays ordinary income taxes on non-medical related withdrawals, with the added perk that you don’t have the mandatory disbursements usually required by traditional IRAs. This protects you from the concern I often hear: “What happens if I don’t need the money for health care”? The simple answer is, don’t worry- you can use it like an IRA in the future.

What Happens if I Die With Money in my Health Savings Account?

It’s not as bad as you think. When you set up your HSA, you will be required to list a primary beneficiary and contingent beneficiary. If you are married and your spouse inherits your HSA, it simply drops into their HSA tax-free. If anyone other than your spouse inherits your HSA, it’s treated just like a regular IRA for inheritance purposes. Frankly, make sure your Revocable Living Trust is your contingent beneficiary so there aren’t any questions or problems with multiple beneficiaries. See my article: “Do I need a Living Trust? – What You Need to Know”.

Bottom line, the HSA is one of the most underutilized tax strategies by Americans today. It’s a fantastic tax savings strategy as well as a powerful tool to help pay for current and future health care costs. Everyone should at least consider the HSA as an option when purchasing insurance and for saving taxes.

[…] expenses could range from an Itemized Deduction (not the best) to a Flexible Spending Account, Health Savings Account (HSA), or if you are a small business owner under a Health Reimbursement Arrangement […]

[…] “self direct” (see above). You can open up your HSA with http://www.directedIRA.com in minutes! Read here for an article with more details to help you guide through the options of an […]

[…] The beauty of the HSA is that the funds grow tax-free and aren’t a “use it or lose it” plan. You can grow and build your HSA account for your future health care needs. You can also spend the money tax-free on qualified medical expenses, and you can invest the money in much the same way you invest in an IRA. Learn more at “The Power of the Health Savings Account (HSA)”. […]

Thanks for simplifying the HSA and helping the layman, like myself, to clearly understand the benefit of having and HSA and the myiraid of investment options.

You’re so kind. Thank you for reading the article, and I presume sharing it. Wish you the best!!

Thank you for always providing us with a wealth of information on how we can save on taxes and take care of our future with different tools to stretch our income.

Hi Mark: You might have mentioned that even if you “need” to go through your company’s HSA (in our case we get extra money from my wife’s company for doing this). You have the right to move the money to a separtate (Fidelity in our case) HSA account and invest it as you choose.

Many people think it’s “stuck” at the HSA their company chose because they think it acts similar to a 401k, but it’s very different in many ways as I’m sure you know.

If you have a child that is 18 years old from a previous relationship and not a dependent but covered under your HDHP. Can the child open their own HSA account and fund it up to there applicable limits? Or are they not allowed to create and fund there own HSA if the coverage they are a beneficiary of is provided under a parents employer health plan.