For high-income individuals, the Mega Backdoor Roth comes with many amazing advantages. But don’t consider it until you’ve ruled out the strategies listed above. You MUST also have an extra $50K set aside without the need for a current tax deduction.

It can be done at any age and there is no phase-out or income limit. The Mega Backdoor Roth is an excellent strategy for maximizing your retirement contributions. Learn more about setting up a solo 401K.

Setting up a Mega Backdoor Roth isn’t always a straightforward process. Typically, it requires some strategy and planning with your tax professional. When you set up Mega Backdoor Roth, the following factors are taken into consideration:

- Age

- Income

- Employment or self-employment

- Marital status

What Exactly is a Mega Backdoor Roth 401K?

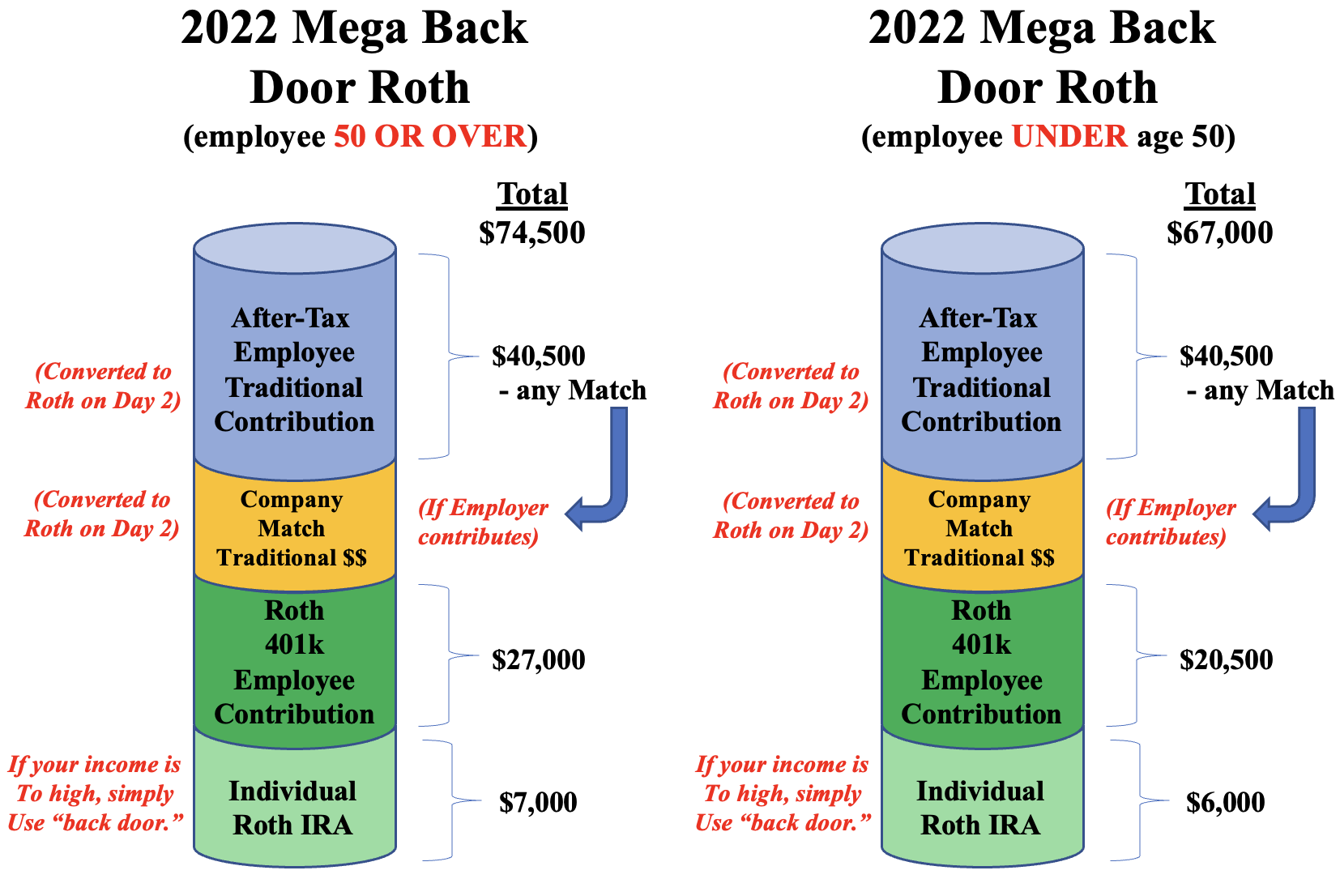

Essentially, it’s being able to contribute to a Roth at in the following amounts:

- Under 50: $70,000

- Over 50: $77,500

Why are the Backdoor Roth IRA Limits So High?

The limits for a Mega Backdoor Roth 401K are much higher than other forms of retirement saving, because a Mega Backdoor Roth is simply a combination of stacking IRA and 401K contributions on ‘day 1’ and then doing Roth conversions on ‘day 2.’

Keep in mind, a Mega Backdoor Roth does not refer to one specific strategy. Rather, it’s a bundle of strategies used to get the maximum contributions in a given year. These strategies include:

- 401ks

- IRAS

- Conversions

- Non-deductible contributions

- After-tax contributions

When Should I Use the Mega Backdoor Roth?

Using the Mega Backdoor Roth to maximize your contributions requires strategy. Before you consider this strategy, ask yourself if you’ve considered or completed the following this year:

- Participated in your employers 401k up to the matching amount

- Funded your Roth or Backdoor IRA up to $6K or $7K?

- Funded your HSA to the maximum amount?

- Funded your spouse’s Roth or Backdoor IRA (if applicable)?

- Funded your children’s Roth IRA (if applicable)?

- Funded your parent’s Roth IRA (if applicable)?

- Funded your child’s ESA (Educational Savings Account) up to $2K per child? (If applicable.)

- Purchased a rental property interest?

At Mark Kohler CPA Attorneys, we advise you don’t consider a Mega Backdoor Roth IRA unless you’ve first explored all the strategies listed above AND have at least $50K set aside in savings, without the need for a current tax deduction.

Depending on your tax attorney, you may receive different advice. But in our experience, our most wealthy and successful clients first consider ALL the options listed above before they embark on the Mega Backdoor Roth IRA.

Steps to Completing the Backdoor Roth Conversion

Keep in mind the “numbers” will vary depending on your age and possible matching with a day job, solo-401(k), or even a safe-harbor 401(k) in your own small business.

Next, you must be enrolled in an employer-sponsored traditional 401(k) plan that permits after-tax contributions and in-service withdrawals

If you own a small business, you must adopt the provisions you want in your own Solo 401(k) and won’t be dependent on an ‘employer’.

Here is a visual representation of how it may look as you combine these different accounts and contributions:

Step 1: Make Your Regular Roth an IRA Contribution

Depending on your age, your contribution to an individual Roth can be either $6K or $7K. If you make too much for a regular Roth IRA contribution (phase out is AGI of $129K – $144K if Single, or $204K – $214K if Married), this is where the ‘Back Door’ method comes into play.

First, make a non-deductible contribution to a traditional IRA, and then convert it to a Roth. Ensure a reporting period (a month, for example) has passed before doing the Roth conversion. It’s not uncommon for financial service companies to attempt a conversion on the heels of a contribution. They may assume you want a Roth but are unaware you do not qualify.

Next, convert the traditional IRA contribution you just made to a Roth. You have until December 31 of each year to convert as much as you want. But you must first convert ANY other traditional IRA money to Roth before you can convert the contribution you just made.

- Pro tip for small business owners: If you have a Solo 401K, roll your traditional IRA money to this 401K account. This way, you don’t have to convert it to Roth before doing the Roth conversion to your current contribution.

At the Directed IRA Trust Company we simplified the process into one application and account set-up fee, provided your plan is to end with a Roth. This cuts down on confusion and saves you time and money. Start the Back-Door Roth process here to learn more.

Step 2: Contribute your Roth 401(k)

To build that “Mega Backdoor Roth”, max out your annual contributions to your Roth 401k. Depending on your age this will either be a maximum of $2.5K or $27K.

If you participate in two (2) 401(k)s (maybe a day job and a Solo 401k), be strategic on how much you contribute to both. For example, you might put $5K into your ‘day job’ 401(k), to get the match. You should then put the remaining $15.5K into your Solo 401k (assuming you’re under age 50).

It’s critical you indicate this as a Roth contribution. This is allowed at any age and any income level. This WILL NOT be converted to Roth dollars later. It’s Roth money from the outset.

Step 3: Consider the Company Match

If you participate in an employer-sponsored plan there is typically a ‘match’ portion to your 401(k). For example maybe 5% of your compensation (a typical safe-harbor plan). If you have an $80K salary, the company matches up to $4K of your Roth contribution.

This money is considered ‘traditional’. You will need to convert this to Roth on ‘Day 2’ (a similar process to that of the Roth IRA conversion above in Step 1).

Speak with your 401k administrator to complete the paperwork and the ‘conversion’ of the company match to a Roth.

For those with a Solo 401(k), skip the ‘matching strategy’ and proceed directly to Step 4: After-Tax Employee Contribution below. This is because matching is unnecessary in a Solo 401k structure when you have the proper plan documents.

If you have questions or don’t have the correct type of Solo 401(k), consider a consultation with one of our attorneys at KKOS Lawyers. We can help make the transition affordable and will help get you set up with the correct Solo 401(k).

Step 4: Make an After-Tax Employee Contribution

This is where complications can arise. This step depends on your employer’s 401(k) plan. In 2021, for example, an individual and employer can contribute up to $58K into the employee’s 401(k) account. The ‘math’ involves subtracting what ‘you’ the employee contributed, and any match, from the $58K. This calculation determines the amount of ‘after-tax’ contribution.

- Example Your 401(k) employee contribution limit in 2021 is $19.5K , or $26K if you’re 50 or older. Next, an employer can contribute enough to bring your total contribution to $58K, or $64.5K if you are 50 or older. Assuming your employer doesn’t make any contributions, the maximum you can contribute in after-tax contributions in 2021 is $38.5K (or $45K for people 50 or older).

Step 5: Use the In-Service Withdrawal Provision

The in-service withdrawal provision is a necessary part of the Mega Backdoor Roth process. An employee who makes the after-tax contribution (Step 4 above), then immediately takes an in-service withdrawal before the contributions generate taxable returns.. The “withdrawal” is essentially transferred to a Roth IRA as a ‘conversion’. No tax is due, but you didn’t receive a deduction either with the contribution in the first place.

Next Level Strategy

Successful clients typically self-direct a good portion of their retirement account. They usually also invest in:

- Real estate

- Precious metals

- Crypto

- Small businesses

Diversifying your retirement savings often leads to incredible, lucrative results!

It’s not uncommon to see 10-20% rates of return in self-directed accounts because business owners and investors typically invest in closely held projects.

To learn more about how to self-direct your IRA and ramp up your account value.

In summary, if the following applies to you, you’re in great position to set yourself up for significant retirement savings:

- You’ve checked everything else off your list

- You have the extra income

- You have a 401(k) plan that makes a Mega Backdoor Roth viable

The Roth truly allows you to enjoy the luxury of tax-free Roth distributions. It also lets you avoid required minimum distributions (RMDs) after age 72.

If you believe in Roth IRAs, the magic of the Mega Backdoor Roth is just waiting for you to take your retirement to the next level.

FAQs

Learn the answers to commonly asked questions on the Mega Backdoor Roth below.

Is a Mega Backdoor Roth Still Allowed in 2024?

Yes, the Mega Backdoor Roth is still allowed in 2024. In 2024, the Mega Backdoor Roth IRA contribution limits were $69K or $76.5K. Contribution limits typically increase year to year. See below for 2025 contribution limits.

What is the Mega Backdoor Roth for 2025?

In 2025, the maximum you can save with a Mega Backdoor Roth is $70,000 for those under 50. For those over 50, the maximum contribution is $77.5K.

What is the 5 Year Rule for the Mega Backdoor Roth?

Using the Mega Backdoor Roth strategy requires you wait at least 5 years after your first contribution to your Roth IRA before you can withdraw any of your savings tax-free. Withdrawing money from your Roth IRA before the five years is up will cause you to incur a penalty.

What is the Salary Limit for the Mega Backdoor Roth?

As of 2025, the salary limit for a Mega Backdoor Roth is $165K if you’re filing as head of household or single. If you are a married couple filing jointly, the salary limit is $246K.