The little-known fact that can transform your Coverdell ESA into a powerhouse for college savings is that you can self-direct the investments.

The Coverdell Education Savings Account (ESA) is the best tool to save and build wealth for college expenses tax-free. In fact, it offers greater benefits than the popular 529 plan.

So why don’t more people use it?

The Wall Street Lobby makes the 529 easier to access and contribute to. This needs to change! In the meantime, know that the Coverdell employs a secret weapon that can build a nest egg for college faster than the 529.

Investment accounts are crucial for your future, including a 401K. KKOS is currently providing a special for $100 off a 401K set up, click here to check it out.

I realize that my bold opinion on Coverdell savings accounts vs 529 plans may fly in the face of what you’ve heard from your tax professional or financial advisor. But, stick with me, I will back up this opinion and explain why the Coverdell is the “hidden gem” in the financial marketplace for college savings.

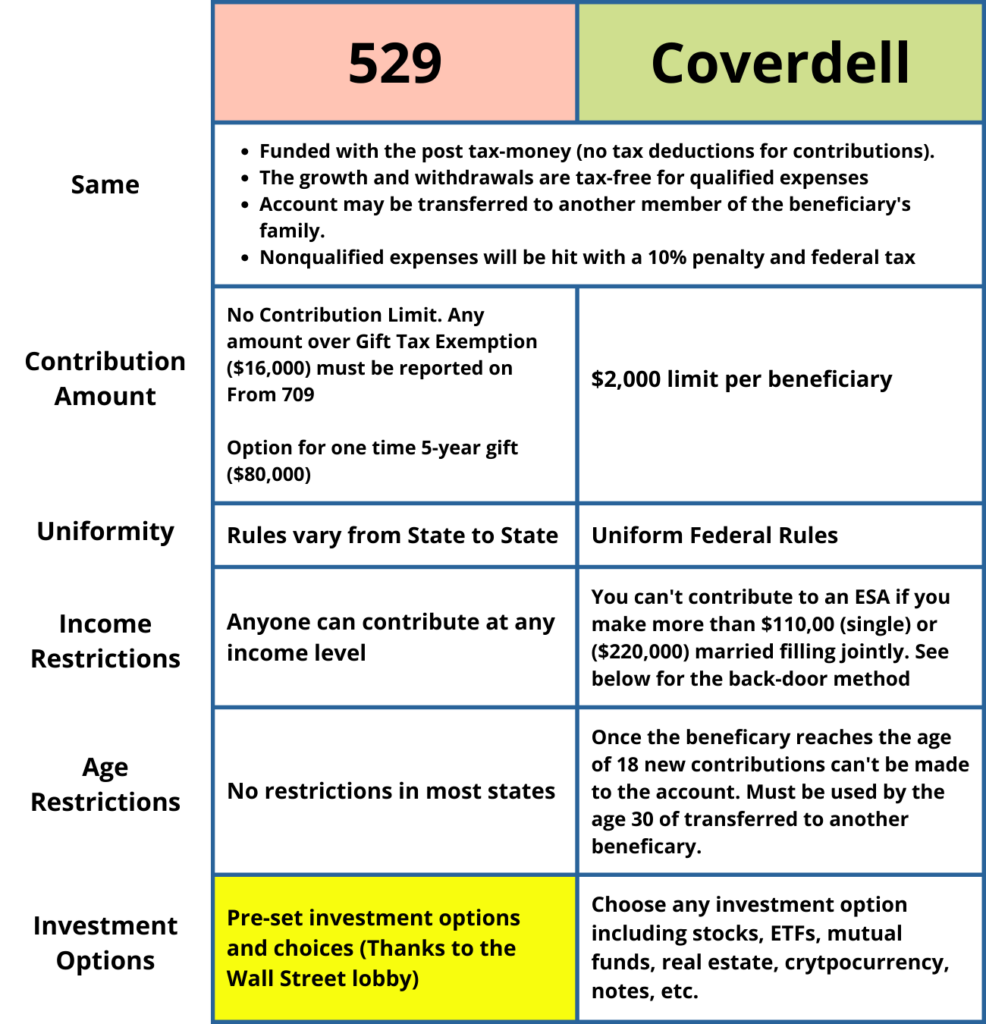

Coverdell vs 529: The Main Similarities and Differences Between a 529 and Coverdell ESA

What’s with the Name Coverdell?

The account gets its name from primary champion in the U.S. Senate, Senator Paul Coverdell, a Republican from the State of Georgia.

The name “Coverdell ESA” can be confusing as this tax-preferred structure has been referred to various names in the past. Since it originally passed in 1997 it has been referred to as an Education Savings Account, a Coverdell account, and formerly known as an Educational IRA.

But here’s what you need to know: all those names now refer to the same thing—the Coverdell ESA. For simplicity, I’ll just call it a “Coverdell” throughout this article.

Why the 529 is so Popular?

The reason 529s get so much more ‘press’ and special treatment is two words: Wall Street. The financial industry gets to trade and bury their expensive fees in the 529 accounts. Which are almost impossible for the average person to pinpoint and calculate.

To encourage investment into 529 accounts and make them more appealing, Wall Street has lobbied Congress to include features like :

- Massive contribution limits (80k in one year compared to 2k for Coverdell)

- No income limitations on donors opening an account

- Flexible options in making changes to beneficiaries

On the surface, these features seem great. But here’s the problem: with a 529, you have no control over the investments, and you don’t know what fees you’re paying. That means you’re handing your money over to the financial industry to manage however they like— with no transparency.

If you don’t like what I’m saying Wall Street, just allow for self-directed 529 accounts…I didn’t think so. We’ll keep trying to lobby Congress for what’s fair and allow investors to choose their own investments.

The Secret Weapon Inside the Coverdell

Here’s what makes the Coverdell a game-changer: you can self-direct your investments.

That means you can invest in what YOU KNOW BEST…not the options spoon-fed to you by Wall Street and 529 sponsors. Proponents of the 529 Plan rarely acknowledge this, let alone mention it.

Why does this matter?

Because the average 529 ROR (Rate of Return) is well below 10% (on an annualized basis after expenses- what really matters). The Coverdell rate of return can be unlimited, with lower costs, and far more control.

EXAMPLE #1: Potential in Crypto

Yes…cryptocurrency is volatile but consider this. If you had invested your $2,000 Coverdell on May 1, 2020 in the Cryptocurrency Ripple (XRP), approximately one year later, on April 29, 2021, it would have been worth $180,797. That’s a 9,039% Rate of Return! Are you kidding me?!

Yes, Cryptocurrency is clearly a risky investment and that’s not XRP’s value today. Nonetheless, this example shows the possibilities of a Corverdell that you won’t find in a 529 plan.

EXAMPLE #2: Real Estate Through an LLC

I’ve had countless clients set up their LLCs to own rental property with their children’s Coverdell account as a small owner in the LLC. Later when the property is sold and the LLC liquidated, all the cash from the investment (attributed to the Coverdell’s ownership in the LLC) goes back to the Coverdell tax free to be used for college.

The rates of return on rental real estate including the appreciation, cash-flow, and mortgage reduction is exponentially greater than that of a State’s financial industry supported 529 plan.

When it comes to the 529 plan vs ESA debate, one of the biggest differences is investment flexibility. With a 529 plan, you’re locked into pre-approved funds— you can’t invest in real estate, notes, cryptocurrency, private businesses, gold, or individual stocks.

But with a Coverdell ESA, you’re in control. You can use your knowledge and experience to invest in alternative assets, and even use non-recourse loans (leverage) to make small investments that have the potential for big returns. This flexibility can accelerate your college savings in a way that 529 plans simply don’t allow.

How does the Coverdell Education Account work?

Fundamentally, think of the Coverdell as a Roth IRA for educational expenses.

Like a Roth IRA, any investments inside the Coverdell will grow tax-free and all qualified education expenses come out tax-free. These distributions would include qualified elementary and secondary school expenses – Not just college expenses. (More below).

Here are the 3 key people involved in the Coverdell:

- Beneficiary. The child the account is for. They must be under the age of 18 when the account is established.

- Responsible Party. The adult is managing the account. This is the person that decides where the account is invested and when to make withdrawals for educational expenses. If the Beneficiary doesn’t use all the money by age 30, the Responsible Individual can change the Beneficiary to a different family member.

- Donor/Contributor. This is the person, which doesn’t have to be a family member, that makes the contribution to the Coverdell ESA in any given year under the applicable rules.

Contributions on Behalf of a Beneficiary

You don’t have to be related to a child to open a Coverdell ESA for them. Anyone can contribute as long as the beneficiary is under 18 when the account is opened. Along with that the contributions of $2,000 a year can only be made up until the date of their 18th birthday (not the year they turn 18).

Example #3: You just had a new baby, and a friend of the family opens a Coverdell up for your child as a gift and contributes $1,000. Later that same year, you want to open a different Coverdell account for your child. You can open a new account, but the TOTAL contribution for the beneficiary, per year, is still $2,000.

You could only put in $1,000 into the account and your child would then have (2) Coverdell accounts of a value of $1,000 each.

Even if a child has multiple Coverdell accounts, the maximum contribution is $2,000 per Beneficiary across all of them. Contributions can be made up until April 15th for the prior year.

Example #4: If it’s currently May 1st, 2022, and your child’s birthday is on July 15th (they are currently 12 years old), you would be able to contribute $12,000 between today and their 18th birthday. Note that you are unable to contribute for 2021 as it’s after April 15th 2022, but you can deposit $2,000 for 2022 and for another 5 years, as long as you make the final contribution before July 15th (their birthday) in 2027.

That may not sound like a lot with the current cost of a college education, but this is where the Coverdell’s flexibility becomes a powerful tool.

Who may be the Grantor or Depositor

It’s important to understand who qualifies to make a ‘contribution’ into a Coverdell for a Beneficiary. This is because while anyone can contribute, not just family members, there are income limits. Before we further discuss the income limits, here is a quick list of who can contribute to a Coverdell:

- Mom or Dad

- Grandma or Grandpa

- Aunt or Uncle

- Even the Beneficiary of the ESA themselves

In fact, anyone! They don’t have to be family. Just someone that wants to help the Beneficiary save for college.

Now the current rule in 2022 is that no one with more than $110,000 (single) or $220,000 (married filing joint) of Adjusted Gross Income, contribute to a Coverdell on someone’s behalf.

That’s one reason people often compare a 529 plan vs Coverdell— 529 plans don’t have income limits for contributors. But don’t worry—there’s a workaround.

Over the years when necessary for a client, we employ a simple ‘work around’ or ‘back door’ method to make contributions.

Before getting into an example of how this works, there are a couple things to keep in mind:

- the person ‘establishing’ or ‘opening’ the Coverdell, doesn’t have to be the Depositor. This is the ‘Responsible Individual’.

- The Depositor doesn’t have to have earned an income or a minimum level of income either to make a contribution.

Back Door Method Example:

Mom and/or Dad can open the Coverdell account and control it as the “Responsible Individual”, but earn too much money to contribute. They can gift money to a friend or family member (under applicable gifting rules and limits of course). Then the recipient of the gift makes the deposit into the Coverdell on behalf of the Beneficiary. Simple, straightforward, allowed, and nothing wrong with that!

The Control of the Responsible Individual

This is a wonderful feature of the Coverdell because the Responsible Individual can be involved in the Coverdell right from the beginning and help make it happen at the forefront and carry it ultimately across the finish line when all the funds are distributed.

The Responsible Individual is the one that:

- ‘opens’ the ESA

- Manages the investments

- Decides when and how to use the funds

- Generally, coordinates the contribution. EVEN IF they aren’t the Donor themselves due to an income limitation .

Most importantly, the Responsible Individual can change the named ‘Beneficiary’ at any time! The only caveat is that the ‘roll-over’ or ‘transfer’ to a new beneficiary must be a qualified family member under the age of 30 who is ‘in relationship to the original Beneficiary’, NOT the Responsible Individual OR the Donor/Contributor.

To comply with the beneficiary change rules, the new beneficiary must be one of the following family members in relation to the current Beneficiary of the Coverdell before the change:

- Spouse

- Child or descendent of child, stepchild, or eligible foster child

- Brother, sister, stepbrother, or stepsister

- Father, mother, stepfather, or stepmother

- Aunt or uncle, niece or nephew

- Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

- Spouse of any person described above

- First cousin

Important Note During Formation: When the Coverdell is established, make sure the Responsible Individual retains control after the child turns 18. IF this election isn’t made on the documentation, the Beneficiary will assume control of the Coverdell at age 18 and can make any decisions they want regarding investments or distributions (giving them unfettered access to the ‘cookie jar’).

What are Qualified Education Expenses?

Essentially, this term means tuition, fees, books, supplies, and equipment required for study at any accredited college, university, or vocational school in the United States and at some foreign universities. However, the money can also be used for room and board, as long as the fund beneficiary is at least a half-time student.

Off-campus housing costs are covered up to the allowance for room and board that the college includes in its cost of attendance for federal financial-aid purposes.

Beneficiaries may withdraw the money tax-free for qualified elementary and secondary school expenses- Not just college expenses. This means you can pull money out tax-free for private elementary, middle, or high school.

Do I get a Tax Deduction for Contributing to the Coverdell?

There is no state or federal tax deduction to ‘contribute’ to the Coverdell, which is certainly a drawback compared to the 529. Most states allow for a State Tax Deduction for contributions to ‘their’ 529 plans. Although, donors receive NO Federal Tax Deduction.

Note, that a deduction can only be taken for the 529 in certain States where the donor is a resident of the same State where the Plan is established.

Why isn’t Wall Street on Board with the Coverdell?

One simple reason: Wall Street makes more money with 529 plans, has more control of YOUR money, and can charge excessive fees (compared to self-directing an ESA).

I seriously can’t calculate the amount of time I’ve wasted trying to find the actual Rate of Return (ROR) on any 529 Plan, AFTER expenses, set forth in a simple, straightforward manner, front and center on a 529 Plan’s website.

Promoters or advocates of the 529, Wall Street banks, Brokerages, and Mutual Fund Managers, will load up their websites with:

- performance rankings with other plans,

- how great their diversified plans are (when they offer only one mutual fund managing the plan),

- how their expense ratios relate to other plans, and

ALL of this without disclosing an actual annualized rate of return after expenses.

The only way I’ve found to get to find the truth of the actual expenses and rates of return inside a 529 plan, is to decipher a one-inch thick prospectus and spend hours diving into the detailed reports of any given 529 Plan. If anyone reading this article has access to a web page simply summarizing the actual rates of return on 529 Plans across the country, I would truly welcome it and link it here to this article.

Coverdell ESAs + Roth Accounts!

The ‘next level’ strategy that we’ve implemented countless times clients. I use in my own personal business structure and portfolio, it is to combine the Coverdell and Roth accounts of family members in a multi-member LLC to invest in real estate and small business to get greater rates of return. There are options and NOT just what Wall Street is telling you!

Yet true, these types of structures are complex. They will certainly involve a consultation with one of our accountants or tax attorneys. If you’re not ready to make an appointment with one of our specialists, but want to start learning about the concept of self-directing ANY of your retirement accounts including your Coverdell ESA, please watch our “6th Semi-Annual Self-Directed IRA Summit” held just this past month in April of 2022.

This strategy would take several pages to explain in detail. I will simply explain it here in the form of “steps” with a sentence or two of explanation per each step.

Steps:

• Step 1. Create a Coverdell for each of your children, grandchildren, or nieces and nephews (the Beneficiaries). Make yourself the “Responsible Individual” and elect to continue serving as the Responsible Individual once they turn 18.

• Step 2. Have a person that falls within the income limitation fund each of these accounts. Use a “backdoor method” to contribute to the beneficiary’s account if the Responsible Individual has too high of an income.

• Step 3. Contribute $2,000 to each account for 2022. Each beneficiary can only have $2,000 contributed to an ESA on their behalf, no matter how many accounts.

• Step 4. Create a Roth IRA for each Beneficiary that you are also establishing a Coverdell. This requires that the Beneficiary has earned income up to the contribution amount, not to exceed $6,000. This is a multi-step procedure with lots of moving parts. For more details, see my article: “Paying Your Children in the Business- Young or Old”.

• Step 5. Combine Accounts. Combine the Coverdell ESA accounts and Roth IRA Accounts into one self-directed special purpose LLC (aka. IRA/LLC). This will allow you to pool funds to create a bigger account to use for projects and open up more. For more details, see my YouTube video: “What is an IRA LLC?”

• Step 6. Self-Direct On! Invest the LLC funds in what YOU KNOW best and that ultimately gets you the best rate of return.

• Step 7. Make Distributions. Distribute funds to the primary Beneficiary you designated in the beginning.

• Step 8. Change the Beneficiary. If the funds aren’t used entirely by your first Beneficiary before they turn 30, change to another Beneficiary/family member under age 30.

Conclusion

All in all, many a parents understand the seriousness and stress ‘college savings’ can place on a family. However, just like a retirement savings plan, the best strategy is to just start saving now. In my opinion, start self-directing your Coverdell as soon as possible to reap the highest possible rates of returns.

As a parent myself with 4 kids, and two of their spouses in college this year, I encourage you to take this seriously. Just start with a simple Coverdell account, and don’t give up. When considering a Coverdell ESA vs 529 plan, the Coverdell is simply hands down better than the 529…every time.

To learn more or open a self-directed Coverdell account visit Directed IRA’s Coverdell Account Page.