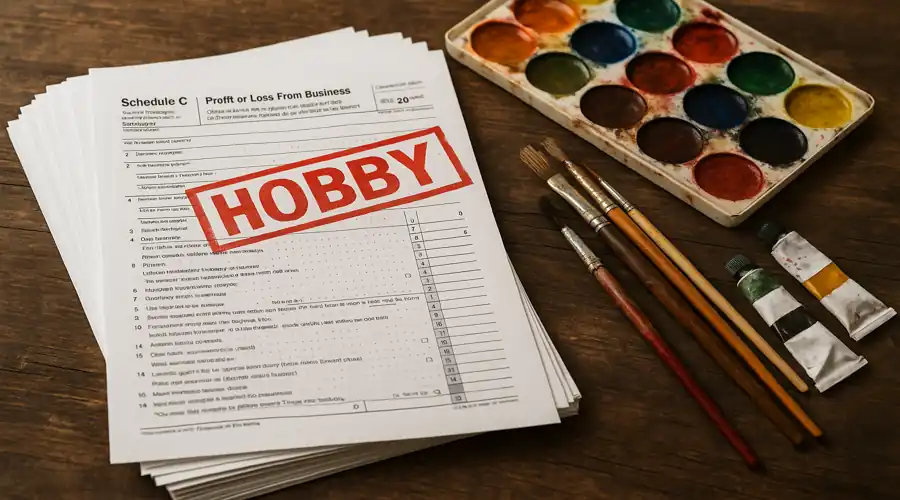

Hobby or Business? How to Avoid the Hobby Loss Rules and Keep Your Write-Offs Safe

Think your side hustle is a business? The IRS might call it a hobby—and torch your deductions. In 2025, the IRS is cracking down harder than ever with AI-powered audits and zero write-offs for hobbies. Here’s how to prove you’re legit, protect your losses, and keep every deduction you’ve earned.

Maximizing Your S-Corp Home Office Tax Deduction: Tips and Tricks

Working from home is no longer a trend—it’s the new normal. Whether you’re running a full-time business, managing a side hustle, or freelancing, the S-Corp home office deduction can be a game-changer for your finances.

5 Hot Tax Deductions for Your Business before Filing in 2022

I truly believe that far too many business owners, CPAs and Tax Preparers are overly conservative and miss out on important expenses that we are entitled to.

How to Invest in Opportunity Zones to Save Taxes

This tax incentive allows investors to reduce taxable gains and possibly obtain tax-free growth if they re-invest capital gains into real estate within designated Opportunity Zones