For those of you enjoying the special experience of having grandchildren, you may think it’s flat out wrong or immoral to even consider putting them to work…but please hear me out. Hiring and paying your grandchildren through your business in a creative manner can have incredible financial and emotional benefits.

Consider some of the possibilities of paying your grandchildren for helping in your business:

- What if you could get a tax deduction to pay them, for the money you might want to give them anyway?

- What about starting and funding a Roth IRA in the name of your grandchild?

- Did you know that you could get a tax deduction to help fund their Coverdell IRA for college someday?

- Did you know you could take that same Roth or Coverdell and make it a partner in your next LLC to buy a rental property, stock, precious metals, or cryptocurrency?

- Most importantly, wouldn’t it be wonderful to have another opportunity to teach and show your own kids that you know what’s best for the grandkids and that they’re terrible parents?

Frankly, I’m convinced that one of the most underutilized tax strategies by small business owners with families today is that they can employ their family members, including grandchildren in strategic ways.

The Tax Rules to be Aware of

First, all of us in the U.S. and including our children, don’t pay taxes on the first $12,550 of income this year in 2021!

Second, when you pay your OWN children under 18, you don’t have to withhold any income taxes OR payroll taxes; this also applies to Workers Compensation and Federal and State unemployment. However, that is not the case with your grandchildren.

If you pay your grandkids for services, you have to either issue a W-2 or 1099. This creates a whole domino effect of additional tax reporting that can defeat the purposes from a tax planning standpoint. (I’ll explain the workaround strategy below).

Third, the money you’re paying the grandkids is not subject to the ‘kiddie tax’, it is actually ‘earned income’. The parents can still claim your grandchildren on their tax return as a dependent and get the child tax credit. Earned income of a child under age 18 is irrelevant for these two issues.

Again, I don’t want my clients paying the “Kiddie Tax” and it’s easy to avoid. Most importantly, this ‘earned income’ qualifies for the grandchildren to contribute to their own Roth IRA!

The Workaround Strategy

The workaround, that is completely legitimate and legal, is to pay YOUR children (and their team of employees, that includes your grandchildren), for providing services to your business.

Your business could be a rental property, service business, manufacturing, professional services, retail, restaurant, catering, anything that qualifies as a legitimate business. In turn, the services your grandchildren would be providing, under the direction and supervision of your children, could be any of the following:

- Janitorial

- Paper shredding

- Filing

- Bookkeeping

- Landscaping

- Painting

- Errands

- Demolition or clean up, etc..

Next, you would issue a valid 1099-NEC to your adult children, who would report it on a Schedule C on their 1040 Federal Tax Return. Be careful. (See my article “1099 Rules for Business Owners” for more information on when and how to issue the 1099-NEC.)

However, the children won’t pay any taxes, because they are going to take a deduction under the ‘Other expense’ section for ‘Outside labor’ and pay their children (your grandchildren) for the services they provided as a family in support of your business. This should be close to the same amount you paid the children with the 1099-NEC.

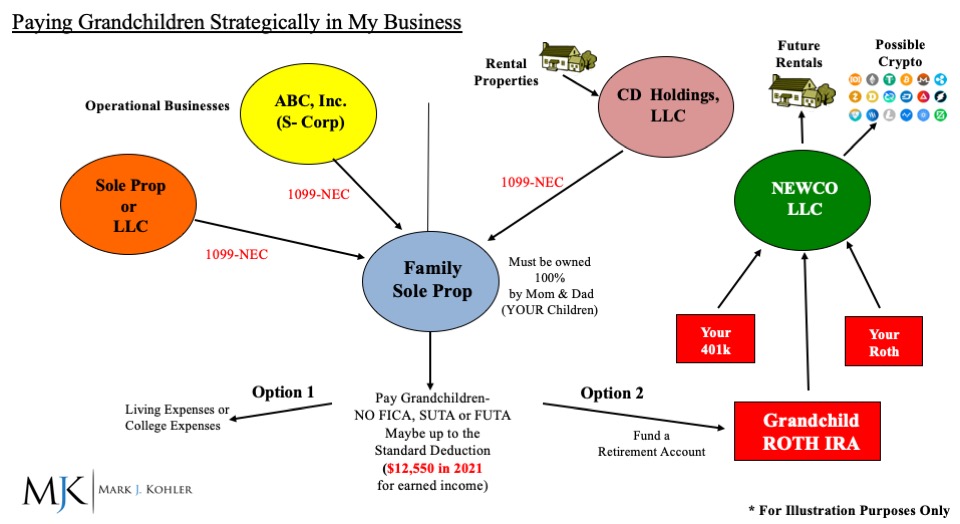

Here is a visual diagram of how it may look:

As I stated above, the beauty of your children paying the grandchildren (and not you directly), is that the children don’t have to withhold any income taxes OR payroll taxes (FICA), as well Workers Compensation, or Federal and State Unemployment. Make sure your children see my other article: “Paying Your Children in the Business: Young or Old.”

It might go without stating, but I’ll say it anyway…The “Parents” of your grandchildren need to realize they are starting a business to support your business. They will need to help coordinate this strategy and make sure the grandchildren are legitimately working for your business. Along with understanding their role in the process.

If completed properly, the end result is that you will accomplish 5 amazing financial benefits when your grandchildren legitimately work with their parents helping you in your business!

- Your children ‘zero out’ their Schedule C and pay no taxes,

- Your grandchildren don’t pay any federal taxes on the first $12,550 this year,

- You get a tax deduction,

- The grandchildren can now fund a Roth IRA (the contributions of which can come out tax-free and penalty-free for college,

- The earnings in the Roth grow with compound interest tax-free into the future, and

- Oh! …did I mention, the grandkids can self-direct their Roth IRA and invest in your next LLC to buy investment property!!

On a cautionary note, remember that not all states have the same ‘Standard Deduction’ for earned income like the Federal amount of $12,550. For example, California has a Standard Deduction of $4,601 and New York $3,100. This means your grandchild may pay state tax if they’re paid more than your State’s Standard Deduction.

The Non-Tax Reasons for Hiring Grandchildren

Now although all of those ‘financial’ reasons sound great for hiring grandkids, the non-tax reasons can be just as compelling.

Overall, the days of the farm are continuing to disappear all across America. More children are leaving the home without work ethic, money management skills, and a concept of entrepreneurship. By getting grandchildren involved in the business you might be able to better teach them about future financial success or even business ownership.

Let’s be real, getting help in the business and finding good workers is also extremely difficult in today’s job market. Small business owners forget that some of their most affordable labor is right there in their family circle eating with them at the dinner table.

Make Sure They Earn It

Of course, I’m not advocating paying your children as a ‘sham’. They have to be legitimately involved in the business and you want to keep records of their time worked. As well as pay them a reasonable wage. Hiring your children to simply do ‘family chores’ is not going to qualify as a valid deduction. It will also certainly set you up for an audit.

Remember, the goal is to pay them for legitimate services BECAUSE they are helping you in the business. You, in turn, want to help them with living expenses and teach fiscal responsibility.

At least, let them pay taxes in their ‘lower bracket’ with money you were going to give them anyway!!

In Summary

I have seen these strategies save clients thousands of dollars in taxes and change the lives of their families. Children begin to learn work ethic. It can draw a family together in ways never fathomed by small business owners.

As you can see, paying your grandchildren is a BIG topic, but I break this down in Chapter 12 of the 2nd edition of my book “The Tax and Legal Playbook – Game Changing Solutions for the Business Owner”. Don’t give up and keep learning!! There are a lot of variables to consider when designing your healthcare strategy. The savings around every corner. Talk to your CPA and get a plan for this year before it’s too late.