Short-term rentals get special tax treatment from the IRS and have significant benefits. As such, more real estate investors are adding short-term rental properties to their portfolios with a lot of success. Learning how short-term rentals are taxed is important for your future.

However, many still have questions about how short-term rentals are taxed. Along with where to place them in their tax and legal structure. Investors’ concerns and confusion are certainly valid. The short-term rental rules are unique to all other types of real estate investments. You need to carefully incorporate them when tax planning. Learning how short-term rentals are taxed is crucial and our team can help you. Reach out to KKOS so we can assist you.

What Does the IRS Deem to be a Short-Term Rental Property?

First, it’s important to realize there are four (4) types of short-term rental properties:

- “Business” short-term rentals, with Material Participation

- “Business” short-term rentals, WITHOUT Material Participation

- Passive short-term rentals, with Material Participation

- Passive short-term rentals, WITHOUT Material Participation

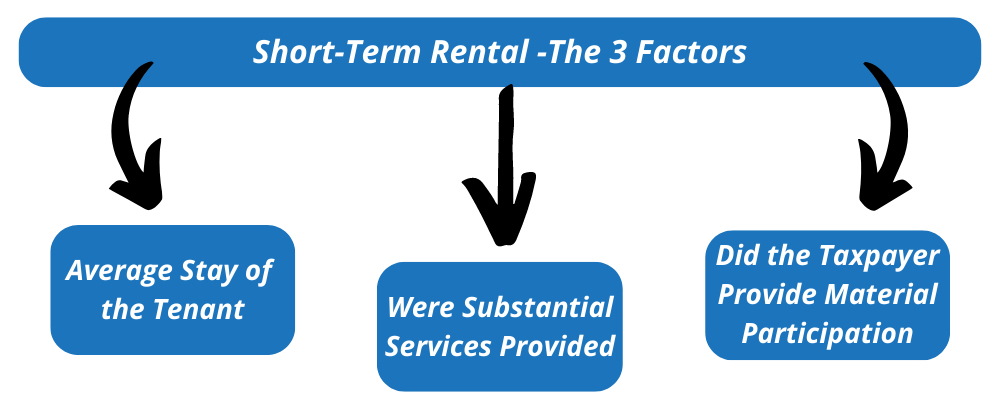

Next, all four of these classifications depend on the following three (3) factors. They will directly impact how your short-term rentals are taxed.

1. Average Rental Days a Tenant or Patron Stays at the Property

The first factor to consider is the average stay at your rental property. In addition to whether or not it’s for less than seven days. The seven-day-or-less rule applies with the ‘average stay duration’ taken over a year’s time. Essentially, you will divide your rental days by the number of renters.

EXAMPLE: Assume you rented out your cabin 21 times (the renters) during the year for a total of 108 days. One would take 108 divided by the 21 renters. Thus, your average rental is 5.14 days (108/21) and falls into the less than seven-day rental category.

- IF the average stay is less than 7 days – You may report the operations on Schedule E (just like a typical long-term rental) and the income is NOT subject to Self-Employment Tax (FICA)…ALSO, you open the opportunity for Ordinary Loss Treatment if you can show Material Participation (see below).

- IF the average stay is MORE than 7 days – Not all is lost, the operations you need to report on a Schedule E (just like a typical long-term rental). The income is NOT subject to Self-Employment Tax (FICA)…BUT Ordinary Loss Treatment is not available to you EVEN IF you can show Material Participation (see below).

The next level of analysis comes down to the type of service you provide for the tenant while they’re staying at your property; i.e. whether or not it’s considered a substantial service. There are pros and cons to providing substantial services. It can affect your rental rates as well as the tax consequences.

2. Substantial Services and a “Business” Short-Term Rental

The IRS has deemed that if you provide substantial services to your guests, then the income you make needs to be reported on a Schedule C, the end. This essentially means you have a “Business Short-term Rental”. You’ve elevated your activity to that of a business (think of it like a hotel).

- IF you provide Substantial Services – You must report the operations on Schedule C and the net-income is subject to Self Employment Tax, and your only salvation would be to implement an S-Corporation to mitigate the FICA tax. ALSO BEWARE! This does not mean you get Ordinary Loss Treatment…you still MUST show Material Participation (see below).

- IF you DON’T provide Substantial Services – You may report the operations on Schedule E (just like a typical long-term rental) and the income is NOT subject to Self-Employment Tax (FICA)…ALSO, you STILL have the opportunity for Ordinary Loss Treatment if you can show Material Participation (see below).

Examples of Substantial Services:

- Cleaning of the rental each day while the property is occupied by the same guests.

- Changing bed sheets and other linens each day while the property is occupied by the same guests.

- Concierge services.

- Conducting guest tours and outings.

- Providing meals and entertainment (like providing breakfast each morning).

- Providing transportation.

- Providing other “hotel-like” services.

Regrettably, the IRS hasn’t provided much guidance other than the few items above. There aren’t any court cases, Revenue Rulings, or Treasury Regs on this topic. We expect to have more clarity on what constitutes ‘substantial services’ in the near future.

But a word of caution. I know some educators on this suggest aggressive tactics to provide more benefits for your tenants in order to increase demand for your property and even daily rates, but be careful not to get too close to meeting the definition of substantial services – the tax result could be devastating.

3. “Personally” Serving with Material Participation

This is where things get interesting. Typically, in order to take flow-thru passive rental losses as ordinary losses, one has to qualify as a real estate professional. See (“The Tax Strategy of being a Real Estate Professional.”). However, under essentially ‘outdated’ Treasury Regulations (that were put in place by the IRS far before the onset of the ‘Airbnb’ concept, there is a unique loophole related to how short-term rentals are taxed.

Under this seemingly aggressive provision, if an owner can show personal material participation. That way then the rental losses on a short-term rental “morph” into ordinary losses.

In order to qualify as Materially Participating in the operations of your rental, a taxpayer must meet (1) of the following (7) tests. NOT ALL 7, but just one. We have found over the years that clients generally find it easier to qualify under tests 1, 2, or 3 (highlighted in ‘red’ below). Here are the tests directly quoted from the IRS code:

7 Tests of Material Participation

- The individual participates in the activity for more than 500 hours during the year.

- The individual’s participation in the activity for the taxable year constitutes substantially all of the participation in such activity of all individuals (including individuals who are not owners of interests in the activity) for such year.

- The individual participates in the activity for more than 100 hours during the taxable year, and such an individual’s participation in the activity for the taxable year is not less than the participation in the activity of any other individual (including individuals who are not owners of interests in the activity) for such year.

- The activity is a significant participation activity for the taxable year, and the individual’s aggregate participation in all significant participation activities during such year exceeds 500 hours.

- The individual materially participated in the activity for any five taxable years (whether or not consecutive) during the ten taxable years that immediately precede the taxable year

- The activity is a personal service activity, and the individual materially participated in the activity for any three taxable years (whether or not consecutive) preceding the taxable year.

- Based on all of the facts and circumstances, the individual participates in the activity on a regular, continuous, and substantial basis during such a year.

How it Works

Again, by qualifying under one of the tests above, essentially any net-loss on the operations of the property is considered an ordinary loss and is also deductible against any other income as an above-the-line deduction on your tax return.

This is where investors (that qualify) discover the power of utilizing a ‘Cost Segregation Analysis’ and dramatically increasing the depreciation deduction in the first year they place the property in service.

However, as I stated above, in order to capitalize on this strategy a taxpayer is relying on an IRS Code Section and Treas. Reg. that is clearly out of date. Now, I find nothing wrong with using a loophole until it’s shut…I just don’t want to be the one (or my client) that gets their hand caught in the door when they shut it. Most CPAs agree that by taking these passive losses when their client isn’t a real estate professional, it could trigger an audit. Be careful

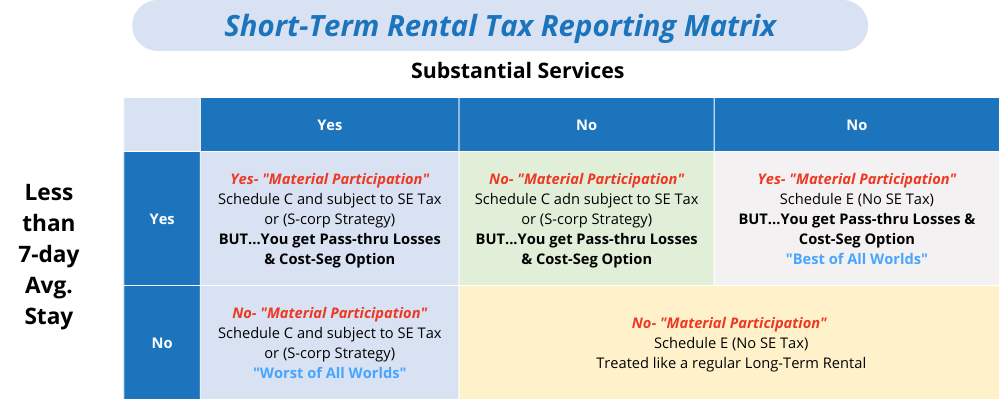

The Short-Term Rental Taxation Matrix

To help simplify the analysis when considering the 4 types of short-term rentals and the 3 phases of analysis, I created the following matrix. Hopefully, this assists you in your decision-making for yourself, and/or your clients.

Notice the new term, material participation, I introduce in this matrix. This is a unique rule in the Internal Revenue Code related to the strategy for real estate professionals.

Short-Term Rentals on Schedule E

If you do not provide substantial services then you can report your income from your short-term rental as passive income. Passive Schedule E income isn’t subject to self-employment taxes (which is a big advantage).

Does this mean you can’t provide any perks or benefits for your tenants during their stay? Absolutely not! The following is a list of insubstantial services that you can provide without jeopardizing your Schedule E status:

- Heating and air conditioning

- Water and gas

- Internet and Wi-Fi

- Cleaning of common areas

- Customary repairs and maintenance

- Trash collection

- Payment of HOA dues

Personal Use of the Property

Remember, personal use of the property doesn’t forfeit the property’s status as a rental 100% of the year. As long as you don’t stay at the property for “personal use or benefit” for more than 14 days or 10% of the total days it was rented to 3rd parties. It’s important to think about strategy! Remember, if you are staying at the property in order to work on it, take good notes. The notes should be of your activities and tasks you complete. That way those days you stay at the property you won’t have to consider them “personal use”.

IMPORTANT: When you incur “fix up days” staying at your short-term rental working on the property, this also unlocks the write-offs for travel, dining, auto, and tools while you work on your short-term rental.

I don’t want to see any “personal use” of the property. You’re always going to be there to work on the property – Right?

In sum, knowing how tax will apply to your short-term rentals provides multiple benefits. A little bit of tax planning can go a long way in making sure you save on your taxes.