Many business owners don’t realize that they still may need to file a tax return even if the business didn’t make any money this past year. Filing is an Extension for your business doesn’t cost anything and it’s an easy way to avoid any penalties and give you additional time to file a more accurate return.

But if you miss the deadline and don’t file an Extension, the penalties can add up quickly. Thus, business owners need to take these deadlines very seriously, pay attention to the type of business entity they have, and not trust their professional to always alert them for potential filing deadlines.

Here are the basics and I encourage you to take action and note on your calendar if necessary.

Does my Entity have to File a Tax Return?

You DO NOT need to file a business tax return if you meet one of the following exceptions:

- If you own an LLC personally, all by yourself 100%, it is considered a Single Member LLC (SMLLC), and does not need to file a Federal Business Tax Return and you’ll report any activity on your 1040 Schedule C, E, or F. (Check your State however, they may be different- think California)

- If your SMLLC is owned by another company i.e. S-Corp, C-Corp, or another LLC (100%), you will report the activity of the SMLLC on the company’s tax return that owns the LLC (Think of it like a consolidated tax return).

However, you DO NEED to file a business tax return if you are in one of the following situations:

- If your LLC is owned by more than 1 person, it’s considered a multi-member LLC (MMLLC) and must file a 1065 Tax return by March 15th (or extend). The members/owners will be issued a K-1 when the return is finished. Owners CANNOT file their personal 1040 Tax Return until the K-1s are issued and received by all the Members of the LLC. (This is why most, if not all, business owners extend their business and personal tax return).

- If your LLC is owned by multiple IRAs, 401ks, individuals, or other companies (which is a common and exciting strategy), it is also considered a multi-member LLC (MMLLC) and must file a 1065 Tax return by March 15th (or extend). The IRS wants to know what’s going on and who the owners are, EVEN if the MMLLC doesn’t owe tax. YOU may know what’s going on, but the IRS doesn’t.

- If your LLC is owned by a husband and wife, it’s now an MMLLC, it must file a 1065 Tax return by March 15th (or extend). You may want to talk to your attorney and change the ownership to just one of you (this is why you maybe shouldn’t set-up your own LLCs online – sorry). Btw…hopefully, it’s not Member-Managed- even worse. Stick to Manager-Managed LLCs.

- If your MMLLC had no activity last year you still must file a 1065 Tax return by March 15th (or extend).

- If your MMLLC didn’t have any sales and only expenses, with or without profit, you still must file a 1065 Tax return by March 15th (or extend).

- If you set up your MMLLC before December 31st, 2023, even December 30th, and didn’t even have sales or expenses, you still must file a 1065 Tax return by March 15th (or extend).

- If you have an SMLLC, or MMLLC that’s ‘taxed’ as an S-Corp, you now have an S-Corp and thus need to file a 1120S tax return by March 15th (or extend).

- All S-corporations need to file a 1120S tax return by March 15th (or extend).

- If you set up your S-Corp last year as late as December 31st, or even December 30th, and didn’t even have sales or expenses, you still must file a 1120S tax return by March 15th (or extend).

- All C-Corporations follow the same rules as above as S-Corps, EXCEPT you need to file an 1120 tax return by April 15th (or extend).

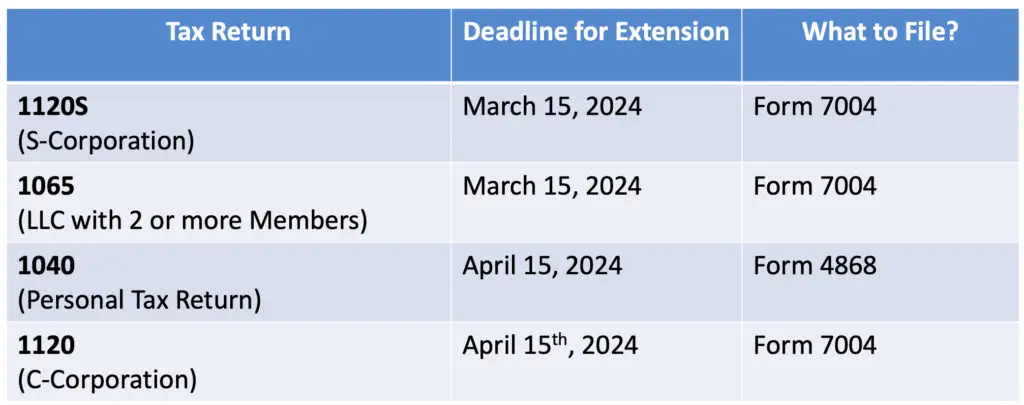

See the following table for appropriate due dates and extension deadlines:

2023 Tax Return Extension Deadlines

Once you know if one or more of your businesses needs to file a separate tax return, rather than simply a schedule on your 1040, you can note your calendar and sleep calmly at night.

Please see my separate article “What to do if You Can’t Pay Your Taxes by April 15th” regarding your personal taxes and a potential extension. Needless to say, the penalties for not personal tax returns and/or extensions can add up just as quickly as a business return, if not faster.

Penalties for not Filing an LLC Tax Return on Time

When a Limited Liability Company (2 Members or more – MMLLC) fails to file Form 1065 by March 15th, or file an Extension – Form 7004, the IRS imposes a penalty of $220 for each month, or part thereof, up to a maximum of 12 months, multiplied by the number of Members.

For Example, if there are 2 Members and they forget to file an Extension by March 15th and file the tax return in September, the penalty would be $2,640 (6 months x $220 x 2). HOWEVER, if the LLC files an Extension (Form 7004), it gives you 6 months to file by September 15th without penalty (and there is no fee to the IRS to file an Extension).

IF the LLC files an Extension BUT doesn’t file by September 15th, the same penalty rule above starts to kick in after September 15th (not to mention the domino effect it will have on the individual Members inability to file their own personal tax return, or requirement to ‘Amend’ their tax return when they finally receive their K-1.

Penalties for not Filing an S-Corporation Tax Return on Time

When an S corporation fails to file Form 1120S by March 15th, or file an Extention – Form 7004, the IRS imposes the same penalty of $220 for each month, or part thereof, multiplied by the number of Shareholders, for a maximum of 12 months.

For Example: if there are 3 shareholders and they forget to file an Extension by March 15th but file the tax return by the end of June, the penalty would be $1,890. (There’s actually could be a penalty and interest calculation on taxes that might be owed in an S-Corporation, but that is extremely rare because an S-Corporation is a pass-thru entity. However, there are some types of taxes that could be assessed, such as a built-in gains tax or something of a similar nature.)

IF the S-Corp files an Extension BUT doesn’t file by September 15th, the penalty rule above starts to kick in after September 15 (and again not to mention the domino effect it will have on the individual Shareholders and their inability to file their own personal tax return until they receive the K-1).

Penalties for not Filing a C-Corporation Tax Return on Time

When a C-Corporation fails to file Form 1120 by April 15th or file an Extension – Form 7004, the penalty for late filing is a monthly penalty that’s equal to 5 percent of any income tax that remains unpaid, up to a maximum 25 percent penalty after the fifth month that the return remains unfiled. If the C-Corporation doesn’t owe any taxes (or a nominal amount), the minimum penalty for a return that is more than 60 days late is the lesser of the tax owed or $485.

How to Obtain a Waiver or Abatement of the Penalty

If you missed filing the extension and find yourself in a predicament assessed with this Failure to File Penalty, the IRS may provide administrative relief under its “First Time Penalty Abatement Policy”.

In order to for a taxpayer to qualify, they need to be able to satisfy ALL of the following 3 tests:

- You didn’t previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

- You filed all currently required returns or filed an extension of time to file.

- You have paid, or arranged to pay, any tax due.

As a cautionary note, keep in mind that the Failure to File Penalty continues to accrue until the tax is paid in full. It may be wise to wait until you fully pay the penalty due before requesting penalty relief under the Service’s first-time penalty abatement policy.

In summary, please make sure you act as the ‘Captain of Your Own Ship’ and be informed as to when the filing deadlines are for your business. Then note your calendar and follow up with your tax professionals with plenty of time to remedy the situation if there is something missing.

Mark J. Kohler is a CPA, Attorney, co-host of the PodCasts “The Main Street Business Podcast” and “The Directed IRA Podcast”, and the author of “The Business Owner’s Guide to Financial Freedom- What Wall Street Isn’t Telling You” and, “The Tax and Legal Playbook- Game Changing Solutions For Your Small Business Questions”, as well as several other well-known books. He is also the CFO of Directed IRA Trust Company, and a senior partner at the law firm Kyler Kohler Ostermiller & Sorensen, LLP.

[…] attention to the type of business they have and the filing deadline. Please see my separate Article “Do I need to file an Extension for My Business Tax Return by March 15th?” for more detailed information on this […]