An S-Corporation, is a common entity to save on taxes and most small business owners should be using them as their entity of choice.

Business owners around the country consistently ask me if an S-Corporation is a good match for their business. I can tell you that there is a lot at stake. So much so, that it is well worth your time to know the basic differences between an S-Corporation and LLC.

Surprisingly, there are advisors across the country that miss the mark. They might give truly damaging advice that costs small business owners thousands of dollars!

You are the captain of your own ship! You need to be able to determine if your professionals are advising you under well-recognized basic concepts.

Introduction to the S-Corporation

LLC Taxed as an S-Corporation

An LLC ‘taxed as an S-Corp’ is the same thing as a standard S-Corporation set-up as an ‘Inc’. The IRS considers them to be the same.

When you convert to an S-Corporation (with a properly filed IRS Form 2553), your name won’t change with the State. You will still have the acronym ‘LLC’ at the end of your company name – and that’s OK!!

The main reason why business owners may start or begin their business with the LLC entity is so they can ‘convert’ or ‘elect’ to the S-Corporation when the time is right. This is an affordable process. Until the ‘election’ is made, the LLCs are taxed as a sole proprietorship or partnership.

But Remember, an LLC (Limited Liability Company) doesn’t save taxes whatsoever!! That is why we want to convert to the S-Corporation.

Benefits of an S-Corporation

The main benefit of an S-Corporation is to honestly and ethically save on Self-Employment Tax (SE Tax). SE tax, also referred to as FICA, consists of Medicare and Social Security taxes totaling a 15.3% hit on your bottom line. In a sole proprietorship or an LLC taxed as a sole proprietorship, SE tax is applied to every dollar of net self-employment income reported on Schedule C or earned on a K-1 from a partnership.

For small business owners, FICA taxes can dwarf even federal income taxes. People overlook this tax as mandatory and unavoidable. The S-Corporation is the solution.

In an S-Corporation, net income is split into a salary portion and a pass-through or net-income portion. They are pass-through entities (just like LLCs); so all the income it earns DOES NOT pay corporate tax. Along with any income is taxable to the individual owners in the year earned and is subject to ordinary income tax rates. However, in an S-Corporation, SE tax only applies to the salary, not on the net income. This means that for every thousand dollars you classify as pass-thru income, you save $150 in taxes!

Other benefits include:

- asset protection,

- the ability to contribute costs effectively to a Solo 401k,

- building of corporate credit,

- AND a decreased chance of an audit.

That’s right! Estimates are that S-Corps are 15x less likely to receive an audit than a LLC/Sole proprietor, even though they save more in taxes!

In a perfect world, you could take all your income as dividends and avoid SE Tax completely, but the IRS requires S-Corps to pay owners a reasonable salary.

When to Use an S-Corp

Here are the 5 Factors that might make you a likely candidate:

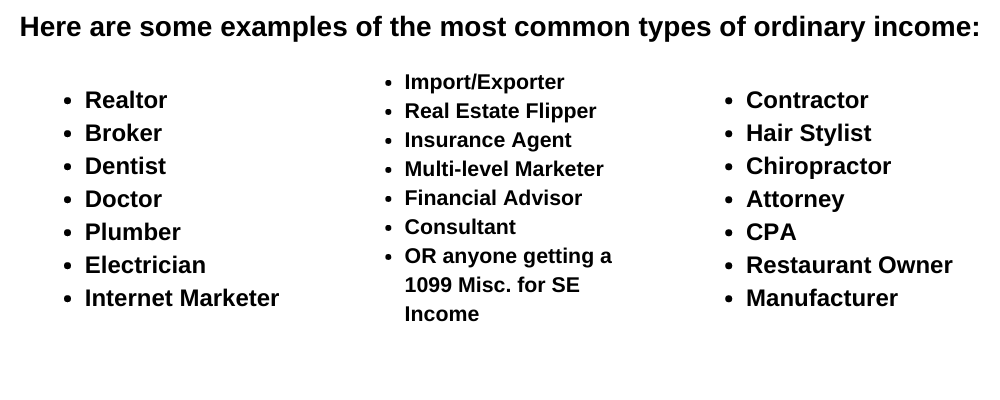

1. Do you have Income Subject to Self-Employment Tax?

The first question we ask clients is if they have income subject to SE tax. This is to determine whether or not they need an S-Corporation. Self-employment income is often referred to as ‘ordinary income’ derived from services or the sale of products. Ordinary income IS NOT income from a W-2.

Passive income IS NOT subject to SE tax. Passive income is rental income, interest, dividends, capital gain, etc.

2. Are There Restrictions on me Operating as an S-Corporation in my Industry?

This question inevitably comes up in locales where licensing is required for your profession. Brokers, realtors, insurance agents, doctors, lawyers, and contractors all need to check with their local licensing boards to make sure they can operate inside an S-Corporation with their license.

The answer is usually yes, but some jurisdictions will require the license to be held by the S-Corporation. They will require the business owner to jump through hoops to make this work. In one recent case, a client told me it was going to cost him over $5,000 to switch his licenses over to the S-Corporation and could take months to complete.

If there are going to be significant hurdles to establishing your S-Corporation, you will want to assess the ultimate tax savings and whether the benefit of it outweighs the cost before making that decision.

3. How much Income do I need Before an S-Corporation Makes Sense?

This is a critical question because a business owner doesn’t need or want to incur the cost of an S-Corporation unless the tax savings exceed the cost. We have generally advised our clients that the break-even point is approximately $40k in net income.

Otherwise stated, if your business is making net ordinary income subject to SE tax of $40k or more then you are a candidate for an S-Corporation. The reason why we feel this is the ‘break-even’ point is because of the salary/net-income allocation. We are careful and cautious to make sure and tailor payroll allocations to each business owner and their situation. Oftentimes there can be $2,000-$3,000 in savings at this threshold.

Again, meet with an advisor that truly understands this strategy and is willing to be cautiously aggressive. To meet with a real tax attorney about whether an S-Corporation is right for you, visit KKOS Lawyers.

4. How will this Affect my 199-A Deduction?

The 199-A deduction is a product of the Tax Cuts and Jobs Act and gives small businesses an automatic 20% deduction on all pass-through income. The deduction can be subject to a phase-out calculation for professional service business owners with AGI (adjusted gross income) over $157,500 for single filers and $315,000 for joint filers.

There is also another calculation that kicks in for non-professionals when they hit similar income levels. Bottom line, this is a wonderful deduction that is not inhibited by the S-Corporation. It is enhanced with the strategy of the S-Corporation. A qualified tax advisor will help its business owner clients to find a balance between salary and net income to minimize SE tax and maximize the 199-A deduction. It’s a huge opportunity for planning!

5. How much will an S-Corporation cost me?

First, you have setup costs. This can range from $200 to $1,000 depending on the amount of consultation, support, and documentation provided by the law firm performing the service. We urge you to be cautious in this process. It IS NOT simply a ‘filing of articles’.

There are multiple documents to include. Consulting and support are critical for a business owner new to the S-Corporation and need to understand the maintenance procedures. We charge either $400 or $800, plus the filing fee, for an S-Corporation in any State in the Country.

Next, you have the ongoing maintenance and the quarterly and annual tax filings. With it you will be paying yourself a salary. Even if you don’t have other employees you will have to do payroll and file quarterly payroll reports with the IRS. It also must file its own year-end tax return and issue you a W-2. These annual costs could range from $1,500-$2,000 depending on your situation.

This is why the ‘savings’ for an S-Corporation owner needs to be more than $2,000 before it makes ‘financial’ sense in the first place. Although the other reasons for asset protection, corporate credit, and audit risk reduction still may all make sense, it’s important to understand the financial situation before pulling the trigger.

Conclusion

Get a Consultation or 2nd Opinion

I am convinced after over 20 years of experience both personally and in our office helping and supporting thousands of business owners, the S-Corporation is ultimately the best entity for an operational business owner in the long run.

Don’t underestimate the power of the S-Corporation. You should make sure to get a second opinion if anyone says it isn’t the best match. Ironically, more people are avoiding the S-Corporation and being talked out of it by an uneducated advisor, rather than prematurely setting up an S-Corporation.

The attorneys in our office are all capable of helping you with this decision based on these factors and more. All things considered, the cost of a consultation is much less than the cost of making a mistake and filing for the wrong entity!