Whether or not to put your spouse on the payroll for tax planning purposes is a very strategic question and something we often analyze for clients. In fact, many clients rush to put their spouse on payroll, but for the wrong reasons. It could actually be quite a costly mistake.

Two reasons why NOT to put your Spouse on a Payroll

First, here are two big reasons NOT to put your spouse on payroll. These are actually common mistakes or misconceptions on why one may put cut the non-working spouse a check.

- Misconception #1- So the non-working spouse can contribute to an IRA – Wrong. A non-working spouse does not have to have a ‘paycheck’ in order to contribute to a traditional or Roth IRA. The non-working spouse can create what’s called a Spousal IRA. There are really only two requirements. One, the working spouse has eligible compensation that’s at least as much as the total contribution to both IRAs. Two, they file a joint income tax return. Bottom line, don’t cut a paycheck to simply fund an IRA or Roth IRA.

- Misconception #2- To get a Social Security benefit for the non-working spouse – Wrong. On the face of it, this would seem logical, right? However, a “non-working spouse” of a “working spouse” already qualifies for spousal benefits. The benefits are limited to 50% of the working spouse’s primary insurance amount, but to get more than that amount a ‘non-working spouse’ may need to pay into the system for years. Thus, going on payroll may not get the ‘non-working spouse’ more than they were already going to get! Speak with a financial advisor that understands Social Security planning to run the “numbers” before cutting another payroll check. I cover this topic in-depth and dedicate an entire chapter to this strategy in my book with Randy Luebke: “The Business Owner’s Guide to Financial Freedom- What Wall Street Isn’t Telling You”.

A Spouse is Always Working for the Business

As a preliminary matter, I always believe it’s a misconception that the spouse is considered ‘non-working’. A spouse is always an integral part of a business…no doubt about it. The spouse should also be serving on the Board of Advisors or Directors for the company.

A spouse would presumably be constantly involved in the operations of the company. Thus, a salary would always be justified and appropriate IF it makes sense for tax planning.

Good Reason #1 – Maximize the Spouse’s 401k contribution

If a business owner and their spouse want to put away some big money for retirement, they may qualify for the Solo 401k. If so, BOTH spouses need to be on payroll AND for the proper amount to max out the 401k match. There’s even the option for an incredible ‘next level’ strategy referred to as the “Mega Back-Door Roth”.

In 2022 the primary business owner and their spouse can EACH contribute up to $20,500 (or $27,000 if 50 or older) into a 401k. The business is allowed to take a tax deduction for the W-2. Neither spouse has to claim the contribution as income on their 1040 (if a traditional contribution and not a Roth).

Yes…there is some FICA or payroll tax due on the W-2 amount for each spouse in order to ‘fund’ the 401k, but the ultimate tax benefit is significant due to the ‘time value of money’ and building a tax-deferred retirement account. Typically, it’s customary to ‘gross-up’ the payroll amount on the spouse to cover the FICA taxes. Then ‘zero out’ the rest with the contribution to the 401k.

401k Contribution Examples

This is an incredible opportunity for the spouse of a business owner. The spouse can create and fund a 401k with a net taxable income of zero! But it gets better!! In addition to the deferral the spouse could make from their paycheck, the company can also do a match on the total payroll amount to the spouse. This would further be a deduction for the company and add to the spouse’s 401k balance.

EXAMPLE #1: If your spouse is under age 50, the payroll amount would be approximately $22,198, with a net pay of $20,500. Then the spouse would elect to ‘defer’ or contribute $20,500 to the 401k, and the W-2 nets out at zero (assuming a Traditional contribution and not Roth). The company would ALSO be able to contribute 25% of the spouse’s payroll into their account of $5,549. The company would have a total tax deduction of $27,748, and the spouse would end up with $26,049 in their 401k!

EXAMPLE #2: If your spouse is age 50 or older, the payroll would be approximately $29,237, with a net pay of $27,000. Then the spouse would elect to ‘defer’ or contribute $27,000 to the 401k, and the W-2 nets out at zero (assuming a Traditional contribution and not Roth). The company would ALSO be able to contribute 25% of the spouse’s payroll into their account of $7,309. The company would have a total tax deduction of $36,546, and the spouse would end up with $34,309 in their 401k!

In fact, if a business owner and spouse can afford to pay a little more in taxes, they can get even more creative. They can fund a ROTH 401k and create tax-free accounts, rather than just deferring taxes until the future.

Good Reason #2 – Potentially Write off More Medical Expenses

Essentially, if your family has a lot of medical costs, put your spouse on the payroll. It may allow you to utilize the Health Reimbursement Arrangement (HRA). However, keep in mind that you would have to utilize a sister management company (typically a Sole-Proprietorship).

It’s important to note that the HRA strategy is impossible for a business owner to use with their S-Corporation without the use of the Sole-Prop. The reason being is the “greater than 2% shareholder rules” that prevent a business owner (or their spouse) from deducting certain fringe benefits for themselves (this includes the HRA).

However, the ‘backdoor strategy’, is to create a ‘support’ or ‘management’ company that would hire the spouse for services provided to the main company, and under this employment relationship provide for an HRA.

On the face of it, the HRA may sound complicated or expensive, but it is rather quite simple and affordable. It is ‘self-administered’ without the need for an insurance company or bank’s involvement. See “How an HRA can Save you Thousands when facing extra Health Care Costs”.

The beauty of the HRA plan being provided through an employment arrangement is that the payroll may be minimal, OR it can be used in conjunction with a larger payroll amount and a 401k contribution. The cost is under $500 at our law firm KKOS Lawyers, or accounting firm K&E CPAs.

DRAWS…The Easy Solution

Let’s look at this logically:

- If you have a spouse, then you’re married.

- If you’re married, there’s a 99% chance you’re filing a joint 1040.

- If you’re filing a joint 1040, then the income from the business is taxed to both of you.

- If the income is taxed to both of you, then ‘Distributions’ or ‘Draws’ to your spouse are treated as if they are distributions to you.

- Give your spouse a freaking Distribution/Draw if they need money

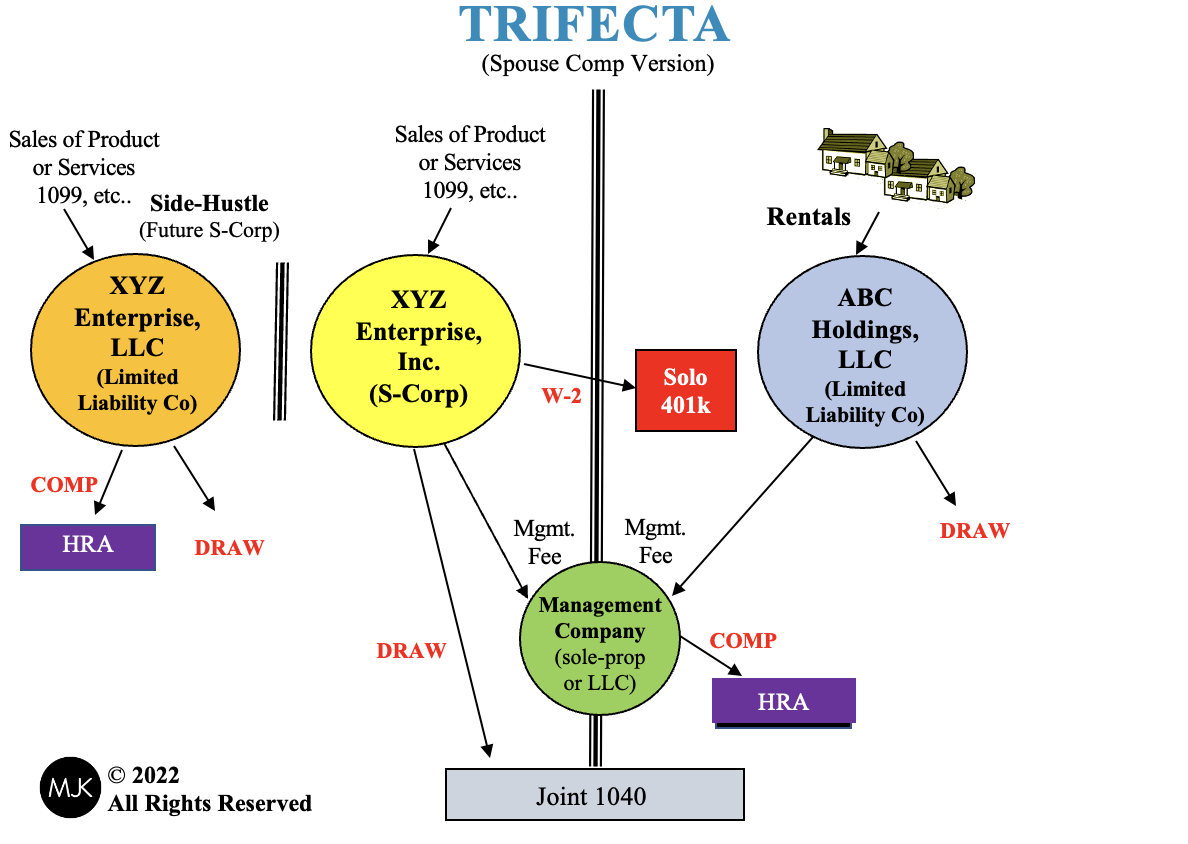

Here is a visual representation of multiple options:

For illustration purposes only.

In Summary, the 401k contribution and the HRA are the only reasons I think business owners should consider having both a ‘non-working’ spouse on the payroll. Make sure to bring this up with your tax and financial advisor to apply these strategies to your particular situation. Schedule a consultation with one of our tax lawyers at KKOS Lawyers and within an hour they can explain and design the right ‘Comp’ structure for your spouse!