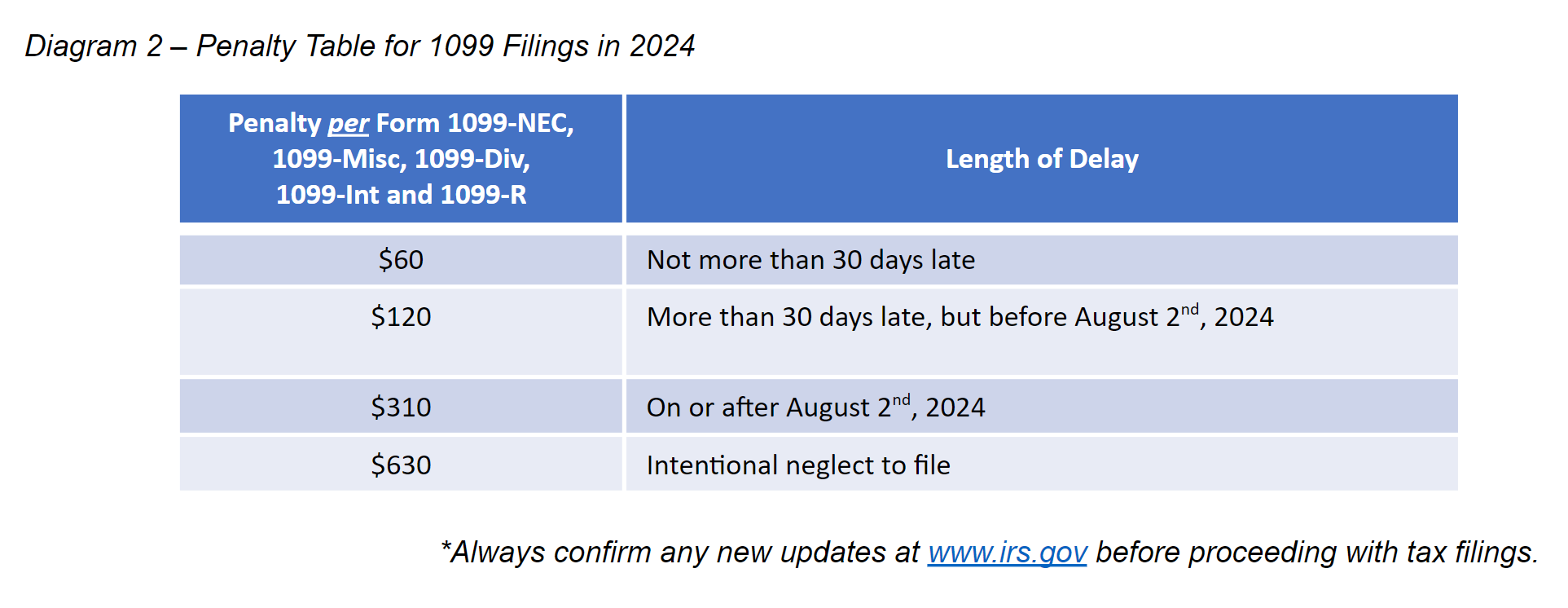

The penalties for not filing 1099s can add up quickly. They vary from $50 to $110 per Form depending on how long past the deadline the company issues them. In fact, if a business intentionally disregards the requirement to provide a correct payee statement, it is subject to a minimum penalty of $550 per statement, with no maximum (More on this below).

Now, that I hopefully have your attention let me break down the basics. I am going to make a couple of recommendations on how you can take care of your 1099 filings.

What if I received a 1099?

Receiving a 1099 is an entirely differently issue and you need to report the income on the proper tax form based on the type of 1099 you received. But it’s not the end of the world, and there are a lot of tax deductions you might be able to take advantage of against that 1099 income.

If you received a 1099 with your side-hustle, or as your main-hustle, see my article: “What to do if I receive a 1099?”.

Who is required to send out 1099s?

As an individual home owner or consumer, you are NOT required to send out a 1099 when you pay someone to serve your individual needs or to perform work at your home for example.

However, if you are a business owner, lender, or manage other people’s money, you are more than likely required to issue a 1099. If you don’t, there are serious penalties (as I mentioned above), and you may even not be entitled to the tax deduction for the expense you incurred. Here are the most common 1099 forms you may encounter:

- 1099-NEC. This is the most common 1099 form issued and the “general rule” is that business owners will now file Form 1099-NEC for each person or business, whom in the course of the payor’s business, paid at least $600 during the year. This payment would have been for services performed by a person or company who IS NOT the payor’s employee. (Instructions to Form 1099-NEC). (There are special rules and exemptions…and much more on this below)

- 1099-MISC. This is the form for other payments over $600 that a payer makes in the course of the payer’s business for things such as rent, prizes, and awards, or “other income payments.” Tthese are all reported on Form 1099-MISC.

- 1099-INT. If you pay interest to investors in a format where you borrow and invest, this is a very important form to file. (This is NOT the 1098 form that indicates the mortgage interest you paid). This is the tax form used to report interest income, paid by all ‘payers’ of interest income to investors or private lenders at year-end (1099-INT Instructions).

- 1099-DIV. This Form is typically used by large banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. If you own and operate a C-Corporation with shareholders, this would be the Form to report payments to those investors (1099-DIV Instructions).

- 1099-R. Again, this is a form generally used by big banks, trust companies, or brokerages. This Form is used to report the distributions of retirement benefits such as pensions and annuities. Also, if you take distributions from a self-directed IRA or 401k, you would receive some type of Form 1099-R. (1099-R Instructions).

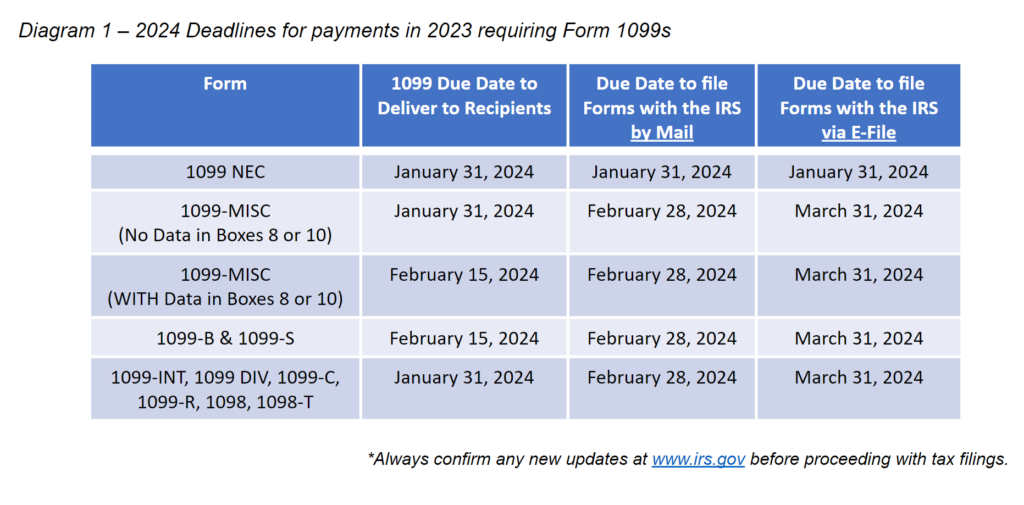

1099 Deadlines in 2024

Business Owner Basics and 1099s

- Who is required to send a Form 1099-NEC? You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than $600. This includes any individual, partnership, Limited Liability Company (LLC), Limited Partnership (LP), or Estate.

- Who are considered Vendors or Sub-Contractors? Essentially, this is a person or company you have paid for services that aren’t an employee.

If you aren’t sure if your worker is an Employee or Sub-Contractor see my article: “The Difference between Sub-Contractors and Employees”

- What are the exceptions? The list is fairly lengthy, but the most common is that you DO NOT need to send a 1099-NEC to:

- Vendors operating as S or C-Corporations (you’ll find their status out when you get a W-9 from them..see below)

- LLCs or partnerships taxed as an S or C-Corp (again see the W-9 procedure below)

- Sellers of merchandise, freight, storage or similar items

- Payments of rent to or through real estate agents (typically property managers). However, you need to issue a 1099 to a landlord you are paying rent (again as a business owner FOR your business, NOT as an individual for your own apartment/home), unless they meet another exception.

- Don’t worry about credit card payments and PayPal. The IRS allows taxpayers to exclude from Form 1099-NEC any payments you made by credit card, debit card, gift card, or third-party payment. As long as you confirm that you are indicating that this is a business payment on the 3rd party platform, networks such as PayPal or Venmo are reporting these payments on a Form 1099-K to the recipients…you don’t need to do it for them.

- Lawyers get the short end of the stick. Ironically, the government doesn’t trust that lawyers will report all of their income. This means that even if your lawyer is ‘incorporated’, you are still required to send them a Form 1099-NEC. This is if you paid them more than $600 in your business, and are wanting to take a business deduction for paying them.

- The procedure. Regrettably, you CANNOT simply go to www.irs.gov and download a bunch of 1099 Forms and send them out to your vendors before the deadline (that was the old method). The new, required, and best method is to file all of your forms electronically, and then mail out the forms to payees by the appropriate deadline. The simplest method is use your accountant handling your payroll and these types of services, OR use a software program/App like www.track1099.com or www.tax1099.com.

- Deadline to Payees. The deadline to send out 1099s to payees is January 31st (via mail or email).

- Deadline to send the IRS Form 1099-NEC…This is a new rule that started in 2023- Take note!! Now if business owners have 10 or more 1099-NEC forms they need to issue, they MUST file them ELECTRONICALLY with the IRS with form 1096 by January 31st (NOT the end of February- under the old rule, or if you had more than 250 1099-NECs). Also, depending on state law, you may also have to file the 1099-NEC with the state. Sounds like fun…right? (This is where delegating the task to your accountant or using approved software really comes in helpful).

- Deadlines to send the IRS all other Form 1099s. For Forms 1099-MISC, 1099-DIV, 1099-INT, and 1099-R, business owners have to compile all of the 1099s and follow the proper method of reporting and the appropriate deadline (see the 1099 Deadline Diagram above)

- Don’t forget the States (sorry). There are a number of states that have filing requirements for form 1099s and the 1099-NEC. Currently, these states require you to file a 1099-NEC with them – CA, DE, HI, KS, MA, MT, NJ, OH, OK, OR, PA, RI, VT, and WI. If you’re operating in a State that requires this make sure to confirm the rules and deadlines.

- MUST I file Electronically? Yes! Again, IF you have more 10 Form 1099s to file, you MUST file electronically. However, you if you have less than 10 forms to report, you can do it via mail. However, If a taxpayer fails to comply with the proper method, there are serious penalties of up to $100 per form for failure to file electronically. If you establish reasonable cause you will not be subject to the penalty.

- What about foreign workers? If you hire a non-U.S. citizen who performs any work inside the United States, you need to issue them a Form 1099-NEC. If they are non-US citizen AND perform all of their work outside the U.S., you are not required to issue a 1099-NEC. However, it is your responsibility to verify that the worker is indeed a non-U.S. citizen. IF the work is a U.S. citizen, no matter where they do the work, you are required to issue the appropriate form 1099 unless they are exempt. For that purpose, in the future you want to have any foreign worker fill out, sign, and return to you Form W-8BEN.

The W-9 is your “Best Friend”

In this process, it may frustrate some of you that you don’t have all the information you NEED to issue Form 1099-NEC to the payee. One of the smartest procedures a business owner can implement is to request a W-9 from any vendor you expect to pay more than $600 before you pay them.

Getting the W-9 upfront as a normal business practice will give you the vendor’s information you need, including mailing information, any exemption they may fall within, and their tax ID number. For example, the form will also require them to indicate if they are a corporation or not and will save you the headache of sending them a 1099-NEC. You can download a W-9 here.

Suggested Procedure for 2024:

Moving forward this year, make sure to get a Form W-9 from all your vendors before they can get paid. If they want you to pay them ‘under the table’…tell them to move to another country. Then tell you “Thank you for paying taxes and providing roads, essential services, and national defense!!”.

Getting a W-9 from them will ALSO ensure you ultimately get your tax-write off for 2024 and it will certainly save you a lot of headaches next January. For more information on this see the Instructions for the W-9.

What are the Penalties if I miss a Deadline?

As I mentioned above, penalties for not filing a correct 1099 can add up quickly. They vary from $50 to $110 per Form depending on how long past the deadline. Moreover, if the IRS can prove that a business intentionally disregarded the requirement to provide a correct payee statement, they are subject to a minimum penalty of $550 per statement, with no maximum!

Real-life Story

I literally had a prior client contact me this past year because they chose to file their 1099s on their own and didn’t carefully follow the rules. They inadvertently mailed in the forms and didn’t electronically file (see rules below regarding electronic filing). RESULT- The IRS hit them with $17,000 in penalties and our only hope was to show reasonable cause to get them out of the penalty. ** UPDATE…months later we were able to help them get out of the penalty…but only after a lot of time, accounting and legal fees, and unnecessary stress.

If you are already late in filing your forms…you have a big decision to make. (Think of “The Rock” in the movie ‘The Rundown’ if you haven’t seen it…it’s a classic! :). The ‘Rock’ in the movie would say: “You have two options: Option A or Option B.” (Spoiler alert…Option A is always better).

- Option (a) – Suck it up and hurry and file any forms. IF this is your first time being late and you show any reasonable cause, the IRA may waive the penalty and often do. I’m not making any promises here…but it’s fairly common the first-time offenders get more mild treatment….again- generally.

- Option (b) – Ignore the issue and hope it goes away. Not good! The IRS will make you pay if your # comes up…and there’s a good chance it will. So…essentially not filing and hoping the IRS or the State doesn’t audit you is not the prudent step to take, and it certainly doesn’t add to good and sound sleep at night.

- By the way, the Rock was quick to remind Seann William Scott, “There is no Option C”

In Summary

Consider getting my 2024 Trifecta Planner and Calendar with all of the essential deadlines and signing up for my E-newsletter. This will ensure you won’t miss a single deadline!! Click here for more information.

Don’t ignore the 1099 or the process and get with your CPA to make sure to meet the appropriate deadlines. The maximum penalty can easily exceed $1M for small businesses in 2024 and they WILL charge interest on those penalties too.

The IRS considers you to be a small business if you’ve earned an average of $5 million or less in annual revenue for the past three tax years. There is no limit on the penalties for the intentional disregard to file (and don’t think ignorence is a defense)!

Finally, be careful trusting websites just to save just a few dollars. It can cost you big time if you miss even a small rule or procedure. Most accountants have an affordable procedure to assist in the filing and can be a huge resource. Business owners need to take this filing process seriously and take personal accountability to make sure they complete them.

once I upload my 1099’s to the IRS portal, do I still need to send them out to recipients

Also, is the only thing that I really need to submit electronically the 1096?

1099 NEC Questions

1 – I have a vendor I paid $500 for services, and $6000 for computer hardware. Does he get a 1099, and for what amount?

2- Similar to the first question, but lets say I paid him $601 for services, and $6000 for the hardware. He would get a 1099 since he is over the $600 in services, but would his 1099 report $601 or $6601? Do I need to account (or somehow record) service vs hardware separately ?

I have a question, If I am buying My business from a private party do i have to file a 1099 Int. for them.

If you are buying a company this year, you do not have to worry about 1099s till the next year.

The 1099 forms are issued for people who received payments in 2022. You need to remember the end of the year is the period borderline for fillings.

I have a question, because I am totally confused… let me explain my situation first.

I work for a small mom and pop place. There are a total of 4 employees that work here. We are getting paid $8/hour with no over-time compensation. We are also working under a form 1099. So, we are actually making less than $8/hour. Does this small business fit the criteria to use 1099s?